Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information related to HA Co. is presented below. 1. On May 7, purchased merchandise from BO Company for $ 23,000, terms 2/10, net/30, FOB

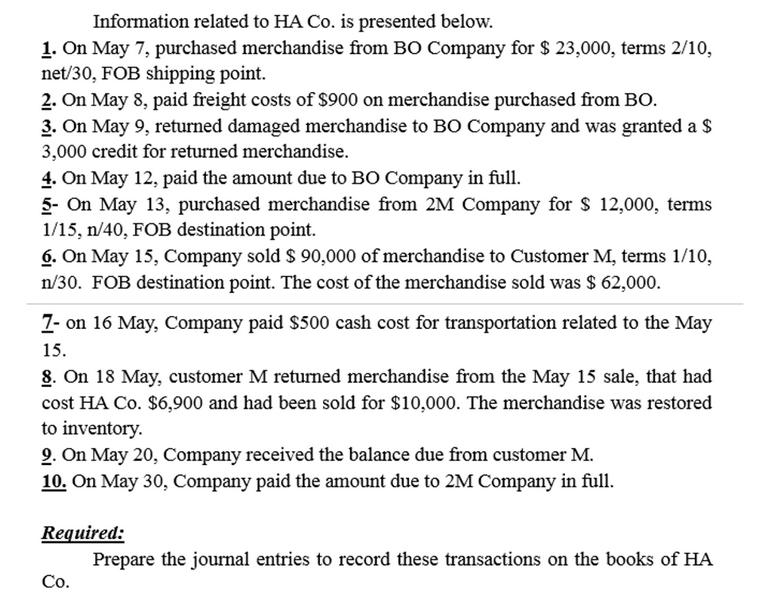

Information related to HA Co. is presented below. 1. On May 7, purchased merchandise from BO Company for $ 23,000, terms 2/10, net/30, FOB shipping point. 2. On May 8, paid freight costs of $900 on merchandise purchased from BO. 3. On May 9, returned damaged merchandise to BO Company and was granted a $ 3,000 credit for returned merchandise. 4. On May 12, paid the amount due to BO Company in full. 5- On May 13, purchased merchandise from 2M Company for $ 12,000, terms 1/15, n/40, FOB destination point. 6. On May 15, Company sold $ 90,000 of merchandise to Customer M, terms 1/10, n/30. FOB destination point. The cost of the merchandise sold was $ 62,000. 7- on 16 May, Company paid $500 cash cost for transportation related to the May 15. 8. On 18 May, customer M returned merchandise from the May 15 sale, that had cost HA Co. $6,900 and had been sold for $10,000. The merchandise was restored to inventory. 2. On May 20, Company received the balance due from customer M. 10. On May 30, Company paid the amount due to 2M Company in full. Required: Prepare the journal entries to record these transactions on the books of HA Co.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Exercise 713 Required 1 MLee Note Total Through Amount Accrued Interest Recognized Maturity At Decem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started