Question

Saleh owned a double-storey house, his second residential house in Kedah. He purchased the house in January 2018 and disposed of the house in May

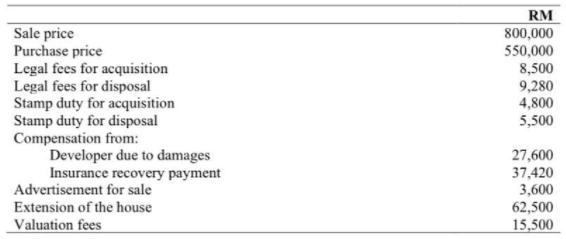

Saleh owned a double-storey house, his second residential house in Kedah. He purchased the house in January 2018 and disposed of the house in May 2020. The information regarding the acquisition and disposal of the house are as follows:

REQUIRED:

Compute the Real Property Gain Tax payable by Saleh under the Real Property Gain Tax Act 1976 in respect of the disposal of the house.

Sale price Purchase price Legal fees for acquisition Legal fees for disposal Stamp duty for acquisition Stamp duty for disposal Compensation from: Developer due to damages Insurance recovery payment Advertisement for sale RM 800,000 550,000 8,500 9,280 4,800 5,500 27,600 37,420 3,600 62,500 15,500 Extension of the house Valuation fees

Step by Step Solution

3.31 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION CALCULATION OF DISPOSAL RATE PARTICULARS AMOUNT RM CONSIDERATION RECEIVED S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2016 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

29th Edition

134104374, 978-0134104379

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App