Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saputo Inc. (SAP) produces, markets, and distributes dairy products in Canada, the United States, Argentina, Australia, and internationally. SAP is considering initiating a project

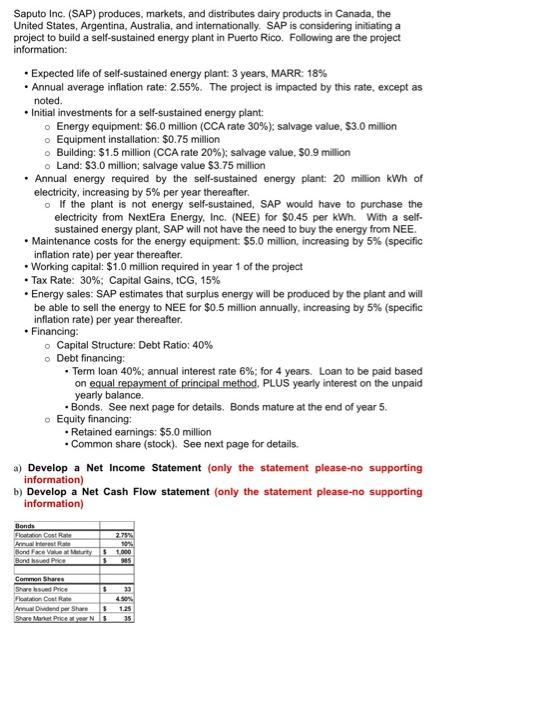

Saputo Inc. (SAP) produces, markets, and distributes dairy products in Canada, the United States, Argentina, Australia, and internationally. SAP is considering initiating a project to build a self-sustained energy plant in Puerto Rico. Following are the project information: Expected life of self-sustained energy plant: 3 years, MARR: 18% Annual average inflation rate: 2.55%. The project is impacted by this rate, except as noted. Initial investments for a self-sustained energy plant: o Energy equipment: $6.0 million (CCA rate 30%); salvage value, $3.0 million o Equipment installation: $0.75 million o Building: $1.5 million (CCA rate 20%); salvage value, $0.9 million o Land: $3.0 million; salvage value $3.75 million Annual energy required by the self-sustained energy plant: 20 million kWh of electricity, increasing by 5% per year thereafter. o If the plant is not energy self-sustained, SAP would have to purchase the electricity from NextEra Energy, Inc. (NEE) for $0.45 per kWh. With a self- sustained energy plant, SAP will not have the need to buy the energy from NEE. Maintenance costs for the energy equipment: $5.0 million, increasing by 5% (specific inflation rate) per year thereafter. Working capital: $1.0 million required in year 1 of the project Tax Rate: 30%; Capital Gains, tCG, 15% Energy sales: SAP estimates that surplus energy will be produced by the plant and will be able to sell the energy to NEE for $0.5 million annually, increasing by 5% (specific inflation rate) per year thereafter. Financing: o Capital Structure: Debt Ratio: 40% o Debt financing: Term loan 40%; annual interest rate 6%; for 4 years. Loan to be paid based on equal repayment of principal method. PLUS yearly interest on the unpaid yearly balance. Bonds. See next page for details. Bonds mature at the end of year 5. o Equity financing: Retained earnings: $5.0 million Common share (stock). See next page for details. a) Develop a Net Income Statement (only the statement please-no supporting information) b) Develop a Net Cash Flow statement (only the statement please-no supporting information) Bonds Floatation Cost Rate Annual Interest Rate Bond Face Value at Maturity Bond Issued Price Common Shares Share issued Price Floatation Cost Rate Annual Dividend per Share Share Market Price at year N 2.75% 10% $ 1.000 S 985 $ S 33 4.50% 1.25 35

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Net Income Statement Sales Revenue Energy sales to NEE 05 million Year 1 and increasing by 5 per year thereafter Cost of Goods Sold Annual energy required 20 million kWh Purchase cost from NEE 045 p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started