Answered step by step

Verified Expert Solution

Question

1 Approved Answer

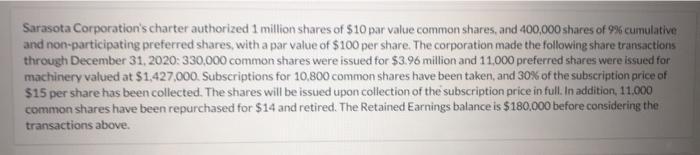

Sarasota Corporation's charter authorized 1 million shares of $10 par value common shares, and 400,000 shares of 9% cumulative and non-participating preferred shares, with

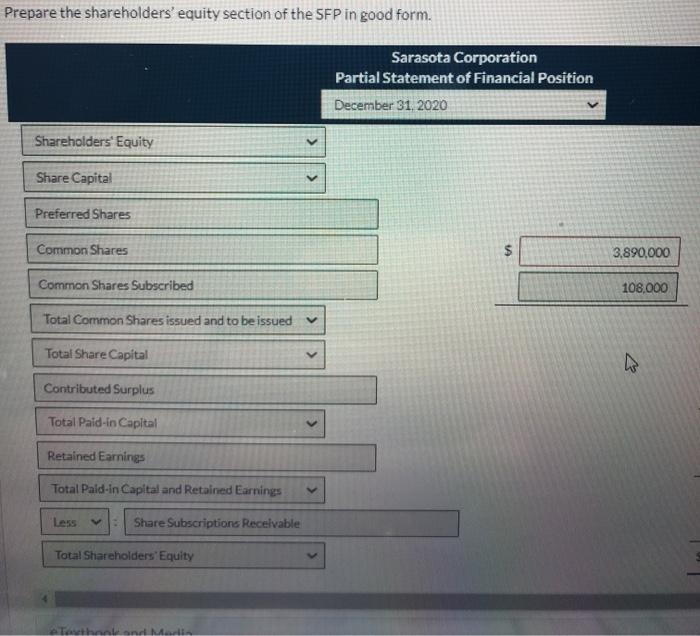

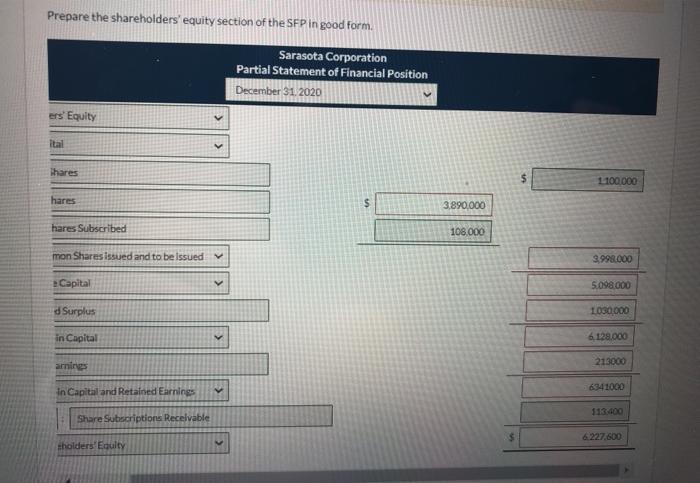

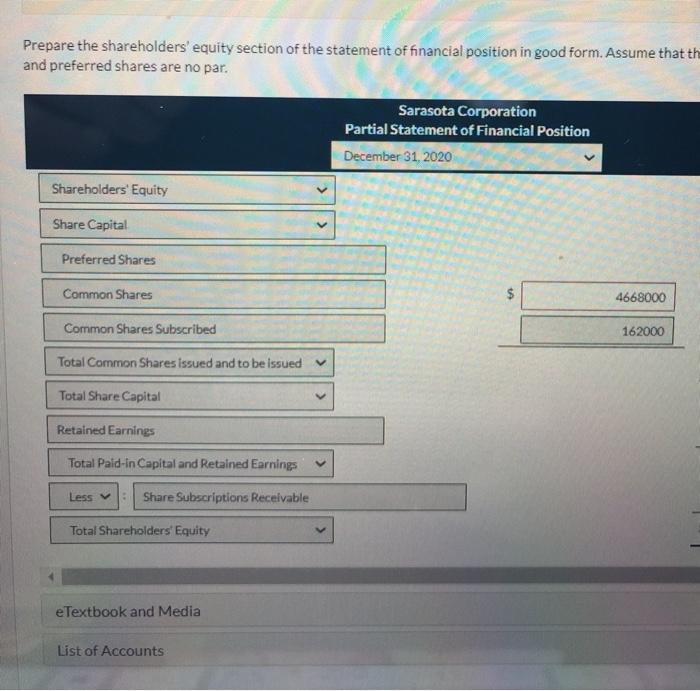

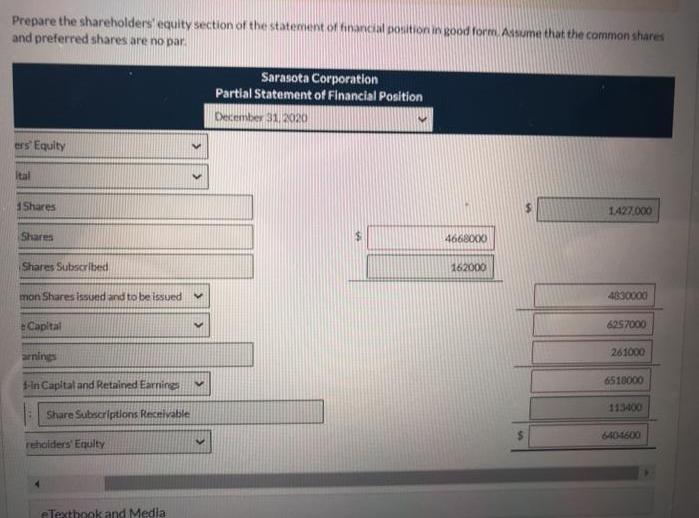

Sarasota Corporation's charter authorized 1 million shares of $10 par value common shares, and 400,000 shares of 9% cumulative and non-participating preferred shares, with a par value of $100 per share. The corporation made the following share transactions through December 31, 2020: 330,000 common shares were issued for $3.96 million and 11,000 preferred shares were issued for machinery valued at $1,427,000. Subscriptions for 10,800 common shares have been taken, and 30% of the subscription price of $15 per share has been collected. The shares will be issued upon collection of the subscription price in full. In addition, 11.000 common shares have been repurchased for $14 and retired. The Retained Earnings balance is $180,000 before considering the transactions above. Prepare the shareholders' equity section of the SFP in good form. Shareholders' Equity Share Capital Preferred Shares Common Shares Common Shares Subscribed Total Common Shares issued and to be issued v Total Share Capital Contributed Surplus Total Paid-in Capital Retained Earnings Total Paid-in Capital and Retained Earnings Less Share Subscriptions Receivable Total Shareholders' Equity Sarasota Corporation Partial Statement of Financial Position December 31, 2020 SA 3,890,000 108,000 4 Prepare the shareholders' equity section of the SFP in good form. Sarasota Corporation Partial Statement of Financial Position December 31, 2020 ers' Equity ital hares hares hares Subscribed mon Shares issued and to be issued Capital d Surplus in Capital arnings in Capital and Retained Earnings Share Subscriptions Receivable sholders' Equity $ 3,890,000 108.000 $ 1.100.000 3,998.000 5,098,000 1,030,000 6.128.000 213000 6341000 113.400 6.227.600 Prepare the shareholders' equity section of the statement of financial position in good form. Assume that the and preferred shares are no par. Shareholders Equity Share Capital Preferred Shares Common Shares Common Shares Subscribed Total Common Shares issued and to be issued Total Share Capital Retained Earnings Total Paid-in Capital and Retained Earnings Less v Share Subscriptions Receivable Total Shareholders' Equity eTextbook and Medial List of Accounts Sarasota Corporation Partial Statement of Financial Position December 31, 2020 1 4668000 162000 Prepare the shareholders' equity section of the statement of financial position in good form. Assume that the common shares and preferred shares are no par. ers' Equity Ital 1Shares Shares Shares Subscribed mon Shares issued and to be issued e Capital arnings 1-in Capital and Retained Earnings Share Subscriptions Receivable reholders' Equity eTextbook and Media V Sarasota Corporation Partial Statement of Financial Position December 31, 2020 4668000 162000 1,427,000 4830000 6257000 261000 6518000 113400 6404600

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through the calculations step by step to accurately prepare the shareholders equity section of the Statement of Financial Position also known ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started