Considering the calculations you have done so far, you need to attend to a number of...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

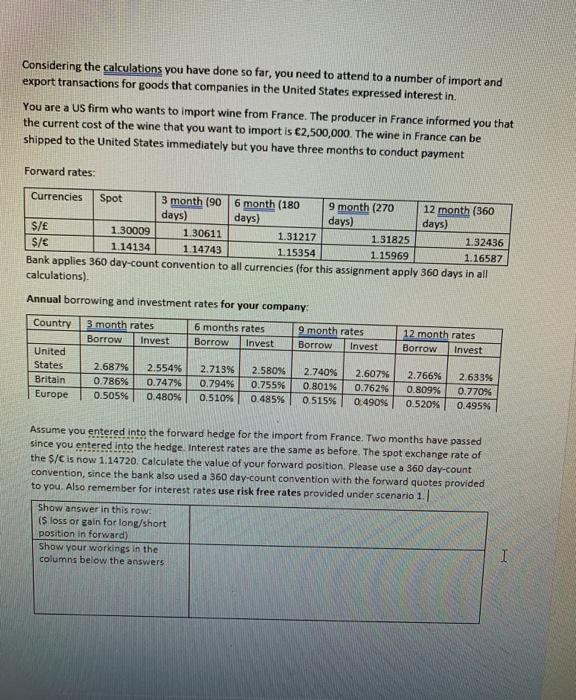

Considering the calculations you have done so far, you need to attend to a number of import and export transactions for goods that companies in the United States expressed interest in. You are a US firm who wants to import wine from France. The producer in France informed you that the current cost of the wine that you want to import is €2,500,000. The wine in France can be shipped to the United States immediately but you have three months to conduct payment Forward rates: Currencies Spot 3 month (90 6 month (180 days) 9 month (270 days) 12 month (360 days) days) 1.30009 1.30611 1.31217 1.31825 1.32436 $/e 1.14134 1.14743 1.15354 1.15969 1.16587 Bank applies 360 day-count convention to all currencies (for this assignment apply 360 days in all calculations). Annual borrowing and investment rates for your company: Country 6 months rates 3 month rates Invest 9 month rates 12 month rates Borrow Borrow Invest Borrow Invest Borrow Invest United States 2.687% 2.554% 2.713% 2.580% 2.740% 2.607% 2.766% 2.633% Britain 0.786% 0.747% 0.794% 0.755% 0.801% 0.762% 0.809% 0.770% Europe 0.505% 0.480% 0.510% 0.485% 0.515% 0.490% 0.520% 0.495% Assume you entered into the forward hedge for the import from France. Two months have passed since you entered into the hedge. Interest rates are the same as before. The spot exchange rate of the $/C is now 1.14720. Calculate the value of your forward position. Please use a 360 day-count convention, since the bank also used a 360 day-count convention with the forward quotes provided to you. Also remember for interest rates use risk free rates provided under scenario 1. Show answer in this row: (S loss or gain for long/short position in forward) Show your workings in the columns below the answers Considering the calculations you have done so far, you need to attend to a number of import and export transactions for goods that companies in the United States expressed interest in. You are a US firm who wants to import wine from France. The producer in France informed you that the current cost of the wine that you want to import is €2,500,000. The wine in France can be shipped to the United States immediately but you have three months to conduct payment Forward rates: Currencies Spot 3 month (90 6 month (180 days) 9 month (270 days) 12 month (360 days) days) 1.30009 1.30611 1.31217 1.31825 1.32436 $/e 1.14134 1.14743 1.15354 1.15969 1.16587 Bank applies 360 day-count convention to all currencies (for this assignment apply 360 days in all calculations). Annual borrowing and investment rates for your company: Country 6 months rates 3 month rates Invest 9 month rates 12 month rates Borrow Borrow Invest Borrow Invest Borrow Invest United States 2.687% 2.554% 2.713% 2.580% 2.740% 2.607% 2.766% 2.633% Britain 0.786% 0.747% 0.794% 0.755% 0.801% 0.762% 0.809% 0.770% Europe 0.505% 0.480% 0.510% 0.485% 0.515% 0.490% 0.520% 0.495% Assume you entered into the forward hedge for the import from France. Two months have passed since you entered into the hedge. Interest rates are the same as before. The spot exchange rate of the $/C is now 1.14720. Calculate the value of your forward position. Please use a 360 day-count convention, since the bank also used a 360 day-count convention with the forward quotes provided to you. Also remember for interest rates use risk free rates provided under scenario 1. Show answer in this row: (S loss or gain for long/short position in forward) Show your workings in the columns below the answers

Expert Answer:

Answer rating: 100% (QA)

Liability to be settled by the US Firm in 3 months or 90 days 2500000 The fir... View the full answer

Related Book For

Advanced Accounting

ISBN: 978-0077862220

12th edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Posted Date:

Students also viewed these finance questions

-

Considering the calculations you have done so far, you need to attend to a number of import transactions for goods that companies in the United States expressed interest in. The first transaction is...

-

Import/Export Company, a U.S. company, made a number of import purchases and export sales denominated in foreign currency in 2008. Information related to these transactions is summarized in the...

-

Import/Export Company, a U.S. company, made a number of import purchases and export sales denominated in foreign currency in 2012. Information related to these transactions is summarized in the...

-

Refer to Example 9. After how many seconds will the rocket be (a) 240 ft above the ground? (b) 112 ft above the ground? Data from in Example 9 EXAMPLE 9 Using a Quadratic Function in an Application...

-

Find the row interchanges that are required to solve the following linear systems using Algorithm 6.1. a. x1 5x2 + x3 = 7, 10x1 + 20x3 = 6, 5x1 x3 = 4 b. x1 + x2 x3 = 1, x1 + x2 + 4x3 = 2, 2x1 x2...

-

Show the contents of registers E, A, Q, and SC (as in Fig. 10-12) during the process of division of (a) 10100011 by 1011; (b) 00001111 by 0011. (Use a dividend of eight bits.) Fig. 10-12 Divisor B =...

-

A spoilage-retarding ingredient is added in brewing beer. To determine the extent to which the taste of the beer is affected by the amount of this ingredient added to each batch, and how such taste...

-

H. Barrajas, T. Dingler, and R. Fisk have capital balances of $95,000, $75,000, and $60,000, respectively. They share income or loss on a 5 : 3 : 2 basis. Fisk withdraws from the partnership under...

-

The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,704...

-

An article in Electronic Packaging and Production (2002, Vol. 42) considered the effect of X-ray inspection of integrated circuits. The rads (radiation dose) were studied as a function of current (in...

-

A public corporation of 980 employees manufactures a popular brand of garments (mostly jeans) that are primarily made and sold in America nation-wide. It has a large contingent of employees in...

-

As you continue exploring HIPAA's requirements regarding fundraising activities, I wanted to consider the impact--if any--that the COVID-19 pandemic should have on those provisions. All of us can...

-

Review the mean, standard deviation, and 5-number summary of the trainees' exam scores below. You can also review the individual exam scores and functions used to calculate the descriptive analyses...

-

Rational choice theory implicitly or explicitly assumes a number of things about consumer choice that are often not true, such as consumers search for an optimal solution to a problem and choose on...

-

Assume that instead of the offer in (a) the pizzeria announces a different special: Buy one pizza, get the second one at half priced. The consumer can use this offer only once. If they want any more...

-

Reva, a stellar student, is upset to learn that Joan, the class entrepreneur, secretly copied her detailed Civil Litigation notes. After months of negotiating with Joan prove fruitless, Reva sues...

-

Grimm, a student, is in the 4 0 % ordinary income tax bracket. He sold a business - use building for a $ 3 0 0 K gain, where half the gain is unrecaptured 1 2 3 1 , and the other half is a regular...

-

Use a calculator to evaluate the expression. Round your result to the nearest thousandth. V (32 + #)

-

The Larisa Company is coming out of reorganization with the following accounts: The company's assets have a $760,000 reorganization value. As part of the reorganization, the company's owners...

-

Cambi Company began operations on January 1, 2014. In the second quarter of 2015, it adopted the FIFO method of inventory valuation. In the past, it used the LIFO method. The company's interim income...

-

Ramshare Company acquired equipment at the beginning of 2015 at a cost of $135,000. The equipment has a 5-year life with no expected salvage value and is depreciated on a straight-line basis. At...

-

A hydraulic lift in a service station has a \(32.50-\mathrm{cm}\)-diameter ram that slides in a \(32.52-\mathrm{cm}\)-diameter cylinder. The annular space is filled with SAE 10 oil at \(20^{\circ}...

-

A 10-kg block slides down a smooth inclined surface as shown in Fig. P1.80. Determine the terminal velocity of the block if the \(0.1-\mathrm{mm}\) gap between the block and the surface contains SAE...

-

Oil (absolute viscosity \(=0.0003 \mathrm{lb} \cdot \mathrm{s} / \mathrm{ft}^{2}\), density \(=50\) \(\mathrm{lbm} / \mathrm{ft}^{3}\) ) flows in the boundary layer, as shown in Fig. P1.82. The plate...

Study smarter with the SolutionInn App