Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting SECTION A: COMPULSORY(ANSWER BOTH QUESTIONS QUESTION ONE The directors of Doggie Ltd a Zambian company are considering closin The directors of Doggie Ltd a

Accounting SECTION A: COMPULSORY(ANSWER BOTH QUESTIONS QUESTION ONE The directors of Doggie Ltd a Zambian company are considering closin

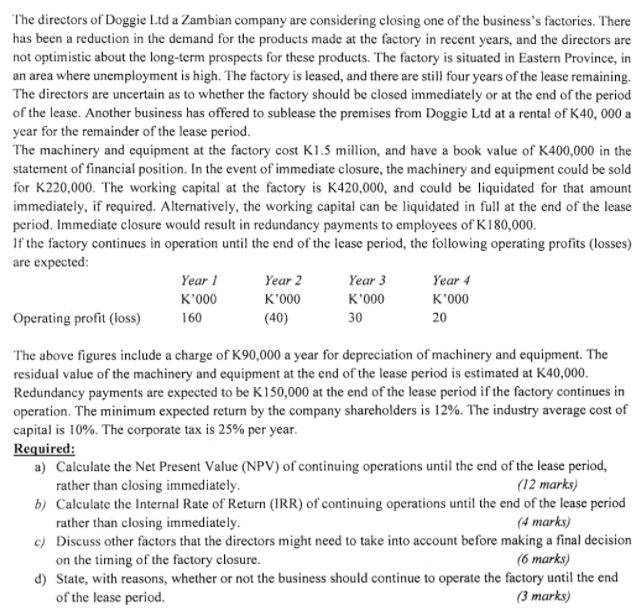

The directors of Doggie Ltd a Zambian company are considering closing one of the business's factories. There has been a reduction in the demand for the products made at the factory in recent years, and the directors are not optimistic about the long-term prospects for these products. The factory is situated in Eastern Province, in an area where unemployment is high. The factory is leased, and there are still four years of the lease remaining. The directors are uncertain as to whether the factory should be closed immediately or at the end of the period of the lease. Another business has offered to sublease the premises from Doggie Ltd at a rental of K40, 000 a year for the remainder of the lease period. The machinery and equipment at the factory cost K1.5 million, and have a book value of K400,000 in the statement of financial position. In the event of immediate closure, the machinery and equipment could be sold for K220,000. The working capital at the factory is K420,000, and could be liquidated for that amount immediately, if required. Alternatively, the working capital can be liquidated in full at the end of the lease period. Immediate closure would result in redundancy payments to employees of K180,000. If the factory continues in operation unti! the end of the lease period, the following operating profits (losses) are expected: Year 1 Year 2 Year 3 Year 4 K'000 K'000 K'000 K'000 Operating profit (loss) 160 (40) 30 20 The above figures include a charge of K90,000 a year for depreciation of machinery and equipment. The residual value of the machinery and equipment at the end of the lease period is estimated at K40,000. Redundancy payments are expected to be K150,000 at the end of the lease period if the factory continues in operation. The minimum expected return by the company shareholders is 12%. The industry average cost of capital is 10%. The corporate tax is 25% per year. Required: a) Calculate the Net Present Value (NPV) of continuing operations until the end of the lease period, (12 marks) rather than closing immediately. b) Calculate the Internal Rate of Return (IRR) of continuing operations until the end of the lease period rather than closing immediately. c) Discuss other factors that the directors might need to take into account before making a final decision on the timing of the factory closure. d) State, with reasons, whether or not the business should continue to operate the factory until the end of the lease period. (4 marks) (6 marks) (3 marks)

Step by Step Solution

★★★★★

3.37 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution a Net Present Value of continuing operations Working i Statement of cash flows of continuing operations Year 0 1 2 3 4 Total Inflows S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started