Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Select key audit issues. You can find them, in the Key Audit Matters paragraphs. For each one, explain auditors reasons of concern with that issue

Select key audit issues. You can find them, in the Key Audit Matters paragraphs. For each one, explain auditors’ reasons of concern with that issue and how the described audit procedures being applied, can give response to them

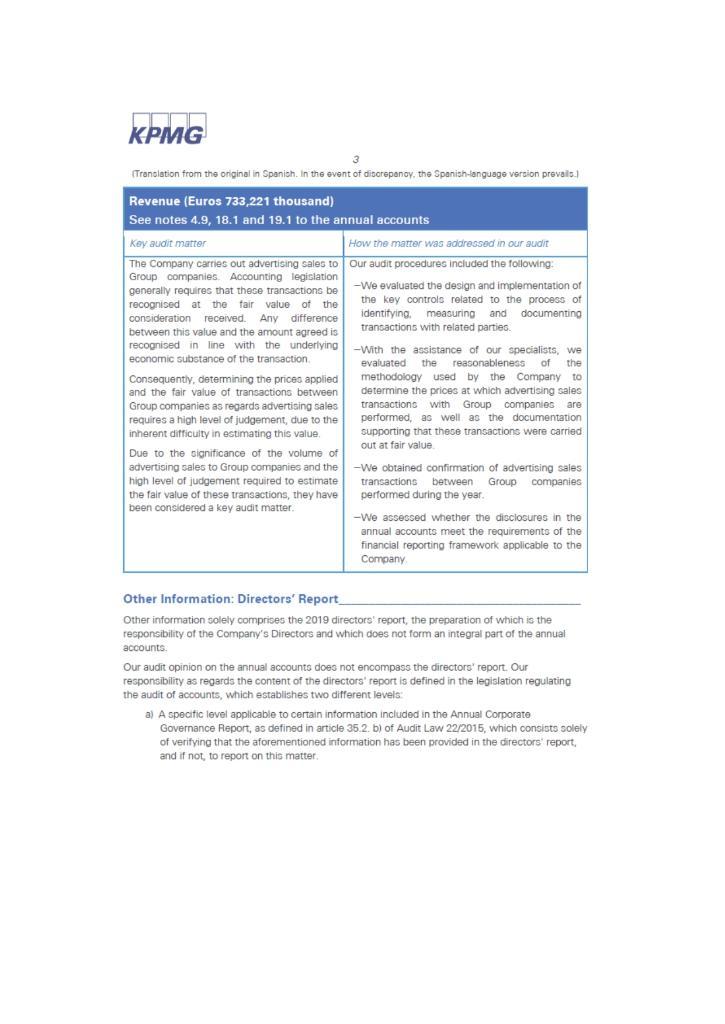

KPMG (Transiation from the original in Spanich. In the event of disorepanoy, the Spanish-language version prevails.) Revenue (Euros 733,221 thousand) See notes 4.9, 18.1 and 19.1 to the annual accounts Key audit matter How the matter was addressed in our audit The Company carries out advertising sales to Our audit procedures included the following: Group companies. Accounting legislation generally requirec that thece trancactions be -We evaluated the design and implementation of recognised at the fair value of the consideration received. Any difference the key controls related to the process of identifying, measuring and documenting transactions with related parties. between this value and the amount agreed is recognised in line with the underlying -With the assistance of our specialists, we economic substance of the transaction. evaluated the reasonableness of the methodology used by the Company to Consequently, determining the prices applied and the fair value of transactions between determine the prices at which advertising sales trancactions with Group companies are performed, as well as the documentation supporting that these transactions were carried out at fair value. Group companies as regards advertising sales requires a high level of judgement, due to the inherent difficulty in estimating this value. Due to the significance of the volume of advertising sales to Group companies and the -We obtained confirmation of advertising sales high level of judgement required to estimate transactions between Group companies performed during the year. the fair value of these transactions, they have been considered a key audit matter. -We assessed whether the disciosures in the annual accounts meet the requirements of the financial reporting framework applicable to the Company Other Information: Directors' Report Other information solely comprises the 2019 directors' report, the preparation of which is the responsibility of the Company's Directors and which does not form an integral part of the annual accounts. Our audit opinion on the annual accounts does not encompass the directors' report. Our responsibility as regards the content of the directors' report is defined in the legislation regulating the audit of accounts, which establishes two different levels: a) A specific level applicable to certain information included in the Annual Corporate Governance Report, as defined in article 35.2. b) of Audit Law 22/2015, which consists solely of verifying that the aforementioned information has been provided in the directors' report, and if not, to report on this matter.

Step by Step Solution

★★★★★

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Solution Auditors Reason of Concern Audit Procedure Response i Transfer Pricing Regulations noncompliance ii Management overide of control resulting in fictious booking of transactions changing the ti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started