Question

Sky High Building Services has seen a growth in business in recent months and, based on the advice of the Accountant, has created a small

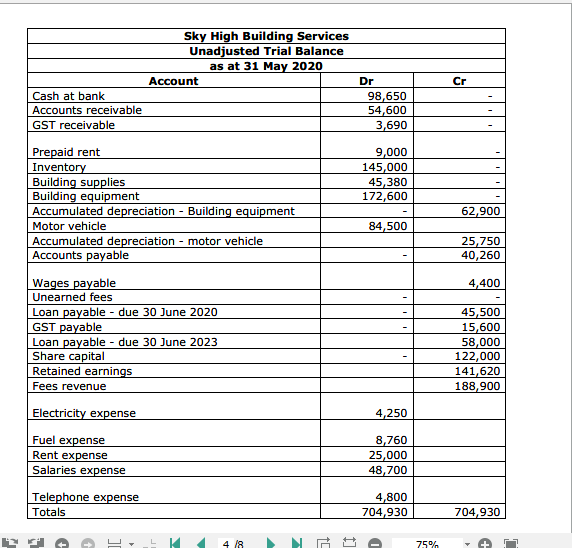

Sky High Building Services has seen a growth in business in recent months and, based on the advice of the Accountant, has created a small proprietary company in order to run the building services operations. Sk High has branched into buying and selling wholesale building products (inventory). Sky High accounts for this inventory on a periodic basis and all purchases are recorded in a ?purchases? account. Sky High still provides building services to regular clients on a cash only basis. All sales on credit are for the sale of inventory. The Balance Sheet for Sky High Building Services Ltd (SHBS) as at 31 May 2020 is shown below:

Requirements :

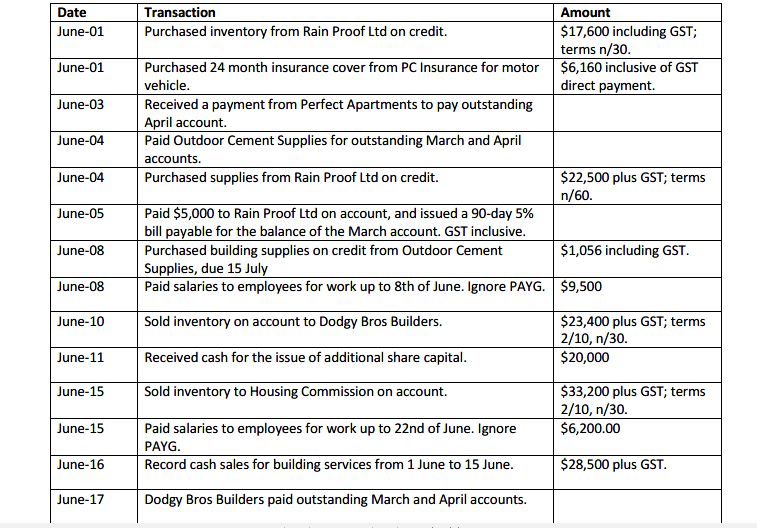

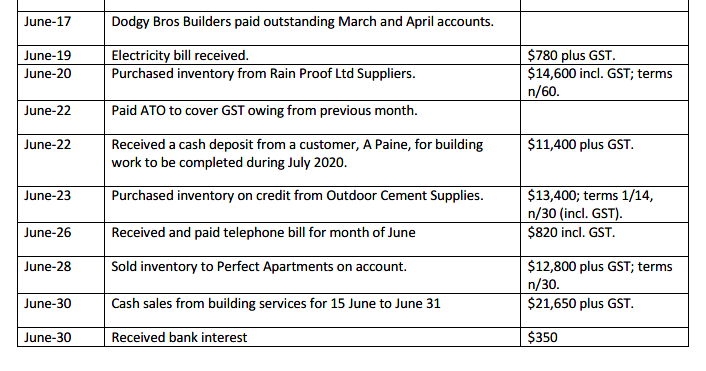

1. Record June transactions

2. Prepare:

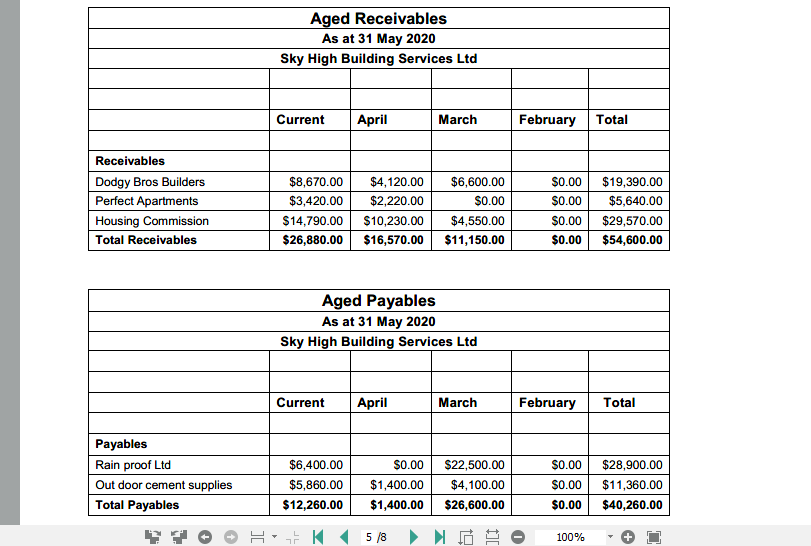

a. Aged Accounts Receivable

b. Aged Accounts payable

c. Proft and Loss Statement for 30 June 2020

d. Balance Sheet as at 30 June 2020?

Cash at bank Accounts receivable GST receivable Prepaid rent Inventory Building supplies Building equipment Accumulated depreciation - Building equipment Motor vehicle Wages payable Unearned fees Sky High Building Services Unadjusted Trial Balance as at 31 May 2020 Accumulated depreciation - motor vehicle Accounts payable Account Loan payable - due 30 June 2020 GST payable Electricity expense Fuel expense Rent expense Salaries expense Loan payable - due 30 June 2023 Share capital Retained earnings Fees revenue Telephone expense Totals 4/8 Dr 98,650 54,600 3,690 9,000 145,000 45,380 172,600 84,500 4,250 8,760 25,000 48,700 4,800 704,930 75% Cr 62,900 25,750 40,260 4,400 45,500 15,600 58,000 122,000 141,620 188,900 704,930

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started