Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Starr Corp., organized in 2018, provided you with the following information. Starr follows ASPE. Starr purchased a license for $2,000 on July 1, 2020.

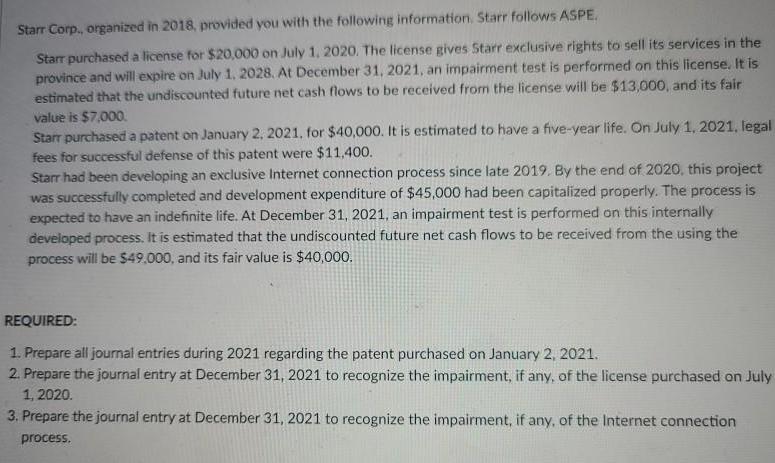

Starr Corp., organized in 2018, provided you with the following information. Starr follows ASPE. Starr purchased a license for $2,000 on July 1, 2020. The license gives Starr exclusive rights to sell its services in the province and will expire on July 1. 2028. At December 31, 2021, an impairment test is performed on this license. It is estimated that the undiscounted future net cash flows to be received from the license will be $13,000, and its fair value is $7,000. Starr purchased a patent on January 2, 2021, for $40,000. It is estimated to have a five-year life. On July 1, 2021, legal fees for successful defense of this patent were $11,400. Starr had been developing an exclusive Internet connection process since late 2019. By the end of 2020, this project was successfully completed and development expenditure of $45,000 had been capitalized properly. The process is expected to have an indefinite life. At December 31, 2021, an impairment test is performed on this internally developed process. It is estimated that the undiscounted future net cash flows to be received from the using the process will be $49.000, and its fair value is $40,000. REQUIRED: 1. Prepare all jourmal entries during 2021 regarding the patent purchased on January 2, 2021. 2. Prepare the journal entry at December 31, 2021 to recognize the impairment, if any, of the license purchased on July 1, 2020. 3. Prepare the journal entry at December 31, 2021 to recognize the impairment, if any, of the Internet connection process.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

JOURNAL ENTRIES SLNO DATE PARTICULARS DEBIT CREDIT 1 JANUARY 22021 PATENT 4000000 TO CASH 4000000 BE...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started