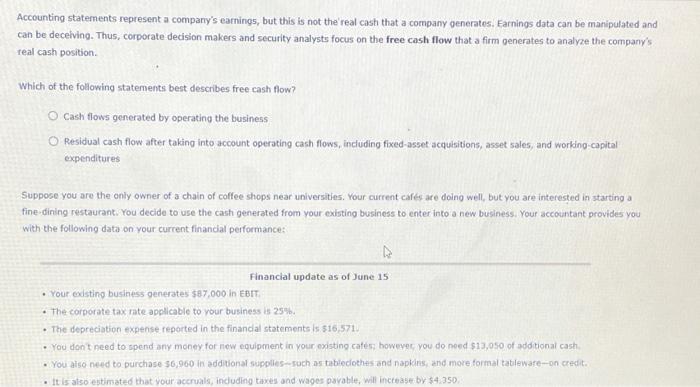

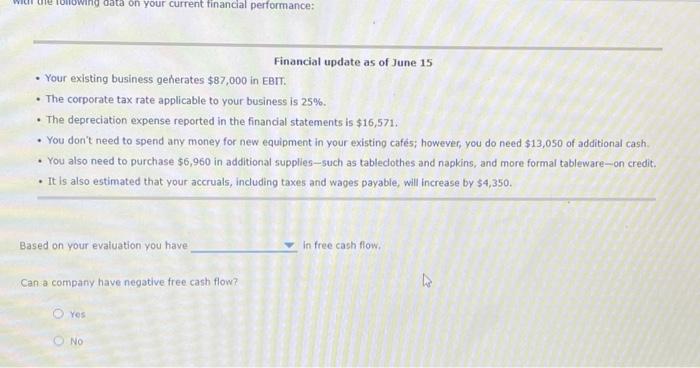

Accounting statements represent a company's earnings, but this is not the real cash that a company generates. Earnings data can be manipulated and can be deceiving. Thus, corporate decision makers and security analysts focus on the free cash flow that a firm generates to analyze the company's real cash position Which of the following statements best describes free cash flow? O Cash flows generated by operating the business O Residual cash flow after taking into account operating cash flows, including fixed asset acquisitions, asset sales, and working-capital expenditures Suppose you are the only owner of a chain of coffee shops near universities. Your current cafes are doing well, but you are interested in starting a fine dining restaurant. You decide to use the cash generated from your existing business to enter into a new business. Your accountant provides you with the following data on your current financial performance: Financial update as of June 15 Your dating business generates $87,000 in EBIT The corporate tax rate applicable to your business is 25% The depreciation expense reported in the financial statements is $16,5711 You dont need to spend any money for new equipment in your risting cafes, however you do need $13,050 of additional cash You also need to purchase 56,960 in additional supplies--such as tableclothes and naplans, and more formal tableware-on credit . It is also estimated that your accruals, including taxes and wages pavable, will increase by $4.350 wille 10lwind data on your current financial performance: Financial update as of June 15 Your existing business generates $87,000 in EBIT. The corporate tax rate applicable to your business is 25%. The depreciation expense reported in the financial statements is $16,571. You don't need to spend any money for new equipment in your existing cafs; however, you do need $13,050 of additional cash. You also need to purchase $6,960 in additional supplies--such as tableclothes and napkins, and more formal tableware-on credit It is also estimated that your accruals, including taxes and wages payable, will increase by $4,350. . Based on your evaluation you have in free cash flow, Can a company have negative free cash flow? Yes