Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stephen Lee has an unincorporated business that he anticipates will have active business income of $200,000 for the taxation year ending December 31, 2021.

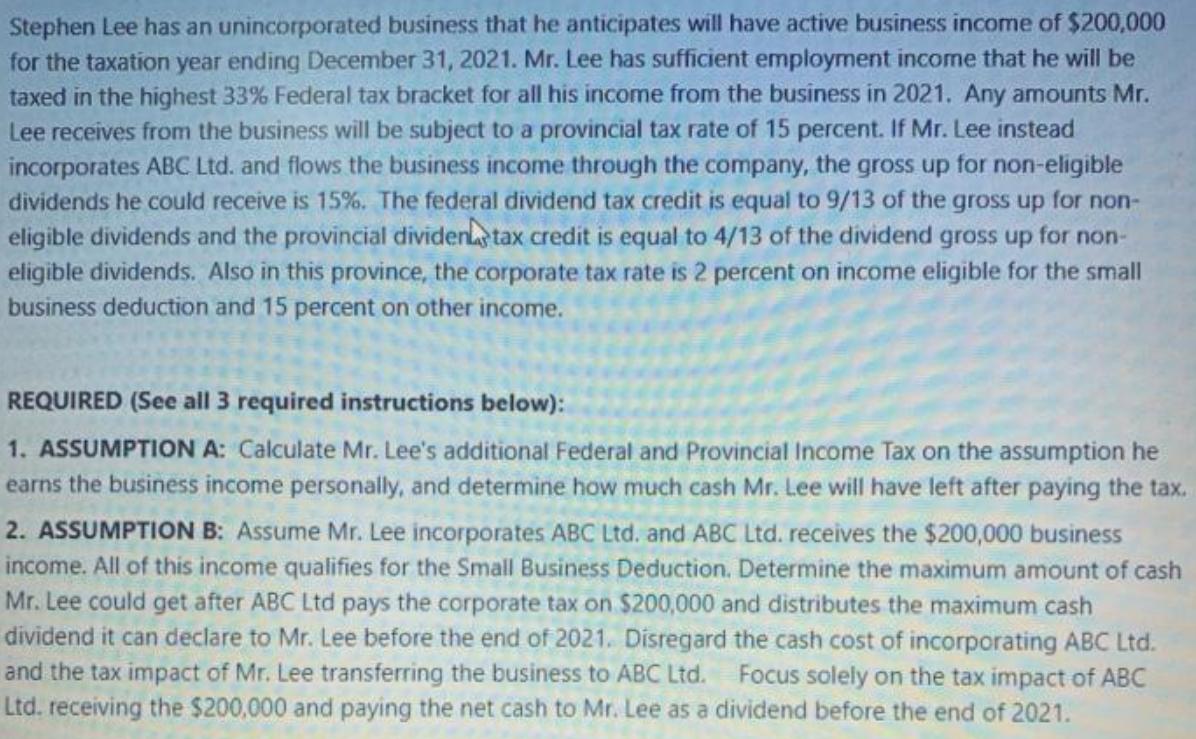

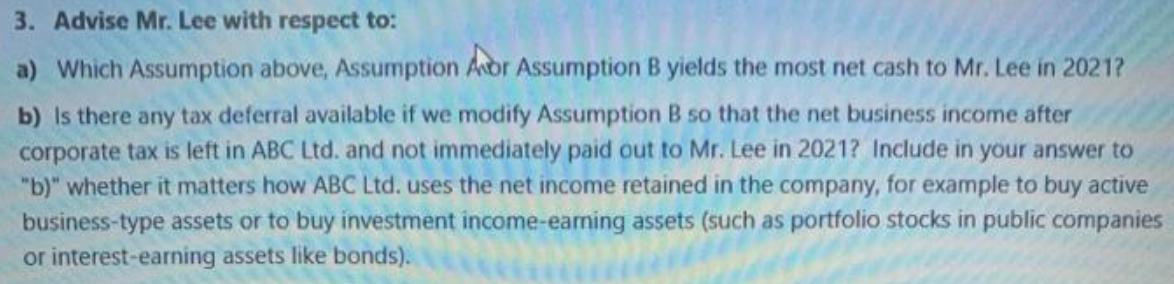

Stephen Lee has an unincorporated business that he anticipates will have active business income of $200,000 for the taxation year ending December 31, 2021. Mr. Lee has sufficient employment income that he will be taxed in the highest 33% Federal tax bracket for all his income from the business in 2021. Any amounts Mr. Lee receives from the business will be subject to a provincial tax rate of 15 percent. If Mr. Lee instead incorporates ABC Ltd. and flows the business income through the company, the gross up for non-eligible dividends he could receive is 15%. The federal dividend tax credit is equal to 9/13 of the gross up for non- eligible dividends and the provincial dividen tax credit is equal to 4/13 of the dividend gross up for non- eligible dividends. Also in this province, the corporate tax rate is 2 percent on income eligible for the small business deduction and 15 percent on other income. REQUIRED (See all 3 required instructions below): 1. ASSUMPTION A: Calculate Mr. Lee's additional Federal and Provincial Income Tax on the assumption he earns the business income personally, and determine how much cash Mr. Lee will have left after paying the tax. 2. ASSUMPTION B: Assume Mr. Lee incorporates ABC Ltd. and ABC Ltd. receives the $200,000 business income. All of this income qualifies for the Small Business Deduction. Determine the maximum amount of cash Mr. Lee could get after ABC Ltd pays the corporate tax on $200,000 and distributes the maximum cash dividend it can declare to Mr. Lee before the end of 2021. Disregard the cash cost of incorporating ABC Ltd. and the tax impact of Mr. Lee transferring the business to ABC Ltd. Focus solely on the tax impact of ABC Ltd. receiving the $200,000 and paying the net cash to Mr. Lee as a dividend before the end of 2021. 3. Advise Mr. Lee with respect to: a) Which Assumption above, Assumption Aor Assumption B yields the most net cash to Mr. Lee in 2021? b) Is there any tax deferral available if we modify Assumption B so that the net business income after corporate tax is left in ABC Ltd. and not immediately paid out to Mr. Lee in 2021? Include in your answer to "b)" whether it matters how ABC Ltd. uses the net income retained in the company, for example to buy active business-type assets or to buy investment income-earning assets (such as portfolio stocks in public companies or interest-earning assets like bonds). Stephen Lee has an unincorporated business that he anticipates will have active business income of $200,000 for the taxation year ending December 31, 2021. Mr. Lee has sufficient employment income that he will be taxed in the highest 33% Federal tax bracket for all his income from the business in 2021. Any amounts Mr. Lee receives from the business will be subject to a provincial tax rate of 15 percent. If Mr. Lee instead incorporates ABC Ltd. and flows the business income through the company, the gross up for non-eligible dividends he could receive is 15%. The federal dividend tax credit is equal to 9/13 of the gross up for non- eligible dividends and the provincial dividen tax credit is equal to 4/13 of the dividend gross up for non- eligible dividends. Also in this province, the corporate tax rate is 2 percent on income eligible for the small business deduction and 15 percent on other income. REQUIRED (See all 3 required instructions below): 1. ASSUMPTION A: Calculate Mr. Lee's additional Federal and Provincial Income Tax on the assumption he earns the business income personally, and determine how much cash Mr. Lee will have left after paying the tax. 2. ASSUMPTION B: Assume Mr. Lee incorporates ABC Ltd. and ABC Ltd. receives the $200,000 business income. All of this income qualifies for the Small Business Deduction. Determine the maximum amount of cash Mr. Lee could get after ABC Ltd pays the corporate tax on $200,000 and distributes the maximum cash dividend it can declare to Mr. Lee before the end of 2021. Disregard the cash cost of incorporating ABC Ltd. and the tax impact of Mr. Lee transferring the business to ABC Ltd. Focus solely on the tax impact of ABC Ltd. receiving the $200,000 and paying the net cash to Mr. Lee as a dividend before the end of 2021. 3. Advise Mr. Lee with respect to: a) Which Assumption above, Assumption Aor Assumption B yields the most net cash to Mr. Lee in 2021? b) Is there any tax deferral available if we modify Assumption B so that the net business income after corporate tax is left in ABC Ltd. and not immediately paid out to Mr. Lee in 2021? Include in your answer to "b)" whether it matters how ABC Ltd. uses the net income retained in the company, for example to buy active business-type assets or to buy investment income-earning assets (such as portfolio stocks in public companies or interest-earning assets like bonds). Stephen Lee has an unincorporated business that he anticipates will have active business income of $200,000 for the taxation year ending December 31, 2021. Mr. Lee has sufficient employment income that he will be taxed in the highest 33% Federal tax bracket for all his income from the business in 2021. Any amounts Mr. Lee receives from the business will be subject to a provincial tax rate of 15 percent. If Mr. Lee instead incorporates ABC Ltd. and flows the business income through the company, the gross up for non-eligible dividends he could receive is 15%. The federal dividend tax credit is equal to 9/13 of the gross up for non- eligible dividends and the provincial dividen tax credit is equal to 4/13 of the dividend gross up for non- eligible dividends. Also in this province, the corporate tax rate is 2 percent on income eligible for the small business deduction and 15 percent on other income. REQUIRED (See all 3 required instructions below): 1. ASSUMPTION A: Calculate Mr. Lee's additional Federal and Provincial Income Tax on the assumption he earns the business income personally, and determine how much cash Mr. Lee will have left after paying the tax. 2. ASSUMPTION B: Assume Mr. Lee incorporates ABC Ltd. and ABC Ltd. receives the $200,000 business income. All of this income qualifies for the Small Business Deduction. Determine the maximum amount of cash Mr. Lee could get after ABC Ltd pays the corporate tax on $200,000 and distributes the maximum cash dividend it can declare to Mr. Lee before the end of 2021. Disregard the cash cost of incorporating ABC Ltd. and the tax impact of Mr. Lee transferring the business to ABC Ltd. Focus solely on the tax impact of ABC Ltd. receiving the $200,000 and paying the net cash to Mr. Lee as a dividend before the end of 2021. 3. Advise Mr. Lee with respect to: a) Which Assumption above, Assumption Aor Assumption B yields the most net cash to Mr. Lee in 2021? b) Is there any tax deferral available if we modify Assumption B so that the net business income after corporate tax is left in ABC Ltd. and not immediately paid out to Mr. Lee in 2021? Include in your answer to "b)" whether it matters how ABC Ltd. uses the net income retained in the company, for example to buy active business-type assets or to buy investment income-earning assets (such as portfolio stocks in public companies or interest-earning assets like bonds).

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution These are the tax rates we will be using in this calculation Personal level Provincial 16 Federal for 2019 income above 210371 33 Total 16 33 49 Corporate level 98000 is all eligible f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started