Question

Summit Corporation, a chain of tourism-based businesses, sponsors a defined benefit pension plan for its employees. Summit follows IFRS. The plans trustee reports the following

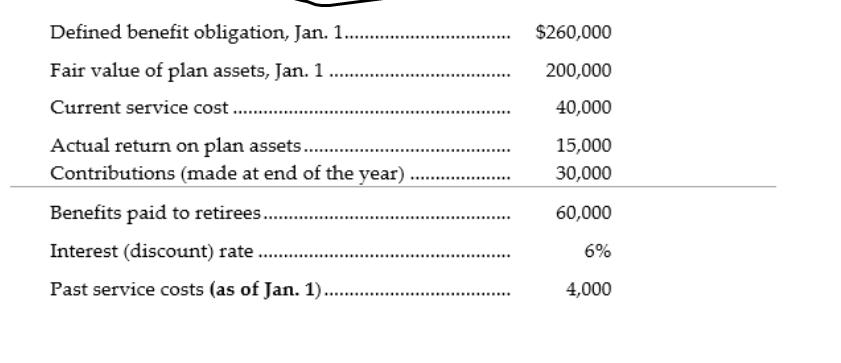

Summit Corporation, a chain of tourism-based businesses, sponsors a defined benefit pension plan for its employees. Summit follows IFRS. The plan’s trustee reports the following information for calendar 2020

Instructions

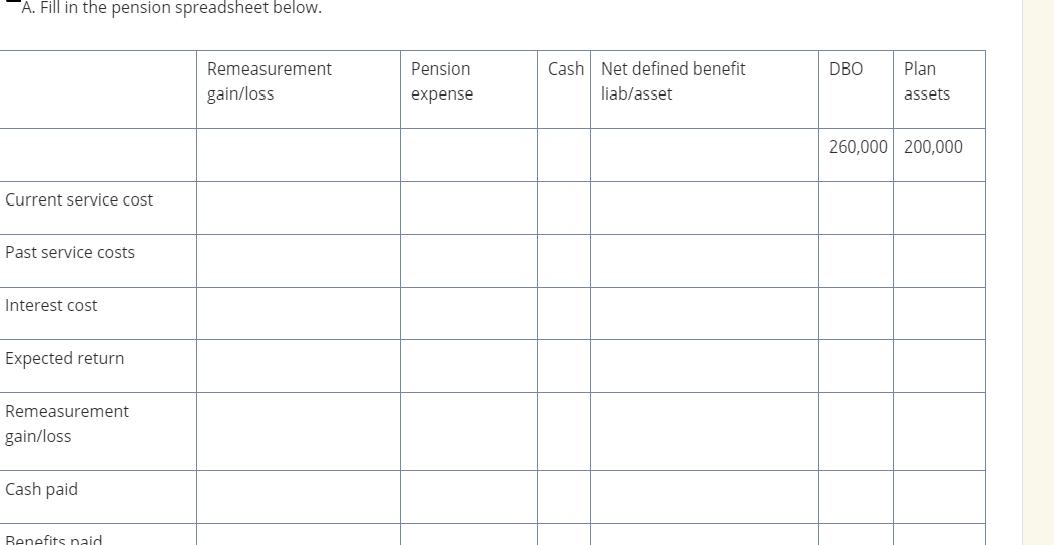

Fill in the pension spreadsheet below.

Provide the following figures:

Pension expense for 2020

DBO ending balance

Plan assets ending balance

Net defined benefit liability/asset ending balance

Remeasurement gain/loss ending balance

Prepare the pension-related journal entries for 2020.

Defined benefit obligation, Jan. 1. $260,000 Fair value of plan assets, Jan. 1 200,000 Current service cost.. 40,000 Actual return on plan assets. 15,000 Contributions (made at end of the year) 30,000 Benefits paid to retirees.. 60,000 Interest (discount) rate 6% Past service costs (as of Jan. 1). 4,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

IFRS edition volume 2

978-0470613474, 470613475, 978-0470616314

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App