Sunland Corporation hired a total of 18 new full-time employees on January 1, 2020. The employees are paid $770 per week, and no changes

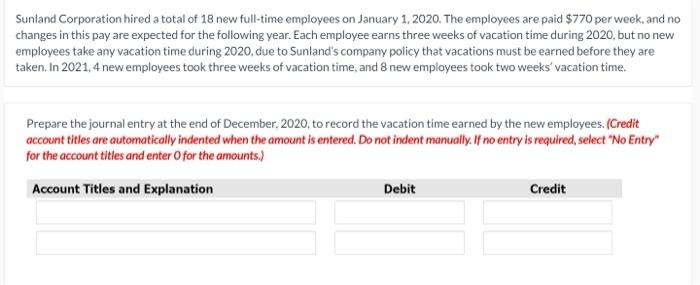

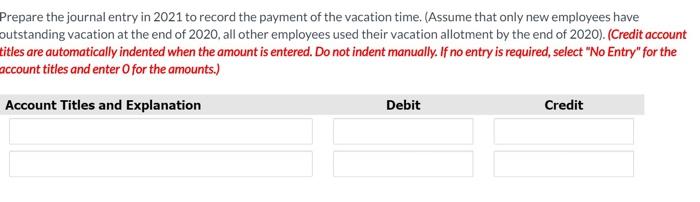

Sunland Corporation hired a total of 18 new full-time employees on January 1, 2020. The employees are paid $770 per week, and no changes in this pay are expected for the following year. Each employee earns three weeks of vacation time during 2020, but no new employees take any vacation time during 2020, due to Sunland's company policy that vacations must be earned before they are taken. In 2021, 4 new employees took three weeks of vacation time, and 8 new employees took two weeks' vacation time. Prepare the journal entry at the end of December, 2020, to record the vacation time earned by the new employees. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Prepare the journal entry in 2021 to record the payment of the vacation time. (Assume that only new employees have outstanding vacation at the end of 2020, all other employees used their vacation allotment by the end of 2020). (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Date Particulars Debit Credit 2020 Vacation expense 18 new employees X 770 per we...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started