Question

Suppose 3 risky assets whose random rates of return are governed by = 8+2f + 3f r = 5+ f + 2f r3 =

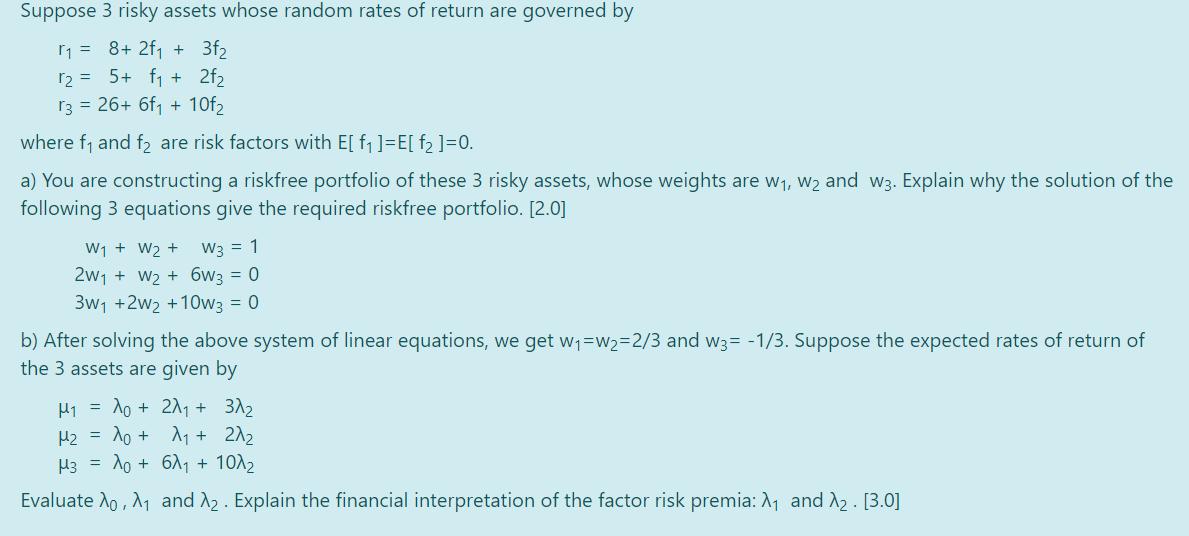

Suppose 3 risky assets whose random rates of return are governed by = 8+2f + 3f r = 5+ f + 2f r3 = 26+ 6f + 10f where f and f are risk factors with E[ f ]=E[f ]=0. a) You are constructing a riskfree portfolio of these 3 risky assets, whose weights are w, W2 and w3. Explain why the solution of the following 3 equations give the required riskfree portfolio. [2.0] W + W + W3 = 1 2w + W + 6w3 = 0 3w +2w +10W3 = 0 b) After solving the above system of linear equations, we get w=w=2/3 and w3= -1/3. Suppose the expected rates of return of the 3 assets are given by = + 2 + 3 H = A + + 2^ 3 = + + 1032 Evaluate A0, A and . Explain the financial interpretation of the factor risk premia: A and A. [3.0]

Step by Step Solution

3.60 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given return 3 risky assets whose random rates of are gov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Corporate Finance

Authors: Richard A. Brealey, Stewart C. Myers

7th edition

72869461, 72467665, 9780072467666, 978-0072869460

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App