Question

Note that Models 4 and 5 uses fitted values from Models 1 and 2. a) Determine and interpret the elasticities of consumption with respect to

Note that Models 4 and 5 uses fitted values from Models 1 and 2.

a) Determine and interpret the elasticities of consumption with respect to income, interest rate and price level. Are the empirical findings on the signs of elasticity measures consistent with economic theory?

b) In one of her Macroeconomics lectures, Jessica Harbour states that if the income level decreases by 10%, then consumption level would be declining by 25%. Can you statistically test this hypothesis by using the estimation results given above? If YES, provide your answer with details. If NO, state what additional information you would need.

c) Mıcheal thinks that prices and interest rates move together. Then their effect on consumption level should be related. Thus, marginal propensity to consume with respect to price should be the same as marginal propensity to consume with respect to interest rates. Can you statistically test this hypothesis by using the estimation results given above? If YES, provide your answer with details. If NO, state what additional information you would need. Why?

d) Jimmy is working on an econometric model for his research and his advisor asks him to determine whether the model has a non-constant variance. He wants to employ White test but he cannot exactly remember the procedures. Suppose he wants to use Model A and write down theoretical model equation for him to estimate for conducting the White test. Also explain him what to do after estimating the White test model.

e) Suppose one of the directors in the central bank does not like heteroscedasticity in the econometric models. Determine whether Model A and Model B exhibit heteroscedasticity problem.

f) The president of the central bank has Mathematics major and likes logarithm functions very much. Thus, the he wants to use the double log model. Do these results support the log-log model compared to linear model? Which model would you recommend? Why?

Econometcris

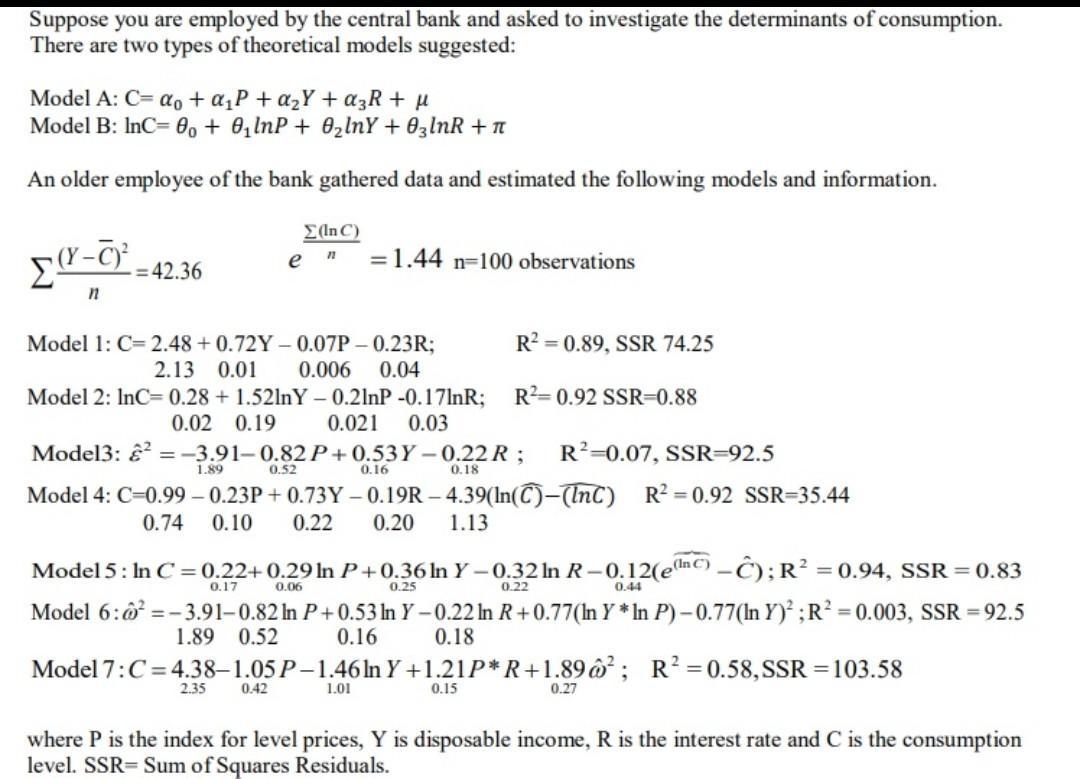

Suppose you are employed by the central bank and asked to investigate the determinants of consumption. There are two types of theoretical models suggested: Model A: C= a + P + aY+ 3R + Model B: InC= 0 + 0 lnP + OlnY + 03lnR + n An older employee of the bank gathered data and estimated the following models and information. (Y-C) = n -=42.36 1.89 (InC) e 0.52 Model 1: C= 2.48+0.72Y-0.07P - 0.23R; 2.13 0.01 0.006 0.04 Model 2: InC= 0.28 + 1.52lnY - 0.21nP -0.17lnR; 0.02 0.19 0.021 0.03 Model3: = -3.91-0.82 P+0.53Y-0.22 R ; R=0.07, SSR-92.5 0.16 Model 4: C-0.99-0.23P+0.73Y-0.19R-4.39(In(C)-(InC) R=0.92 SSR=35.44 0.10 0.22 0.20 1.13 =1.44 n=100 observations 0.42 R=0.89, SSR 74.25 R=0.92 SSR-0.88 0.18 0.74 Model 5: In C = 0.22+0.29 In P+0.36 In Y-0.32 In R-0.12(en)-C); R = 0.94, SSR = 0.83 0,25 0.22 0.17 0.06 0.44 Model 6: = -3.91-0.82 In P+0.53 In Y-0.22 In R+0.77(In Y * In P)-0.77(In Y) ; R = 0.003, SSR = 92.5 1.89 0.52 0.16 0.18 Model 7: C = 4.38-1.05 P-1.46 In Y+1.21P* R+1.89@; R=0.58, SSR=103.58 2.35 1.01 0.15 0.27 where P is the index for level prices, Y is disposable income, R is the interest rate and C is the consumption level. SSR= Sum of Squares Residuals.

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a The elasticities of consumption with respect to income interest rate and price level can be determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started