Answered step by step

Verified Expert Solution

Question

1 Approved Answer

n Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice (Babbling Lunatics, Inc.) with the following investments: A) Suzanne contributes her copyright (basis of $59,000

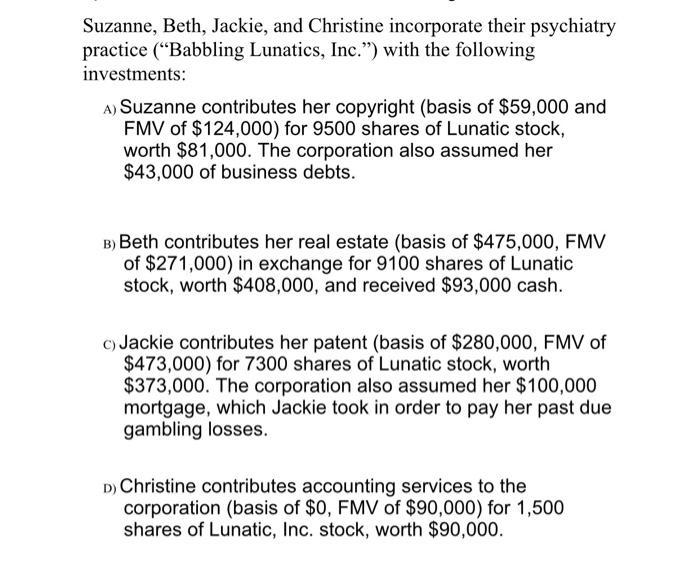

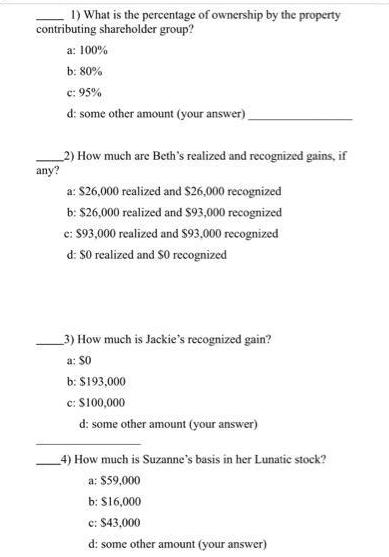

Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice ("Babbling Lunatics, Inc.") with the following investments: A) Suzanne contributes her copyright (basis of $59,000 and FMV of $124,000) for 9500 shares of Lunatic stock, worth $81,000. The corporation also assumed her $43,000 of business debts. B) Beth contributes her real estate (basis of $475,000, FMV of $271,000) in exchange for 9100 shares of Lunatic stock, worth $408,000, and received $93,000 cash. C) Jackie contributes her patent (basis of $280,000, FMV of $473,000) for 7300 shares of Lunatic stock, worth $373,000. The corporation also assumed her $100,000 mortgage, which Jackie took in order to pay her past due gambling losses. D) Christine contributes accounting services to the corporation (basis of $0, FMV of $90,000) for 1,500 shares of Lunatic, Inc. stock, worth $90,000. 1) What is the percentage of ownership by the property contributing shareholder group? a: 100% b: 80% c: 95% d: some other amount (your answer), 2) How much are Beth's realized and recognized gains, if any? a: S26,000 realized and $26,000 recognized b: $26,000 realized and S93,000 recognized e: $93,000 realized and $93,000 recognized d: S0 realized and S0 recognized _3) How much is Jackie's recognized gain? a: S0 b: $193,000 c: S100,000 d: some other amount (your answer) 4) How much is Suzanne's basis in her Lunatic stock? a: $59,000 b: S16,000 c: $43,000 d: some other amount (your answer) Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice ("Babbling Lunatics, Inc.") with the following investments: A) Suzanne contributes her copyright (basis of $59,000 and FMV of $124,000) for 9500 shares of Lunatic stock, worth $81,000. The corporation also assumed her $43,000 of business debts. B) Beth contributes her real estate (basis of $475,000, FMV of $271,000) in exchange for 9100 shares of Lunatic stock, worth $408,000, and received $93,000 cash. C) Jackie contributes her patent (basis of $280,000, FMV of $473,000) for 7300 shares of Lunatic stock, worth $373,000. The corporation also assumed her $100,000 mortgage, which Jackie took in order to pay her past due gambling losses. D) Christine contributes accounting services to the corporation (basis of $0, FMV of $90,000) for 1,500 shares of Lunatic, Inc. stock, worth $90,000. 1) What is the percentage of ownership by the property contributing shareholder group? a: 100% b: 80% c: 95% d: some other amount (your answer), 2) How much are Beth's realized and recognized gains, if any? a: S26,000 realized and $26,000 recognized b: $26,000 realized and S93,000 recognized e: $93,000 realized and $93,000 recognized d: S0 realized and S0 recognized _3) How much is Jackie's recognized gain? a: S0 b: $193,000 c: S100,000 d: some other amount (your answer) 4) How much is Suzanne's basis in her Lunatic stock? a: $59,000 b: S16,000 c: $43,000 d: some other amount (your answer) Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice ("Babbling Lunatics, Inc.") with the following investments: A) Suzanne contributes her copyright (basis of $59,000 and FMV of $124,000) for 9500 shares of Lunatic stock, worth $81,000. The corporation also assumed her $43,000 of business debts. B) Beth contributes her real estate (basis of $475,000, FMV of $271,000) in exchange for 9100 shares of Lunatic stock, worth $408,000, and received $93,000 cash. C) Jackie contributes her patent (basis of $280,000, FMV of $473,000) for 7300 shares of Lunatic stock, worth $373,000. The corporation also assumed her $100,000 mortgage, which Jackie took in order to pay her past due gambling losses. D) Christine contributes accounting services to the corporation (basis of $0, FMV of $90,000) for 1,500 shares of Lunatic, Inc. stock, worth $90,000. 1) What is the percentage of ownership by the property contributing shareholder group? a: 100% b: 80% c: 95% d: some other amount (your answer), 2) How much are Beth's realized and recognized gains, if any? a: S26,000 realized and $26,000 recognized b: $26,000 realized and S93,000 recognized e: $93,000 realized and $93,000 recognized d: S0 realized and S0 recognized _3) How much is Jackie's recognized gain? a: S0 b: $193,000 c: S100,000 d: some other amount (your answer) 4) How much is Suzanne's basis in her Lunatic stock? a: $59,000 b: S16,000 c: $43,000 d: some other amount (your answer) Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice ("Babbling Lunatics, Inc.") with the following investments: A) Suzanne contributes her copyright (basis of $59,000 and FMV of $124,000) for 9500 shares of Lunatic stock, worth $81,000. The corporation also assumed her $43,000 of business debts. B) Beth contributes her real estate (basis of $475,000, FMV of $271,000) in exchange for 9100 shares of Lunatic stock, worth $408,000, and received $93,000 cash. C) Jackie contributes her patent (basis of $280,000, FMV of $473,000) for 7300 shares of Lunatic stock, worth $373,000. The corporation also assumed her $100,000 mortgage, which Jackie took in order to pay her past due gambling losses. D) Christine contributes accounting services to the corporation (basis of $0, FMV of $90,000) for 1,500 shares of Lunatic, Inc. stock, worth $90,000. 1) What is the percentage of ownership by the property contributing shareholder group? a: 100% b: 80% c: 95% d: some other amount (your answer), 2) How much are Beth's realized and recognized gains, if any? a: S26,000 realized and $26,000 recognized b: $26,000 realized and S93,000 recognized e: $93,000 realized and $93,000 recognized d: S0 realized and S0 recognized _3) How much is Jackie's recognized gain? a: S0 b: $193,000 c: S100,000 d: some other amount (your answer) 4) How much is Suzanne's basis in her Lunatic stock? a: $59,000 b: S16,000 c: $43,000 d: some other amount (your answer) Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice ("Babbling Lunatics, Inc.") with the following investments: A) Suzanne contributes her copyright (basis of $59,000 and FMV of $124,000) for 9500 shares of Lunatic stock, worth $81,000. The corporation also assumed her $43,000 of business debts. B) Beth contributes her real estate (basis of $475,000, FMV of $271,000) in exchange for 9100 shares of Lunatic stock, worth $408,000, and received $93,000 cash. C) Jackie contributes her patent (basis of $280,000, FMV of $473,000) for 7300 shares of Lunatic stock, worth $373,000. The corporation also assumed her $100,000 mortgage, which Jackie took in order to pay her past due gambling losses. D) Christine contributes accounting services to the corporation (basis of $0, FMV of $90,000) for 1,500 shares of Lunatic, Inc. stock, worth $90,000. 1) What is the percentage of ownership by the property contributing shareholder group? a: 100% b: 80% c: 95% d: some other amount (your answer), 2) How much are Beth's realized and recognized gains, if any? a: S26,000 realized and $26,000 recognized b: $26,000 realized and S93,000 recognized e: $93,000 realized and $93,000 recognized d: S0 realized and S0 recognized _3) How much is Jackie's recognized gain? a: S0 b: $193,000 c: S100,000 d: some other amount (your answer) 4) How much is Suzanne's basis in her Lunatic stock? a: $59,000 b: S16,000 c: $43,000 d: some other amount (your answer) Suzanne, Beth, Jackie, and Christine incorporate their psychiatry practice ("Babbling Lunatics, Inc.") with the following investments: A) Suzanne contributes her copyright (basis of $59,000 and FMV of $124,000) for 9500 shares of Lunatic stock, worth $81,000. The corporation also assumed her $43,000 of business debts. B) Beth contributes her real estate (basis of $475,000, FMV of $271,000) in exchange for 9100 shares of Lunatic stock, worth $408,000, and received $93,000 cash. C) Jackie contributes her patent (basis of $280,000, FMV of $473,000) for 7300 shares of Lunatic stock, worth $373,000. The corporation also assumed her $100,000 mortgage, which Jackie took in order to pay her past due gambling losses. D) Christine contributes accounting services to the corporation (basis of $0, FMV of $90,000) for 1,500 shares of Lunatic, Inc. stock, worth $90,000. 1) What is the percentage of ownership by the property contributing shareholder group? a: 100% b: 80% c: 95% d: some other amount (your answer), 2) How much are Beth's realized and recognized gains, if any? a: S26,000 realized and $26,000 recognized b: $26,000 realized and S93,000 recognized e: $93,000 realized and $93,000 recognized d: S0 realized and S0 recognized _3) How much is Jackie's recognized gain? a: S0 b: $193,000 c: S100,000 d: some other amount (your answer) 4) How much is Suzanne's basis in her Lunatic stock? a: $59,000 b: S16,000 c: $43,000 d: some other amount (your answer)

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Ans Option A 100 workings Percentage of ownership by the property contributing shareholde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started