Organization We are a general merchandise retailer selling products to our guests through our stores and digital channels. We operate as a single segment

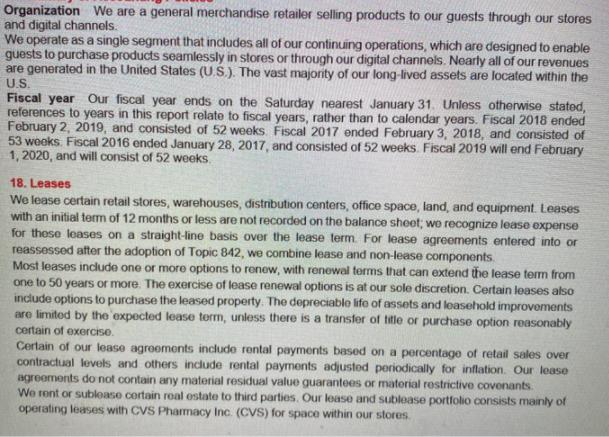

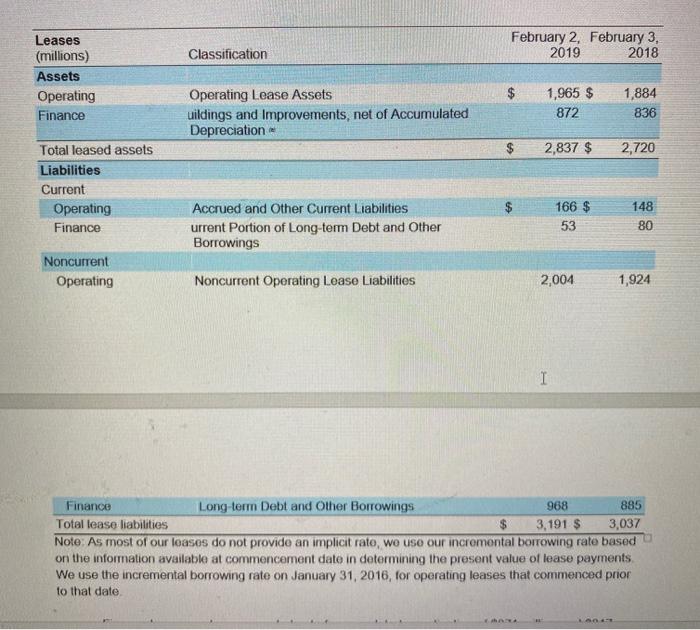

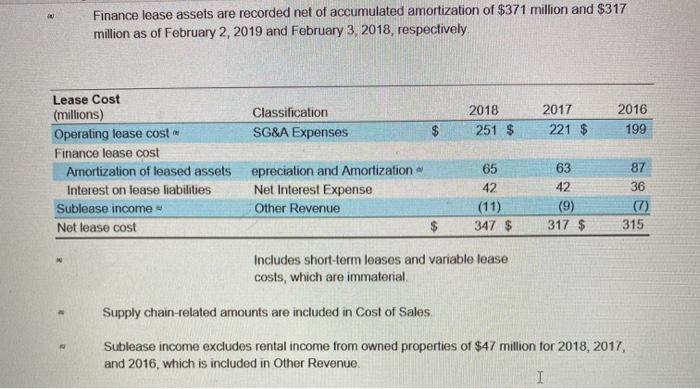

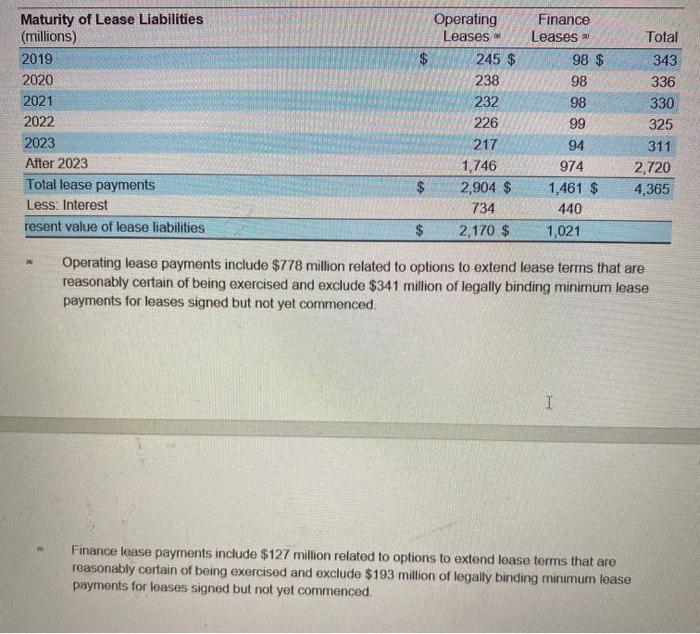

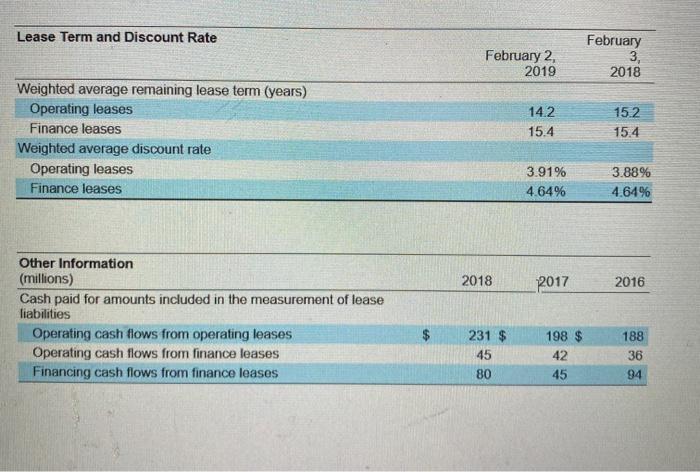

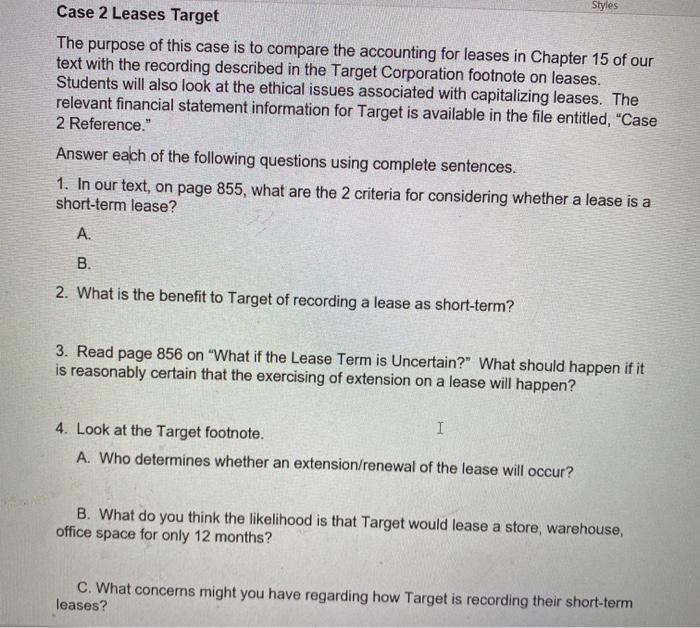

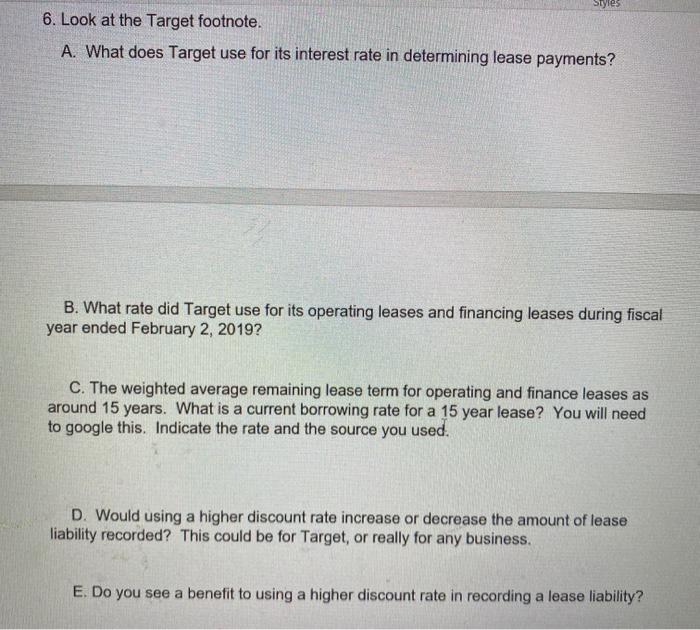

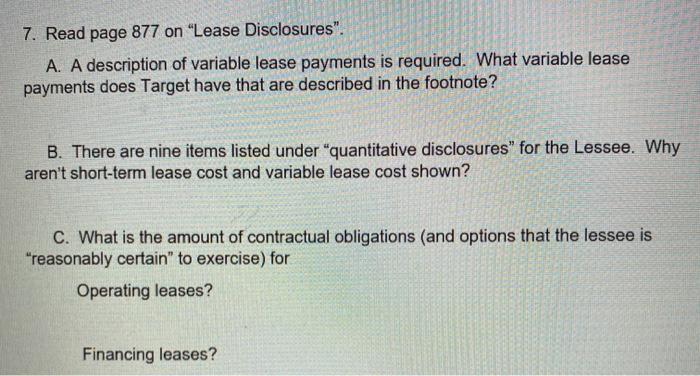

Organization We are a general merchandise retailer selling products to our guests through our stores and digital channels. We operate as a single segment that includes all of our continuing operations, which are designed to enable guests to purchase products seamlessly in stores or through our digital channels. Nearly all of our revenues are generated in the United States (U.S.). The vast majority of our long-lived assets are located within the U.S. Fiscal year Our fiscal year ends on the Saturday nearest January 31. Unless otherwise stated, references to years in this report relate to fiscal years, rather than to calendar years. Fiscal 2018 ended February 2, 2019, and consisted of 52 weeks. Fiscal 2017 ended February 3, 2018, and consisted of 53 weeks. Fiscal 2016 ended January 28, 2017, and consisted of 52 weeks. Fiscal 2019 will end February 1, 2020, and will consist of 52 weeks. 18. Leases We lease certain retail stores, warehouses, distribution centers, office space, land, and equipment. Leases with an initial term of 12 months or less are not recorded on the balance sheet; we recognize lease expense for these leases on a straight-line basis over the lease term. For lease agreements entered into or reassessed after the adoption of Topic 842, we combine lease and non-lease components. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 50 years or more. The exercise of lease renewal options is at our sole discretion. Certain leases also include options to purchase the leased property. The depreciable life of assets and leasehold improvements are limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise. Certain of our lease agreements include rental payments based on a percentage of retail sales over contractual levels and others include rental payments adjusted periodically for inflation. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants. We rent or sublease certain real estate to third parties. Our lease and sublease portfolio consists mainly of operating leases with CVS Pharmacy Inc. (CVS) for space within our stores. Leases (millions) Assets Operating Finance Total leased assets Liabilities Current Operating Finance Noncurrent Operating Classification Operating Lease Assets uildings and Improvements, net of Accumulated. Depreciation De Accrued and Other Current Liabilities urrent Portion of Long-term Debt and Other Borrowings Noncurrent Operating Lease Liabilities February 2, February 3, 2019 2018 IA 1,965 $ 872 MANA 2,837 $ 166 $ 53 2,004 I 1,884 836 1.00.47 2,720 148 80 Finance Long-term Debt and Other Borrowings 968 885 3,191 $ 3,037 Total lease liabilities Note: As most of our leases do not provide an implicit rate, we use our incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. We use the incremental borrowing rate on January 31, 2016, for operating leases that commenced prior to that date. 1,924 IN Finance lease assets are recorded net of accumulated amortization of $371 million and $317 million as of February 2, 2019 and February 3, 2018, respectively Lease Cost (millions) Operating lease cost Finance lease cost Amortization of leased assets Interest on lease liabilities Sublease income = Net lease cost Classification SG&A Expenses epreciation and Amortization Net Interest Expense Other Revenue 2018 251 $ 65 42 (11) 347 $ Includes short-term leases and variable lease costs, which are immaterial. 2017 221 $ 63 42 (9) 317 $ 2016 199 87 36 Supply chain-related amounts are included in Cost of Sales. Sublease income excludes rental income from owned properties of $47 million for 2018, 2017, and 2016, which is included in Other Revenue. I (7) 315 Maturity of Lease Liabilities (millions) 2019 2020 2021 2022 2023 After 2023 Total lease payments Less: Interest resent value of lease liabilities IN $ Operating Leases 245 $ 238 232 226 217 1,746 2,904 $ 734 2,170 $ Finance Leases 98 $ 98 98 99 94 974 1,461 $ 440 1,021 Operating lease payments include $778 million related to options to extend lease terms that are reasonably certain of being exercised and exclude $341 million of legally binding minimum lease payments for leases signed but not yet commenced. I Total 343 336 330 325 311 2,720 4,365 Finance lease payments include $127 million related to options to extend lease terms that are reasonably certain of being exercised and exclude $193 million of legally binding minimum lease payments for leases signed but not yet commenced. Lease Term and Discount Rate Weighted average remaining lease term (years) Operating leases Finance leases Weighted average discount rate Operating leases Finance leases Other Information (millions) Cash paid for amounts included in the measurement of lease liabilities Operating cash flows from operating leases Operating cash flows from finance leases Financing cash flows from finance leases February 2, 2019 2018 231 $ 45 80 14.2 15.4 3.91% 4.64% 2017 198 $ 42 45 February 3, 2018 15.2 15.4 3.88% 4.64% 2016 188 36 94 Case 2 Leases Target The purpose of this case is to compare the accounting for leases in Chapter 15 of our text with the recording described in the Target Corporation footnote on leases. Students will also look at the ethical issues associated with capitalizing leases. The relevant financial statement information for Target is available in the file entitled, "Case 2 Reference." Styles Answer each of the following questions using complete sentences. 1. In our text, on page 855, what are the 2 criteria for considering whether a lease is a short-term lease? A. B. 2. What is the benefit to Target of recording a lease as short-term? 3. Read page 856 on "What if the Lease Term is Uncertain?" What should happen if it is reasonably certain that the exercising of extension on a lease will happen? 4. Look at the Target footnote. A. Who determines whether an extension/renewal of the lease will occur? I B. What do you think the likelihood is that Target would lease a store, warehouse, office space for only 12 months? C. What concerns might you have regarding how Target is recording their short-term leases? Styles 6. Look at the Target footnote. A. What does Target use for its interest rate in determining lease payments? B. What rate did Target use for its operating leases and financing leases during fiscal year ended February 2, 2019? C. The weighted average remaining lease term for operating and finance leases as around 15 years. What is a current borrowing rate for a 15 year lease? You will need to google this. Indicate the rate and the source you used. D. Would using a higher discount rate increase or decrease the amount of lease liability recorded? This could be for Target, or really for any business. E. Do you see a benefit to using a higher discount rate in recording a lease liability? 7. Read page 877 on "Lease Disclosures". A. A description of variable lease payments is required. What variable lease payments does Target have that are described in the footnote? B. There are nine items listed under "quantitative disclosures" for the Lessee. Why aren't short-term lease cost and variable lease cost shown? C. What is the amount of contractual obligations (and options that the lessee is "reasonably certain" to exercise) for Operating leases? Financing leases?

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

First establish the formula then compute For current ratio Current assets Current liabilities 20756 20125 103 For quick ratio Quick assets Current liabilities 20756 10653 159220125 042 For debt ratio ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started