Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Sabeena owns 2 furnished houses, both houses are let out for residential purposes. The details of each residential property for the tax year 1/10/2019

Ms. Sabeena owns 2 furnished houses, both houses are let out for residential purposes. The details of each residential property for the tax year 1/10/2019 are as follows:

a). You are required to calculate the tax liability and tax payable of Ms. Sabeena for the Tax year 2019/20.

b). List out and explain the various incomes exempt from tax.

c) Explain for example, the tax implication of Saving Nil Rate band and Dividend Nil Rate Band. How it affected the tax of Ms. Sabeena?

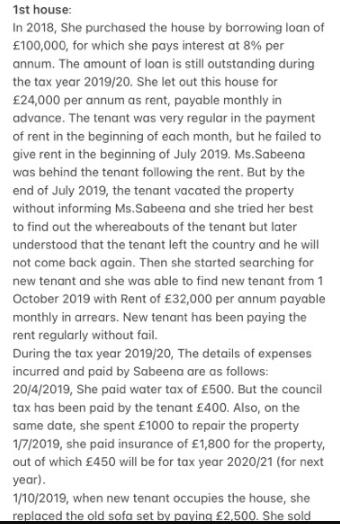

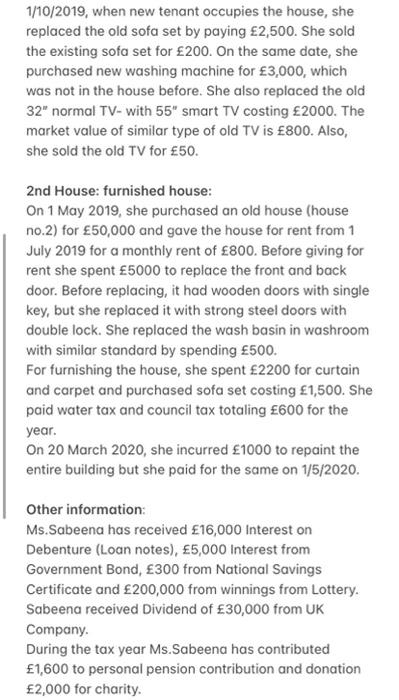

1st house: In 2018, She purchased the house by borrowing loan of 100,000, for which she pays interest at 8% per annum. The amount of loan is still outstanding during the tax year 2019/20. She let out this house for 24,000 per annum as rent, payable monthly in advance. The tenant was very regular in the payment of rent in the beginning of each month, but he failed to give rent in the beginning of July 2019. Ms.Sabeena was behind the tenant following the rent. But by the end of July 2019, the tenant vacated the property without informing Ms.Sabeena and she tried her best to find out the whereabouts of the tenant but later understood that the tenant left the country and he will not come back again. Then she started searching for new tenant and she was able to find new tenant from 1 October 2019 with Rent of 32,000 per annum payable monthly in arrears. New tenant has been paying the rent regularly without fail. During the tax year 2019/20, The details of expenses incurred and paid by Sabeena are as follows: 20/4/2019, She paid water tax of 500. But the council tax has been paid by the tenant 400. Also, on the same date, she spent 1000 to repair the property 1/7/2019, she paid insurance of 1,800 for the property, out of which 450 will be for tax year 2020/21 (for next year). 1/10/2019, when new tenant occupies the house, she replaced the old sofa set by paving 2.500. She sold

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a You are required to calculate the tax liability and tax payable of Ms Sabeena for the Tax year 201920 ANSWER The tax payable by Ms Sabeena for the tax year 201920 would be Income from property 1 Ren...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started