Answered step by step

Verified Expert Solution

Question

1 Approved Answer

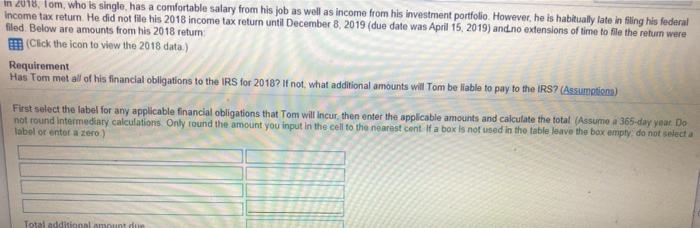

in 2018, Tom, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is

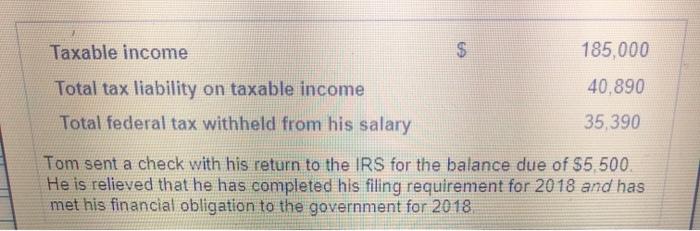

in 2018, Tom, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal Income tax return. He did not file his 2018 income tax return until December 8, 2019 (due date was April 15, 2019) and no extensions of time to file the return were filed. Below are amounts from his 2018 return (Click the icon to view the 2018 data) Requirement Has Tom met all of his financial obligations to the IRS for 2018? If not, what additional amounts will Tom be liable to pay to the IRS? (Assumptions) First select the label for any applicable financial obligations that Tom will incur, then enter the applicable amounts and calculate the total (Assume a 365-day year Do not round intermediary calculations. Only round the amount you input in the cell to the nearest cent. If a box is not used in the table leave the box empty, do not select a label or enter a zero) Total additional amount due Taxable income Total tax liability on taxable income Total federal tax withheld from his salary $ 185,000 40,890 35,390 Tom sent a check with his return to the IRS for the balance due of $5,500. He is relieved that he has completed his filing requirement for 2018 and has met his financial obligation to the government for 2018

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information Tom has not met all of his financial obligations to the IRS for 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started