Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Teal Mountain Inc.'s CFO has just left the office of the company president after a meeting about the draft SFP at April 30, 2020,

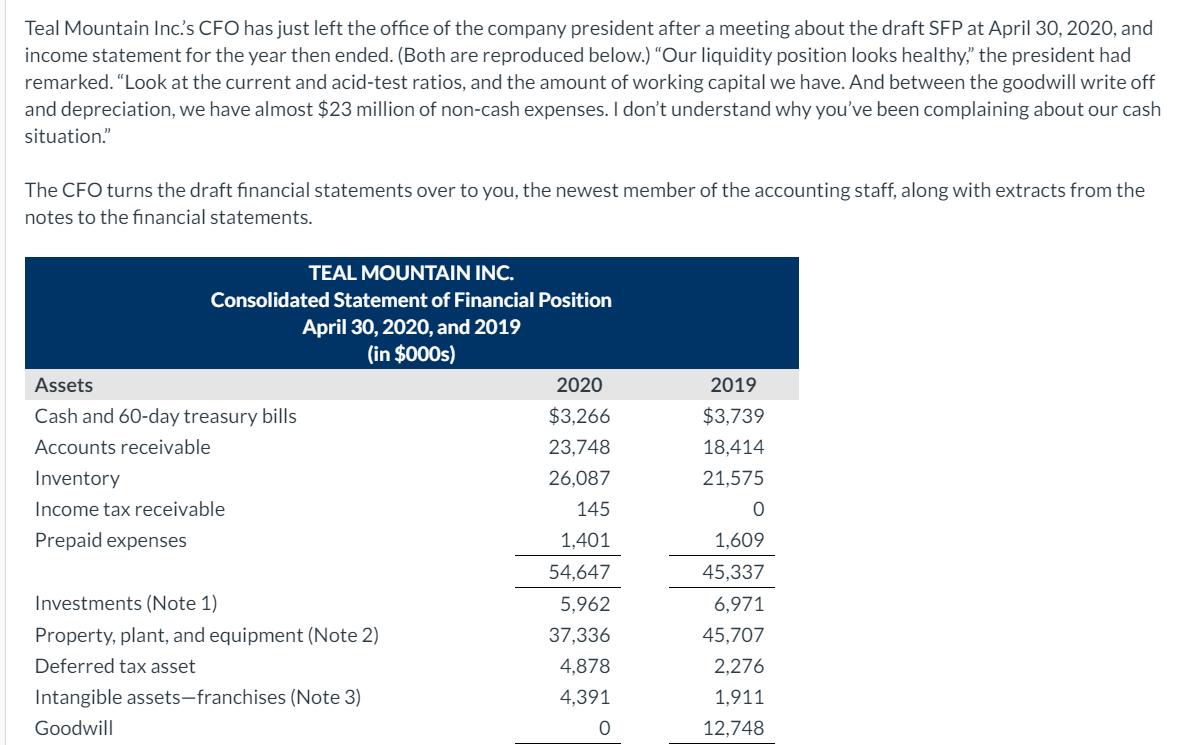

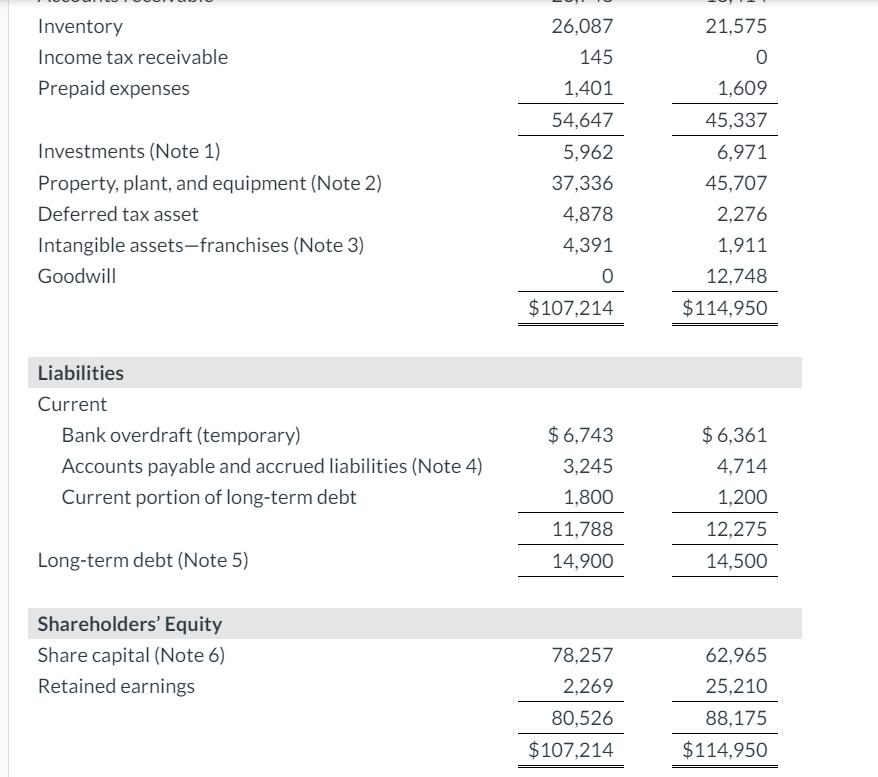

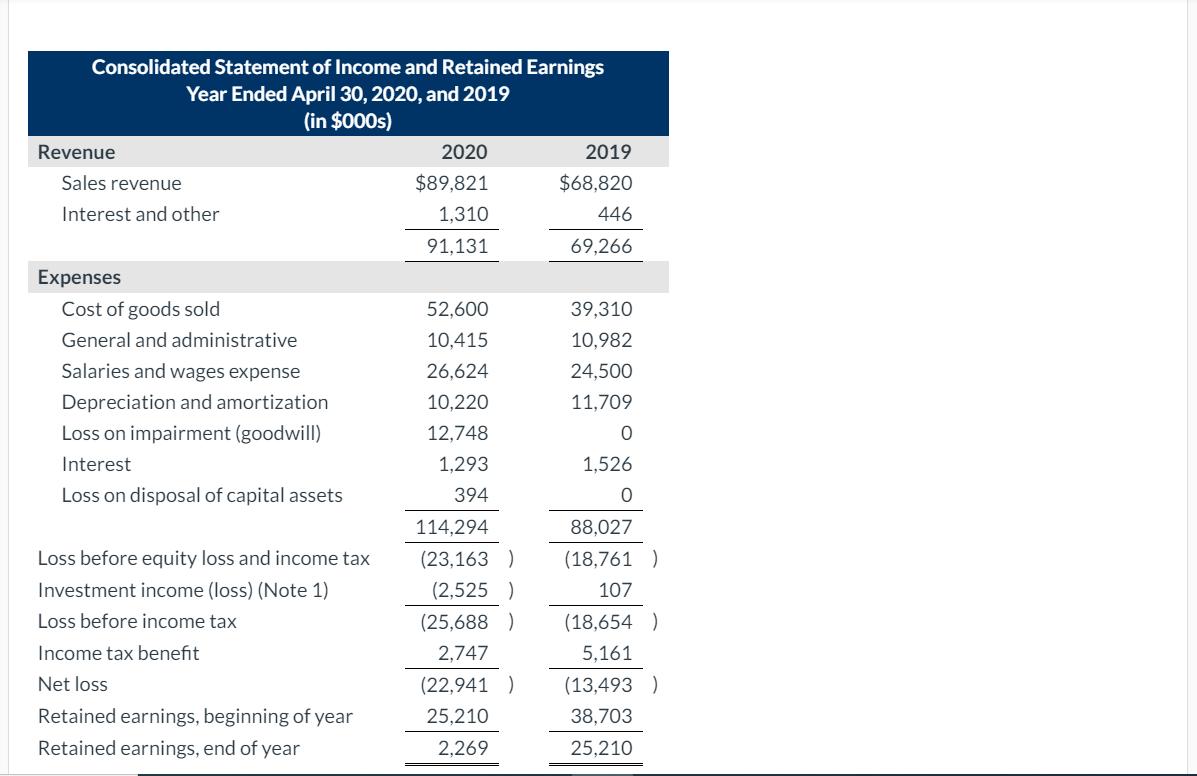

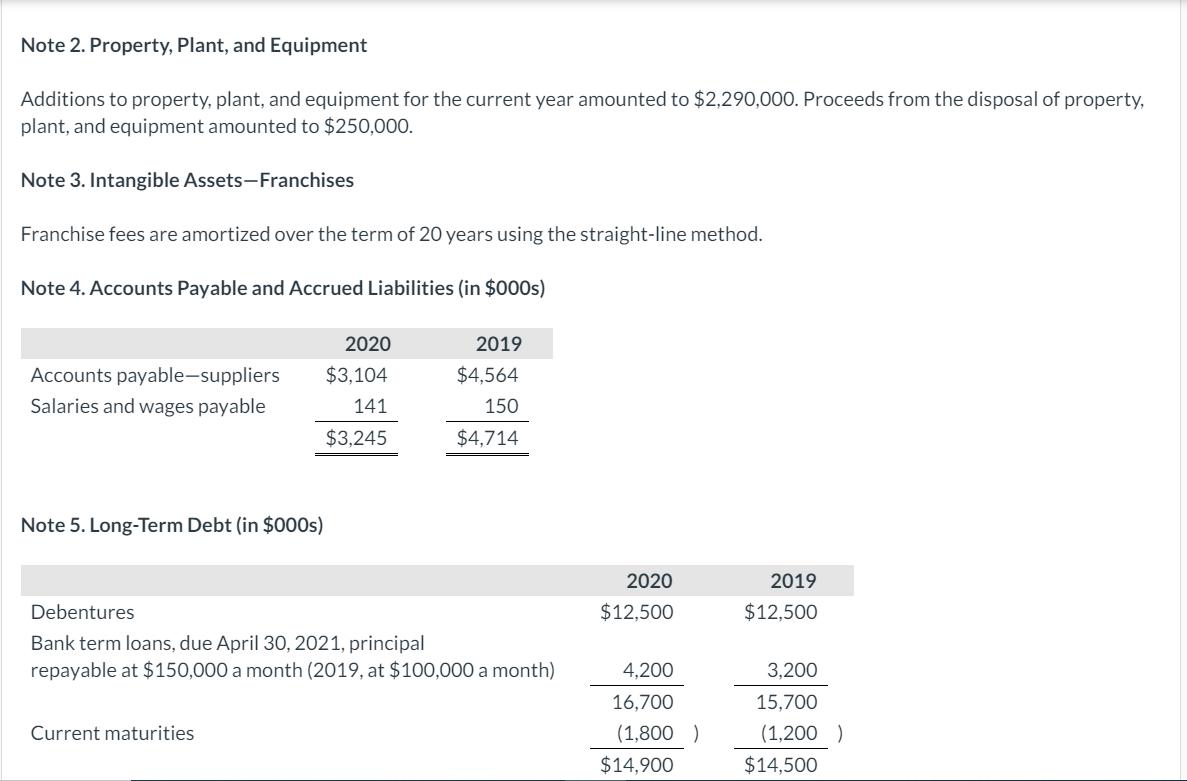

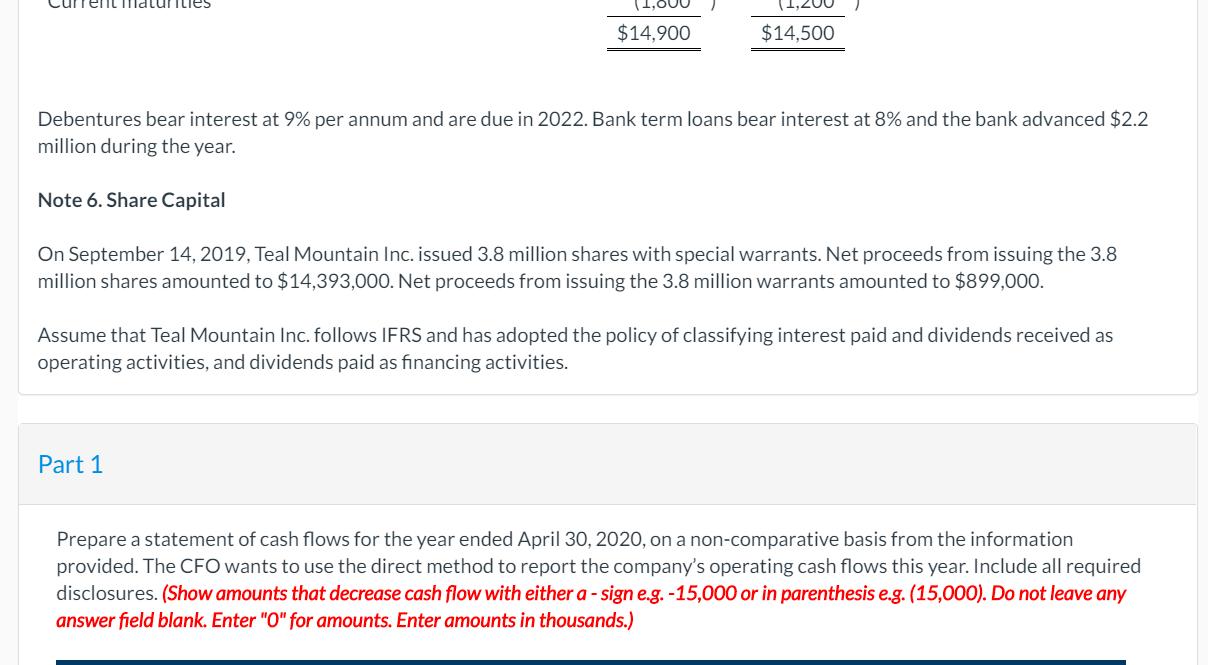

Teal Mountain Inc.'s CFO has just left the office of the company president after a meeting about the draft SFP at April 30, 2020, and income statement for the year then ended. (Both are reproduced below.) "Our liquidity position looks healthy," the president had remarked. "Look at the current and acid-test ratios, and the amount of working capital we have. And between the goodwill write off and depreciation, we have almost $23 million of non-cash expenses. I don't understand why you've been complaining about our cash situation." The CFO turns the draft financial statements over to you, the newest member of the accounting staff, along with extracts from the notes to the financial statements. TEAL MOUNTAIN INC. Consolidated Statement of Financial Position April 30, 2020, and 2019 (in $000s) Assets Cash and 60-day treasury bills Accounts receivable Inventory Income tax receivable Prepaid expenses Investments (Note 1) Property, plant, and equipment (Note 2) Deferred tax asset Intangible assets-franchises (Note 3) Goodwill 2020 $3,266 23,748 26,087 145 1,401 54,647 5,962 37,336 4,878 4,391 0 2019 $3,739 18,414 21,575 0 1,609 45,337 6,971 45,707 2,276 1,911 12,748 Inventory Income tax receivable Prepaid expenses Investments (Note 1) Property, plant, and equipment (Note 2) Deferred tax asset Intangible assets-franchises (Note 3) Goodwill Liabilities Current Bank overdraft (temporary) Accounts payable and accrued liabilities (Note 4) Current portion of long-term debt Long-term debt (Note 5) Shareholders' Equity Share capital (Note 6) Retained earnings 26,087 145 1,401 54,647 5,962 37,336 4,878 4,391 0 $107,214 $6,743 3,245 1,800 11,788 14,900 78,257 2,269 80,526 $107,214 21,575 0 1,609 45,337 6,971 45,707 2,276 1,911 12,748 $114,950 $6,361 4,714 1,200 12,275 14,500 62,965 25,210 88,175 $114,950 Consolidated Statement of Income and Retained Earnings Year Ended April 30, 2020, and 2019 (in $000s) Revenue Sales revenue Interest and other Expenses Cost of goods sold General and administrative Salaries and wages expense Depreciation and amortization Loss on impairment (goodwill) Interest Loss on disposal of capital assets Loss before equity loss and income tax Investment income (loss) (Note 1) Loss before income tax Income tax benefit Net loss Retained earnings, beginning of year Retained earnings, end of year 2020 $89,821 1,310 91,131 52,600 10,415 26,624 10,220 12,748 1,293 394 114,294 (23,163 ) (2,525 ) (25,688 ) 2,747 (22,941 ) 25,210 2,269 2019 $68,820 446 69,266 39,310 10,982 24,500 11,709 0 1,526 0 88,027 (18,761 ) 107 (18,654 ) 5,161 (13,493 ) 38,703 25,210 Note 2. Property, Plant, and Equipment Additions to property, plant, and equipment for the current year amounted to $2,290,000. Proceeds from the disposal of property, plant, and equipment amounted to $250,000. Note 3. Intangible Assets-Franchises Franchise fees are amortized over the term of 20 years using the straight-line method. Note 4. Accounts Payable and Accrued Liabilities (in $000s) Accounts payable-suppliers Salaries and wages payable Note 5. Long-Term Debt (in $000s) 2020 $3,104 141 $3,245 Current maturities 2019 $4,564 150 $4,714 Debentures Bank term loans, due April 30, 2021, principal repayable at $150,000 a month (2019, at $100,000 a month) 2020 $12,500 4,200 16,700 (1,800 ) $14,900 2019 $12,500 3,200 15,700 (1,200 ) $14,500 Note 6. Share Capital (1,600 $14,900 Debentures bear interest at 9% per annum and are due in 2022. Bank term loans bear interest at 8% and the bank advanced $2.2 million during the year. (1,200 $14,500 On September 14, 2019, Teal Mountain Inc. issued 3.8 million shares with special warrants. Net proceeds from issuing the 3.8 million shares amounted to $14,393,000. Net proceeds from issuing the 3.8 million warrants amounted to $899,000. Part 1 Assume that Teal Mountain Inc. follows IFRS and has adopted the policy of classifying interest paid and dividends received as operating activities, and dividends paid as financing activities. Prepare a statement of cash flows for the year ended April 30, 2020, on a non-comparative basis from the information provided. The CFO wants to use the direct method to report the company's operating cash flows this year. Include all required disclosures. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000). Do not leave any answer field blank. Enter "O" for amounts. Enter amounts in thousands.) Teal Mountain Inc. Consolidated Statement of Cash Flows $ $ $

Step by Step Solution

★★★★★

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the statement of cash flows using the direct method we need to analyze the information provided and categorize each item into one of the following sections operating activities investing ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started