Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tess used the proceeds from the sale or her real property and personal property to purchase various investments on January 1st, 2020, and finance

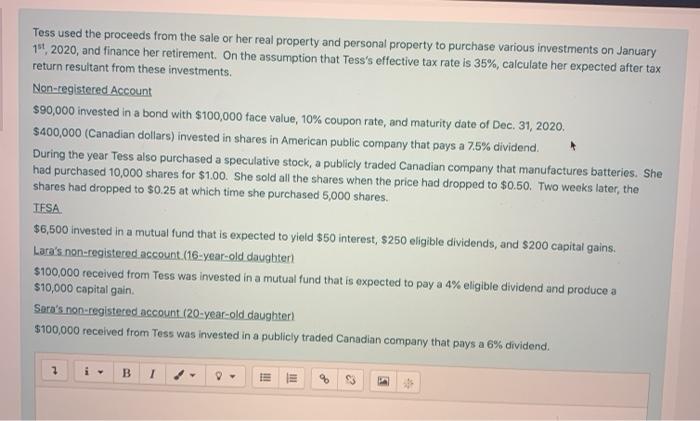

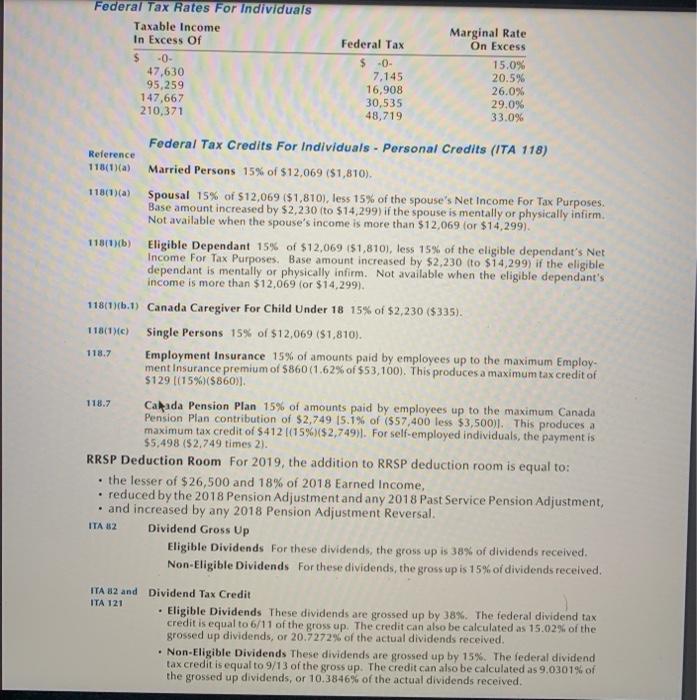

Tess used the proceeds from the sale or her real property and personal property to purchase various investments on January 1st, 2020, and finance her retirement. On the assumption that Tess's effective tax rate is 35%, calculate her expected after tax return resultant from these investments. Non-registered Account $90,000 invested in a bond with $100,000 face value, 10% coupon rate, and maturity date of Dec. 31, 2020. $400,000 (Canadian dollars) invested in shares in American public company that pays a 7.5% dividend. During the year Tess also purchased a speculative stock, a publicly traded Canadian company that manufactures batteries. She had purchased 10,000 shares for $1.00. She sold all the shares when the price had dropped to $0.50. Two weeks later, the shares had dropped to $0.25 at which time she purchased 5,000 shares. IFSA $6,500 invested in a mutual fund that is expected to yield $50 interest, $250 eligible dividends, and $200 capital gains. Lara's non-registered account (16-year-old daughter) $100,000 received from Tess was invested in a mutual fund that is expected to pay a 4% eligible dividend and produce a $10,000 capital gain. Sara's non-registered account (20-year-old daughter) $100,000 received from Tess was invested in a publicly traded Canadian company that pays a 6% dividend. B I Federal Tax Rates For Individuals Taxable Income In Excess Of $ -0- 118.7 47,630 95,259 147,667 210,371 Reference 118(1)(a) Married Persons 15% of $12,069 ($1,810). 118.7 Federal Tax $-0- . 7,145 16,908 30,535 48,719 118(1)(a) Spousal 15% of $12,069 ($1,810), less 15% of the spouse's Net Income For Tax Purposes. Base amount increased by $2,230 (to $14,299) if the spouse is mentally or physically infirm. Not available when the spouse's income is more than $12,069 (or $14,299). 118(1)(b) Eligible Dependant 15% of $12,069 ($1,810), less 15% of the eligible dependant's Net Income For Tax Purposes. Base amount increased by $2,230 (to $14,299) if the eligible dependant is mentally or physically infirm. Not available when the eligible dependant's income is more than $12,069 (or $14,299). 118(1)(b.1) Canada Caregiver For Child Under 18 15% of $2,230 ($335). 118(1)(c) Single Persons 15% of $12,069 ($1,810). ITA 82 and ITA 121 Marginal Ratel On Excess Federal Tax Credits For Individuals - Personal Credits (ITA 118) 15.0% 20.5% 26.0% 29.0% 33.0% Calada Pension Plan 15% of amounts paid by employees up to the maximum Canada Pension Plan contribution of $2,749 15.1% of ($57,400 less $3,500). This produces a maximum tax credit of $412 ((15%) ($2,749)1. For self-employed individuals, the payment is $5,498 ($2,749 times 2). RRSP Deduction Room For 2019, the addition to RRSP deduction room is equal to: Employment Insurance 15% of amounts paid by employees up to the maximum Employ- ment Insurance premium of $860 (1.62% of $53,100). This produces a maximum tax credit of $129 [(15%) ($860)]. the lesser of $26,500 and 18% of 2018 Earned Income, reduced by the 2018 Pension Adjustment and any 2018 Past Service Pension Adjustment, and increased by any 2018 Pension Adjustment Reversal. ITA 82 . Dividend Gross Up Eligible Dividends For these dividends, the gross up is 38% of dividends received. Non-Eligible Dividends For these dividends, the gross up is 15% of dividends received. Dividend Tax Credit Eligible Dividends These dividends are grossed up by 38%. The federal dividend tax credit is equal to 6/11 of the gross up. The credit can also be calculated as 15.02% of the grossed up dividends, or 20.7272% of the actual dividends received. Non-Eligible Dividends These dividends are grossed up by 15%. The federal dividend tax credit is equal to 9/13 of the gross up. The credit can also be calculated as 9.0301% of the grossed up dividends, or 10.3846% of the actual dividends received.

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Tesss expected after tax return on her investments is Bond 90000 x 1 035 x 1 01 103500 Amer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started