Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Alabama National Guard has asked your development company for a preliminary proposal to deliver a 10,000 SF small multi-purpose military education building on

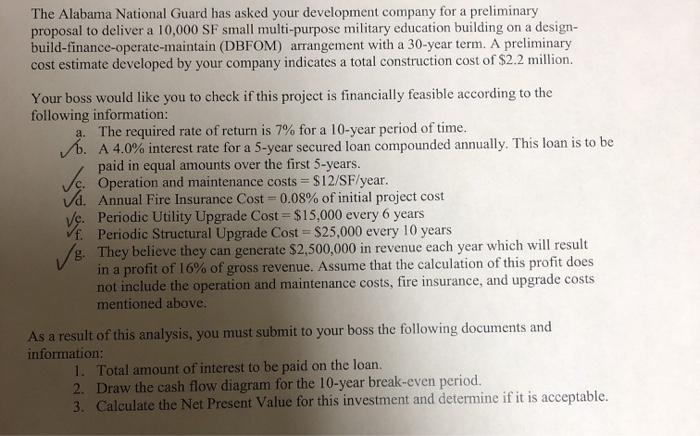

The Alabama National Guard has asked your development company for a preliminary proposal to deliver a 10,000 SF small multi-purpose military education building on a design- build-finance-operate-maintain (DBFOM) arrangement with a 30-year term. A preliminary cost estimate developed by your company indicates a total construction cost of $2.2 million. Your boss would like you to check if this project is financially feasible according to the following information: a. The required rate of return is 7% for a 10-year period of time. b. A 4.0% interest rate for a 5-year secured loan compounded annually. This loan is to be paid in equal amounts over the first 5-years. Je. Operation and maintenance costs $12/SF/year. Vd. Annual Fire Insurance Cost = 0.08% of initial project cost Ve. Periodic Utility Upgrade Cost = $15,000 every 6 years Vf. Periodic Structural Upgrade Cost = $25,000 every 10 years g. They believe they can generate $2,500,000 in revenue each year which will result in a profit of 16% of gross revenue. Assume that the calculation of this profit does not include the operation and maintenance costs, fire insurance, and upgrade costs %3D mentioned above. As a result of this analysis, you must submit to your boss the following documents and information: 1. Total amount of interest to be paid on the loan. 2. Draw the cash flow diagram for the 10-year break-even period. 3. Calculate the Net Present Value for this investment and determine if it is acceptable.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Equated Annnual installment of Loan P r 1 rn1 rn 1 220000004104510451 49417965 Total amount of interst on the loan Year Opening Balance EAI Principa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started