Answered step by step

Verified Expert Solution

Question

1 Approved Answer

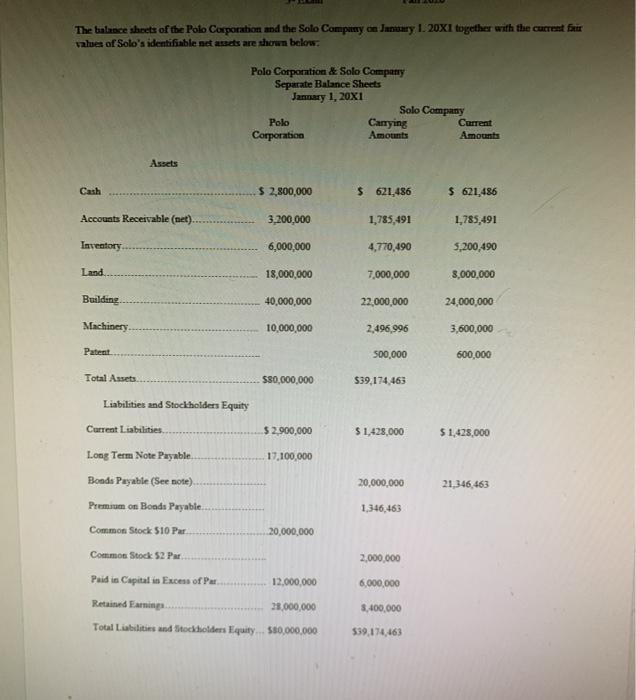

The balance sheets of the Polo Corporation and the Solo Company on January 1. 20X1 together with the current fair values of Solo's identifiable

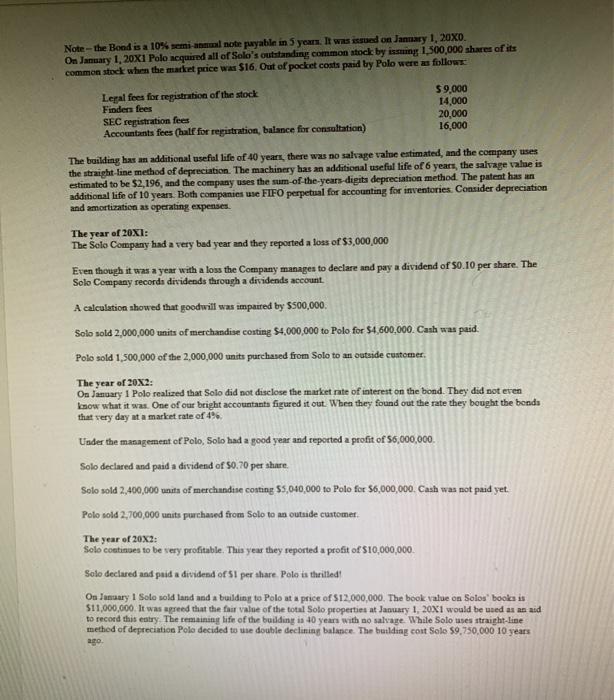

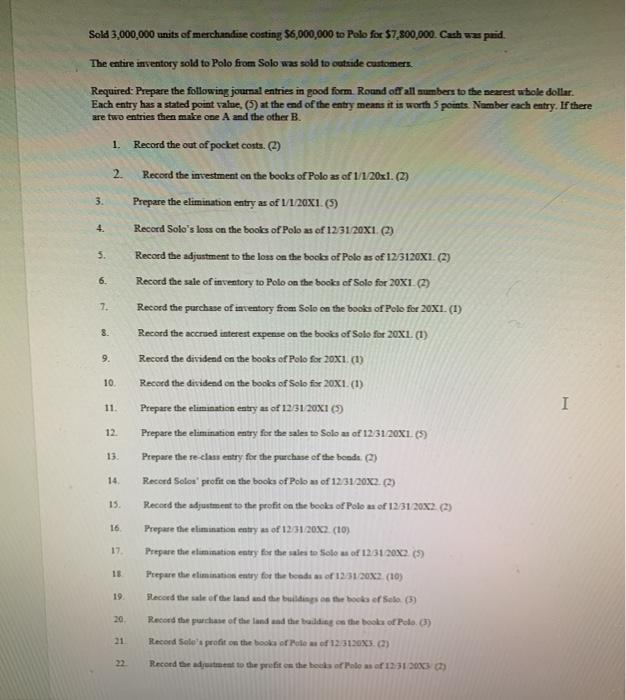

The balance sheets of the Polo Corporation and the Solo Company on January 1. 20X1 together with the current fair values of Solo's identifiable net assets are shown below: Cash Accounts Receivable (net). Inventory. Land.. Building. Machinery. Patent Assets Total Assets.. Liabilities and Stockholders Equity Current Liabilities. Polo Corporation & Solo Company Separate Balance Sheets January 1, 20XI Polo Corporation $ 2,800,000 3,200,000 6,000,000 18,000,000 40,000,000 10,000,000 $80,000,000 $2,900,000 Long Term Note Payable.. Bonds Payable (See note).. Premium on Bonds Payable. Common Stock $10 Par... Common Stock $2 Par. Paid in Capital in Excess of Par Retained Earnings 28,000,000 Total Liabilities and Stockholders Equity... $50,000,000 17,100,000 20,000,000 12,000,000 Solo Company Carrying Amounts $ 621,486 1,785,491 4,770,490 7,000,000 22,000,000 2,496,996 500,000 $39,174,463 $ 1,428,000 20,000,000 1,346,463 2,000,000 6,000,000 $,400,000 $39,174,463 Current Amounts $ 621,486 1,785,491 5,200,490 3,000,000 24,000,000 3,600,000 600,000 $1,428,000 21,346,463 Note-the Bond is a 10% semi-annual note payable in 5 years. It was issued on January 1, 20X0. On January 1, 20X1 Polo acquired all of Solo's outstanding common stock by issuing 1,500,000 shares of its common stock when the market price was $16. Out of pocket costs paid by Polo were as follows Legal fees for registration of the stock Finders fees SEC registration fees Accountants fees (half for registration, balance for consultation) $9,000 14,000 The year of 20XI: The Solo Company had a very bad year and they reported a loss of $3,000,000 20,000 16,000 The building has an additional useful life of 40 years, there was no salvage value estimated, and the company uses the straight-line method of depreciation. The machinery has an additional useful life of 6 years, the salvage value is estimated to be $2,196, and the company uses the sum-of-the-years-digits depreciation method. The patent has an additional life of 10 years. Both companies use FIFO perpetual for accounting for inventories. Consider depreciation and amortization as operating expenses. Even though it was a year with a loss the Company manages to declare and pay a dividend of $0.10 per share. The Solo Company records dividends through a dividends account. A calculation showed that goodwill was impaired by $500,000. Solo sold 2,000,000 units of merchandise costing $4,000,000 to Polo for $4,500,000. Cash was paid. Polo sold 1,500,000 of the 2,000,000 units purchased from Solo to an outside customer. The year of 20X2: On January 1 Polo realized that Solo did not disclose the market rate of interest on the bond. They did not even know what it was. One of our bright accountants figured it out. When they found out the rate they bought the bonds that very day at a market rate of 4%. Under the management of Polo, Solo had a good year and reported a profit of $6,000,000. Solo declared and paid a dividend of $0.70 per share. Solo sold 2,400,000 units of merchandise costing $5,040,000 to Polo for $6,000,000. Cash was not paid yet. Polo sold 2,700,000 units purchased from Solo to an outside customer. The year of 20X2: Solo continues to be very profitable. This year they reported a profit of $10,000,000. Solo declared and paid a dividend of 51 per share. Polo is thrilled! On January 1 Solo sold land and a building to Polo at a price of $12,000,000. The book value on Solos' books is $11,000,000. It was agreed that the fair value of the total Solo properties at January 1, 20X1 would be used as an aid to record this entry. The remaining life of the building is 40 years with no salvage. While Solo uses straight-line method of depreciation Polo decided to use double declining balance. The building cost Solo $9,750,000 10 years ago. Sold 3,000,000 units of merchandise costing $6,000,000 to Polo for $7,800,000 Cash was paid. The entire inventory sold to Polo from Solo was sold to outside customers. Required: Prepare the following journal entries in good form. Round off all numbers to the nearest whole dollar. Each entry has a stated point value, (5) at the end of the entry means it is worth 5 points. Namber each entry. If there are two entries then make one A and the other B. Record the out of pocket costs. (2) Record the investment on the books of Polo as of 1/1/20x1. (2) Prepare the elimination entry as of 1/1/20X1. (5) Record Solo's loss on the books of Polo as of 12/31/20X1. (2) Record the adjustment to the loss on the books of Polo as of 12/3120X1. (2) Record the sale of inventory to Polo on the books of Solo for 20X1. (2) Record the purchase of inventory from Solo on the books of Polo for 20X1. (1) Record the accrued interest expense on the books of Solo for 20X1. (1) Record the dividend on the books of Polo for 20X1. (1) Record the dividend on the books of Solo for 20X1. (1) Prepare the elimination entry as of 12/31/20X1 (5) Prepare the elimination entry for the sales to Solo as of 12/31/20X1. (5) Prepare the re-class entry for the purchase of the bonds. (2) Record Solos' profit on the books of Polo as of 12/31/20X2. (2) Record the adjustment to the profit on the books of Polo as of 12/31/20X2. (2) Prepare the elimination entry as of 12/31/2002 (10) Prepare the elimination entry for the sales to Solo as of 12/31/20X2 (5) Prepare the elimination entry for the bonds as of 12/31/20X2 (10) Record the sale of the land and the buildings on the books of Selo (3) 20 Record the purchase of the land and the building on the books of Polo. (3) 21 Record Sole's profit on t books of 2 as of 12/3120X3. (2) 3. 4. 5. 6. 7. 9. 1. 2. 10. 11. 12. 13. 14. 15. 16. 17, 18 19. #A 22 Record the adjustment to the profit on the books of Polo as of 12/31/2003 (2) I 23. 24. 25. 26. Prepare the elimination entry as of 12/31/20X2. (10) Prepare the elimination entry for the sales to Solo as of 12/31/20X3. (5) Prepare the elimination entry for the sales of the land and the building as of 12/31/20X3. (10) Prepare the elimination entry for the bond as of 12/31/20X3. (5) I

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Dundlu2 semi Cnel Pros ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started