Answered step by step

Verified Expert Solution

Question

1 Approved Answer

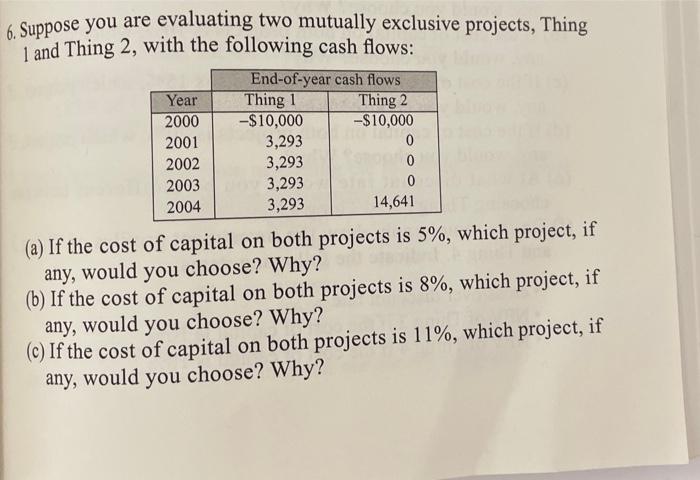

6. Suppose you are evaluating two mutually exclusive projects, Thing 1 and Thing 2, with the following cash flows: Year 2000 2001 2002 2003

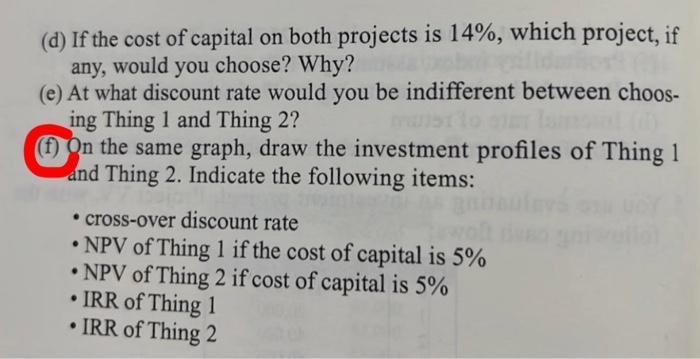

6. Suppose you are evaluating two mutually exclusive projects, Thing 1 and Thing 2, with the following cash flows: Year 2000 2001 2002 2003 2004 End-of-year cash flows Thing 1 -$10,000 3,293 3,293 3,293 3,293 Thing 2 -$10,000 0 0 320 14,641 (a) If the cost of capital on both projects is 5%, which project, if any, would you choose? Why? (b) If the cost of capital on both projects is 8%, which project, if any, would you choose? Why? (c) If the cost of capital on both projects is 11 %, which project, if any, would you choose? Why? (d) If the cost of capital on both projects is 14%, which project, if any, would you choose? Why? (e) At what discount rate would you be indifferent between choos- ing Thing 1 and Thing 2? (f) On the same graph, draw the investment profiles of Thing 1 and Thing 2. Indicate the following items: gan cross-over discount rate NPV of Thing 1 if the cost of capital is 5% NPV of Thing 2 if cost of capital is 5% IRR of Thing 1 IRR of Thing 2 (h) Internal rate of return emaidon to be (i) Modified internal rate of return, assuming reinvestment at 10% (j) Modified internal rate of return, assuming reinvestment at 14% conf

Step by Step Solution

★★★★★

3.31 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a If the cost of capital on both projects is 5 then I would choose Thing 1 This is because the project has a higher internal rate of return IRR of 155 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started