Question

Accounting The following information was gathered for you by a client looking for support in determining their deferred taxes: Investments are carried at FC-OCI and

Accounting The following information was gathered for you by a client looking for support in determining their deferred taxes:

Investments are carried at FC-OCI and FV-NI depending on the intention to hold Accounting Income for the year is $125,000

In 2015 a large inflow of cash was invested in short-term and long-term investments with elections taken to show investments at fair value

Class 10 (30%) equipment was purchased in the current year with a value of $20,000 (assume ½ year does not apply).

The company uses straight line depreciation and estimates a useful life of 5 years.

On February 1, 2020, the beginning of the fiscal year, accounts and records include the following information:

Cost 2015 Market Value 2020 Market Value 2021

Fair value through net income investments $55,000 $60,000 $62,000

Fair value through other comprehensive income investments $70,000 $77,000 $74,000

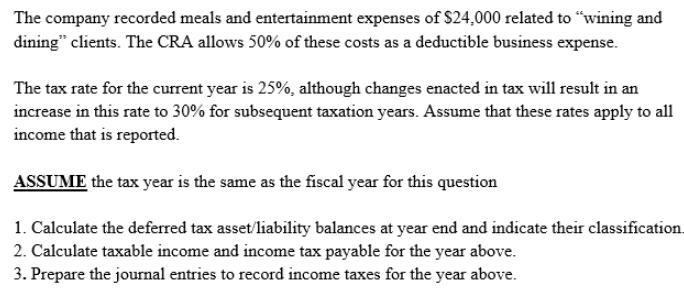

The company recorded meals and entertainment expenses of $24,000 related to "wining and dining clients. The CRA allows 50% of these costs as a deductible business expense. The tax rate for the current year is 25%, although changes enacted in tax will result in an increase in this rate to 30% for subsequent taxation years. Assume that these rates apply to all income that is reported. ASSUME the tax year is the same as the fiscal year for this question 1. Calculate the deferred tax asset/liability balances at year end and indicate their classification. 2. Calculate taxable income and income tax payable for the year above. 3. Prepare the journal entries to record income taxes for the year above.

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the deferred tax assetliability and income tax payable for income taxes for the given year we need to consider the temporary differences ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started