Answered step by step

Verified Expert Solution

Question

1 Approved Answer

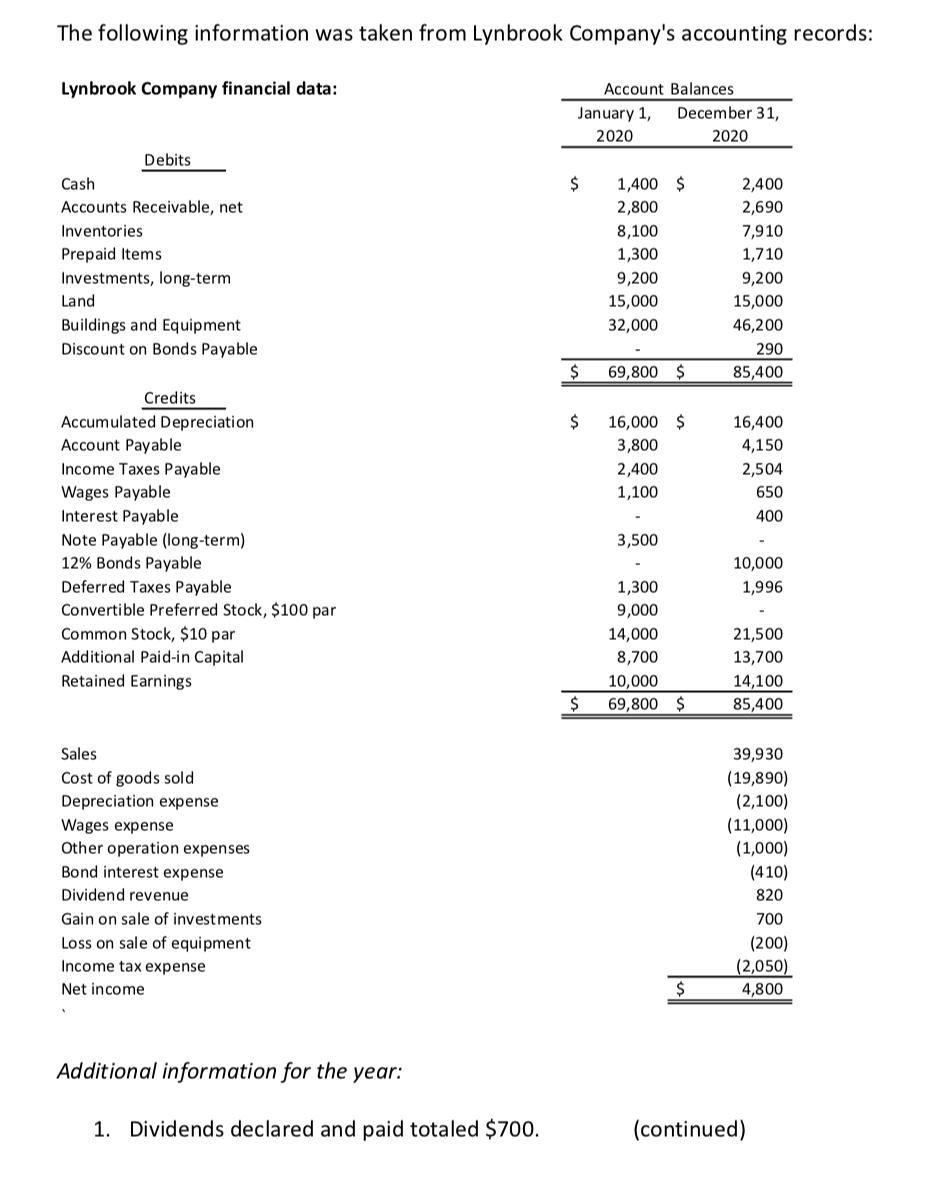

. The following information was taken from Lynbrook Company's accounting records: Lynbrook Company financial data: Debits Cash Accounts Receivable, net Inventories Prepaid Items Investments, long-term

.

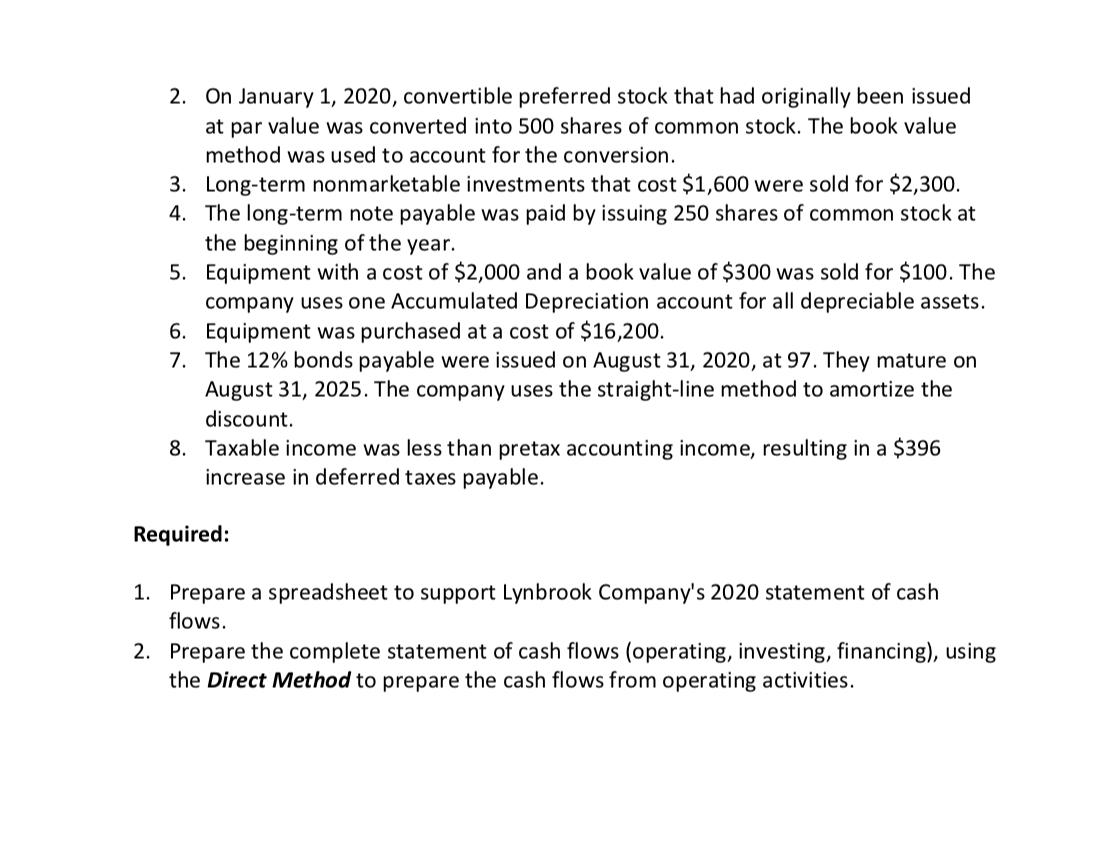

The following information was taken from Lynbrook Company's accounting records: Lynbrook Company financial data: Debits Cash Accounts Receivable, net Inventories Prepaid Items Investments, long-term Land Buildings and Equipment Discount on Bonds Payable Credits Accumulated Depreciation Account Payable Income Taxes Payable Wages Payable Interest Payable Note Payable (long-term) 12% Bonds Payable Deferred Taxes Payable Convertible Preferred Stock, $100 par Common Stock, $10 par Additional Paid-in Capital Retained Earnings Sales Cost of goods sold Depreciation expense Wages expense Other operation expenses Bond interest expense Dividend revenue Gain on sale of investments. Loss on sale of equipment Income tax expense Net income Additional information for the year: 1. Dividends declared and paid totaled $700. January 1, 2020 $ Account Balances $ 1,400 $ 2,800 8,100 1,300 9,200 15,000 32,000 December 31, 2020 69,800 $ $ 16,000 $ 3,800 2,400 1,100 3,500 1,300 9,000 14,000 8,700 10,000 $ 69,800 $ $ 2,400 2,690 7,910 1,710 9,200 15,000 46,200 290 85,400 16,400 4,150 2,504 650 400 10,000 1,996 21,500 13,700 14,100 85,400 39,930 (19,890) (2,100) (11,000) (1,000) (410) 820 700 (200) (2,050) 4,800 (continued)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Lynbrook Company Statement of Cash Flows For the Year Ended December 31 2020 Operating Activities Net income 4800 Adjustments to reconcile net incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started