Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information was taken from the financial records of Buccaneer Ltd, on 31 December 2019: Land at valuation (note 1). . Office buildings

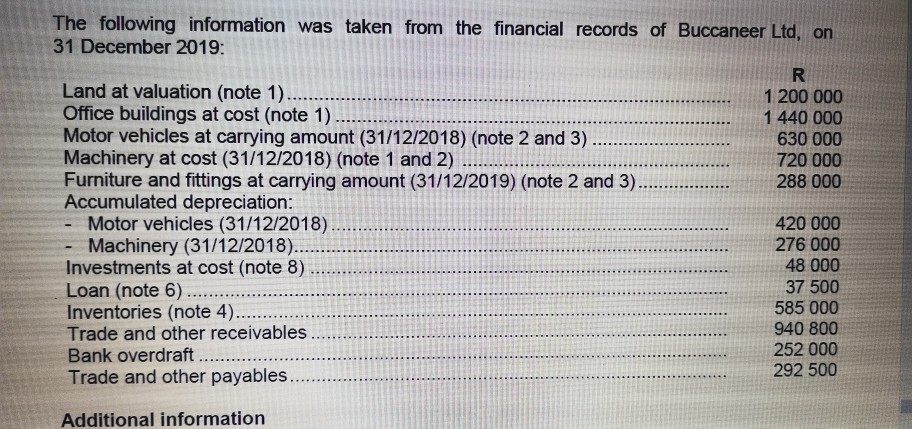

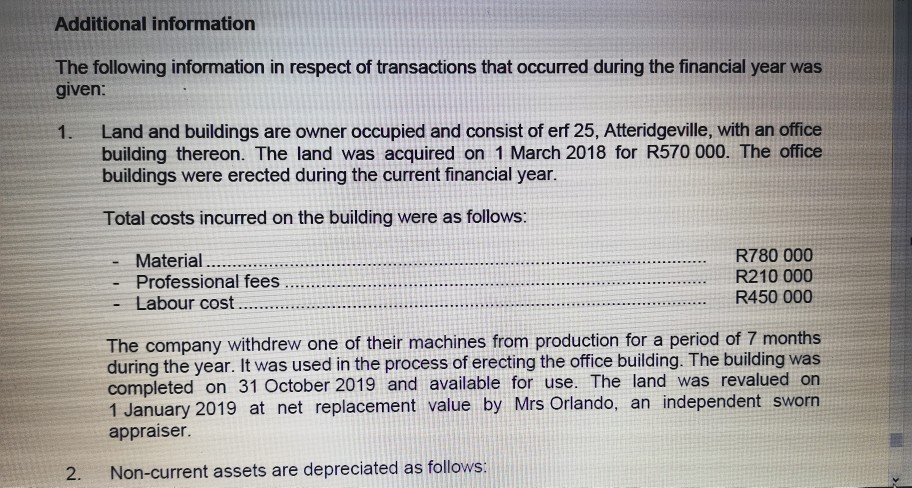

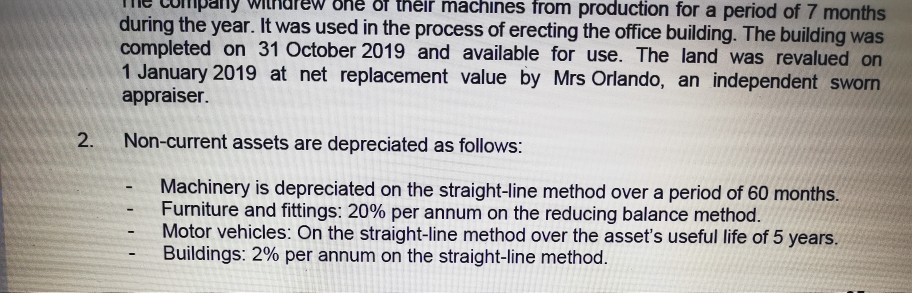

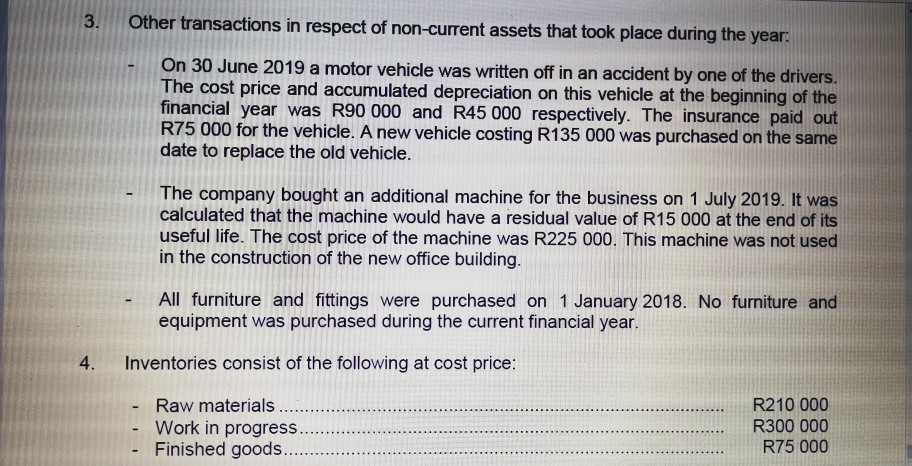

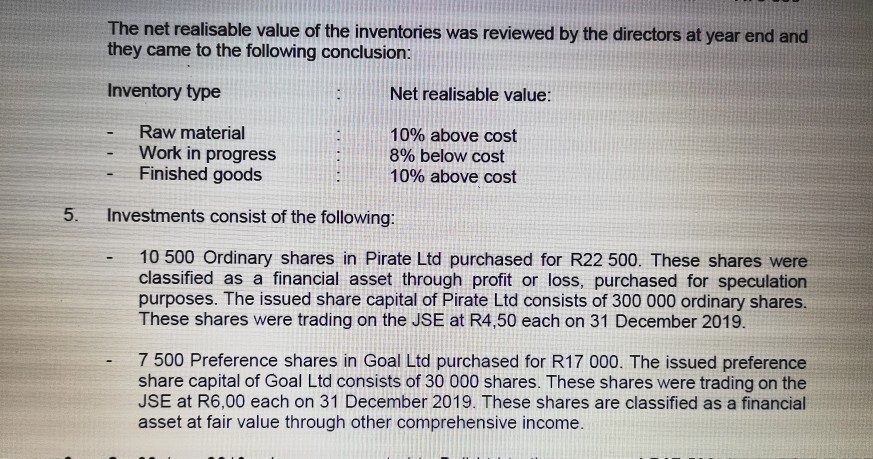

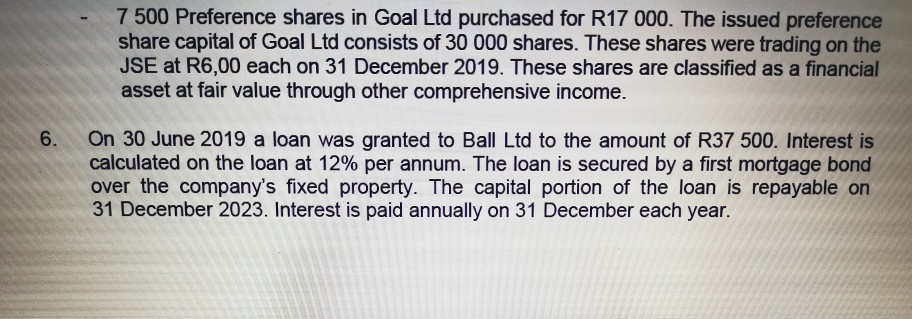

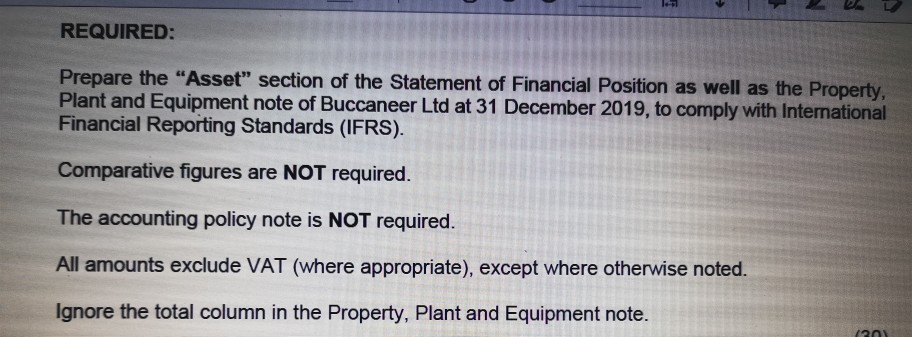

The following information was taken from the financial records of Buccaneer Ltd, on 31 December 2019: Land at valuation (note 1). . Office buildings at cost (note 1) Motor vehicles at carrying amount (31/12/2018) (note 2 and 3) Machinery at cost (31/12/2018) (note 1 and 2) Furniture and fittings at carrying amount (31/12/2019) (note 2 and 3)... Accumulated depreciation: Motor vehicles (31/12/2018) Machinery (31/12/2018).. Investments at cost (note 8) Loan (note 6) ....... Inventories (note 4)... Trade and other receivables Bank overdraft .. Trade and other payables. 1 200 000 1 440 000 630 000 720 000 288 000 420 000 276 000 48 000 37 500 585 000 940 800 252 000 292 500 Additional information Additional information The following information in respect of transactions that occurred during the financial year was given: Land and buildings are owner occupied and consist of erf 25, Atteridgeville, with an office building thereon. The land was acquired on 1 March 2018 for R570 000. The office buildings were erected during the current financial year. 1. Total costs incurred on the building were as follows: Material.. Professional fees R780 000 R210 000 Labour cost. R450 000 The company withdrew one of their machines from production for a period of 7 months during the year. It was used in the process of erecting the office building. The building was completed on 31 October 2019 and available for use. The land was revalued on 1 January 2019 at net replacement value by Mrs Orlando, an independent sworn appraiser. 2. Non-current assets are depreciated as follows: of their machines from production for a period of 7 months during the year. It was used in the process of erecting the office building. The building was completed on 31 October 2019 and available for use. The land was revalued on 1 January 2019 at net replacement value by Mrs Orlando, an independent sworn appraiser. Non-current assets are depreciated as follows: Machinery is depreciated on the straight-line method over a period of 60 months. Furniture and fittings: 20% per annum on the reducing balance method. Motor vehicles: On the straight-line method over the asset's useful life of 5 years. Buildings: 2% per annum on the straight-line method. 2. Other transactions in respect of non-current assets that took place during the year: On 30 June 2019 a motor vehicle was written off in an accident by one of the drivers. The cost price and accumulated depreciation on this vehicle at the beginning of the financial year was R90 000 and R45 000 respectively. The insurance paid out R75 000 for the vehicle. A new vehicle costing R135 000 was purchased on the same date to replace the old vehicle. The company bought an additional machine for the business on 1 July 2019. It was calculated that the machine would have a residual value of R15 000 at the end of its useful life. The cost price of the machine was R225 000. This machine was not used in the construction of the new office building. All furniture and fittings were purchased on 1 January 2018. No furniture and equipment was purchased during the current financial year. 4. Inventories consist of the following at cost price: Raw materials. R210 000 - Work in progress. Finished goods... R300 000 R75 000 3. The net realisable value of the inventories was reviewed by the directors at year end and they came to the following conclusion: Inventory type Net realisable value: Raw material Work in progress Finished goods 10% above cost 8% below cost 10% above cost 5. Investments consist of the following: 10 500 Ordinary shares in Pirate Ltd purchased for R22 500. These shares were classified as a financial asset through profit or loss, purchased for speculation purposes. The issued share capital of Pirate Ltd consists of 300 000 ordinary shares. These shares were trading on the JSE at R4,50 each on 31 December 2019. 7 500 Preference shares in Goal Ltd purchased for R17 000. The issued preference share capital of Goal Ltd consists of 30 000 shares. These shares were trading on the JSE at R6,00 each on 31 December 2019. These shares are classified as a financial asset at fair value through other comprehensive income. 7 500 Preference shares in Goal Ltd purchased for R17 000. The issued preference share capital of Goal Ltd consists of 30 000 shares. These shares were trading on the JSE at R6,00 each on 31 December 2019. These shares are classified as a financial asset at fair value through other comprehensive income. On 30 June 2019 a loan was granted to Ball Ltd to the amount of R37 500. Interest is calculated on the loan at 12% per annum. The loan is secured by a first mortgage bond over the company's fixed property. The capital portion of the loan is repayable on 31 December 2023. Interest is paid annually on 31 December each year. 6. REQUIRED: Prepare the "Asset" section of the Statement of Financial Position as well as the Property, Plant and Equipment note of Buccaneer Ltd at 31 December 2019, to comply with International Financial Reporting Standards (IFRS). Comparative figures are NOT required. The accounting policy note is NOT required. All amounts exclude VAT (where appropriate), except where otherwise noted. Ignore the total column in the Property, Plant and Equipment note. 1301

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Particular Note No Amount as on 31st December 2019 ASSETS Noncurrent assets a Property Plant and Equipment 1 3524400 b Capital workinprogress c lnvest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started