Answered step by step

Verified Expert Solution

Question

1 Approved Answer

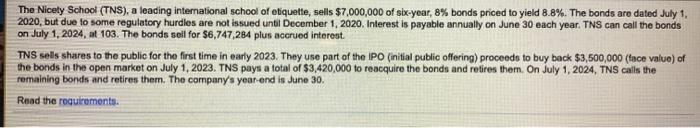

The Nicety School (TNS), a leading international school of etiquette, sells $7,000,000 of six-year, 8% bonds priced to yield 8.8%. The bonds are dated

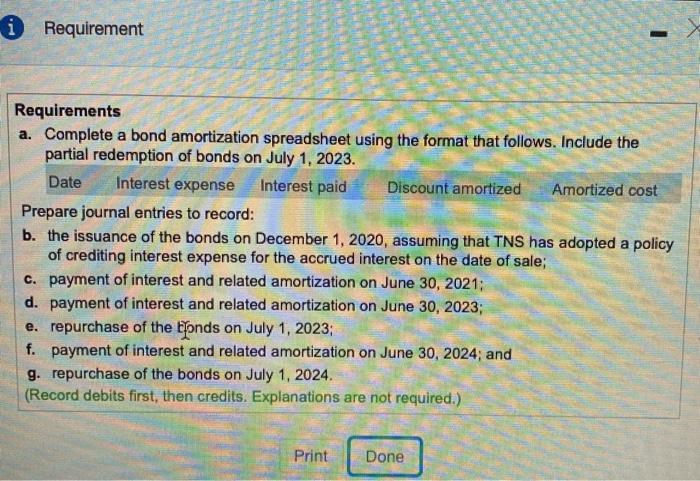

The Nicety School (TNS), a leading international school of etiquette, sells $7,000,000 of six-year, 8% bonds priced to yield 8.8%. The bonds are dated July 1, 2020, but due to some regulatory hurdles are not issued until December 1, 2020. Interest is payable annually on June 30 each year. TNS can call the bonds on July 1, 2024, at 103. The bonds sell for $6,747,284 plus accrued interest. TNS sells shares to the public for the first time in early 2023. They use part of the IPO (initial public offering) proceeds to buy back $3,500,000 (face value) of the bonds in the open market on July 1, 2023. TNS pays a total of $3,420,000 to reacquire the bonds and retires them. On July 1, 2024, TNS calls the remaining bonds and retires them. The company's year-end is June 30. Read the requirements. iRequirement Requirements a. Complete a bond amortization spreadsheet using the format that follows. Include the partial redemption of bonds on July 1, 2023. Date Interest expense Interest paid Discount amortized Amortized cost Prepare journal entries to record: b. the issuance of the bonds on December 1, 2020, assuming that TNS has adopted a policy of crediting interest expense for the accrued interest on the date of sale; c. payment of interest and related amortization on June 30, 2021; d. payment of interest and related amortization on June 30, 2023; e. repurchase of the bonds on July 1, 2023; f. payment of interest and related amortization on June 30, 2024; and g. repurchase of the bonds on July 1, 2024. (Record debits first, then credits. Explanations are not required.) Print Done

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Year 1212020 Bond 712023 Amortization Table Interest expense...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started