Question

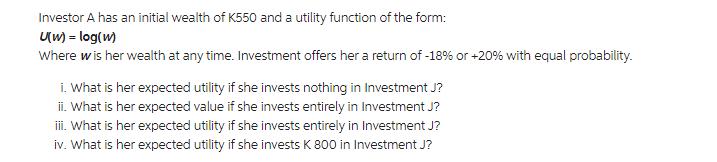

Investor A has an initial wealth of K550 and a utility function of the form: U(w) = log(w) Where w is her wealth at

Investor A has an initial wealth of K550 and a utility function of the form: U(w) = log(w) Where w is her wealth at any time. Investment offers her a return of -18% or + 20% with equal probability. i. What is her expected utility if she invests nothing in Investment J? ii. What is her expected value if she invests entirely in Investment J? iii. What is her expected utility if she invests entirely in Investment J? iv. What is her expected utility if she invests K 800 in Investment J?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Utility Logw a Expected Utility when nothing is invested in Z When th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Microeconomics and Its Application

Authors: Walter Nicholson, Christopher M. Snyder

12th edition

978-1133189022, 1133189024, 1133189032, 978-1305176386, 1305176383, 978-0357687000, 978-1133189039

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App