Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This last research assignment requires you to analyze a couple's tax scenario. They are asking you to forecast their 2020 tax return given the

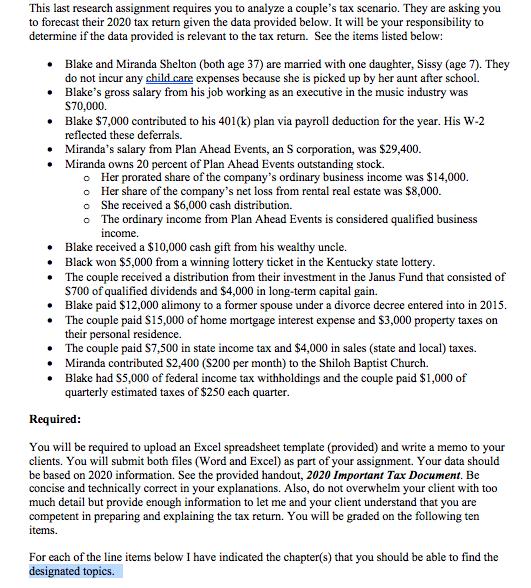

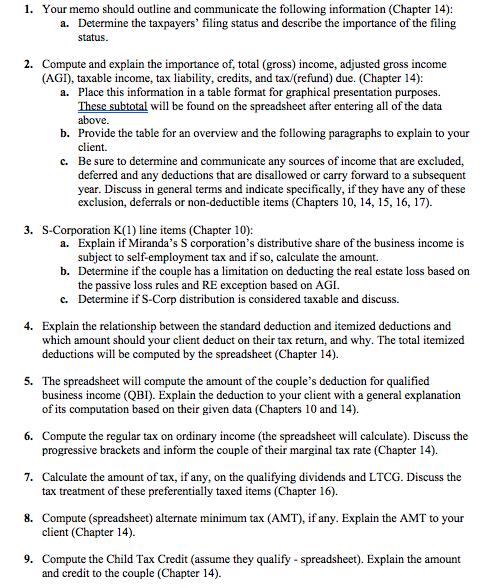

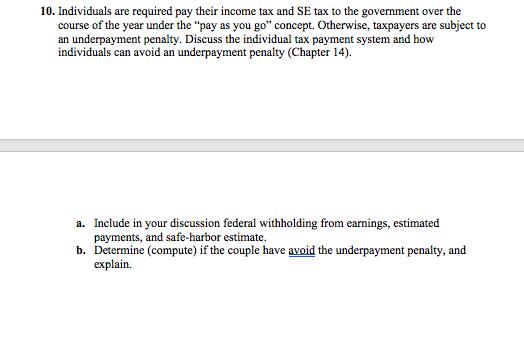

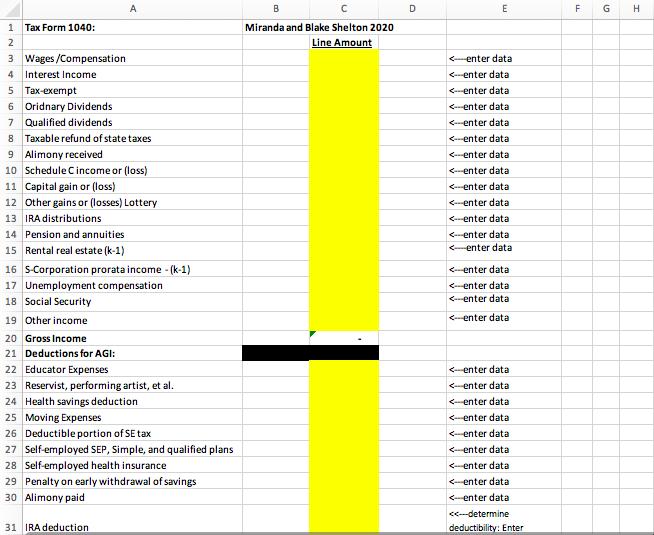

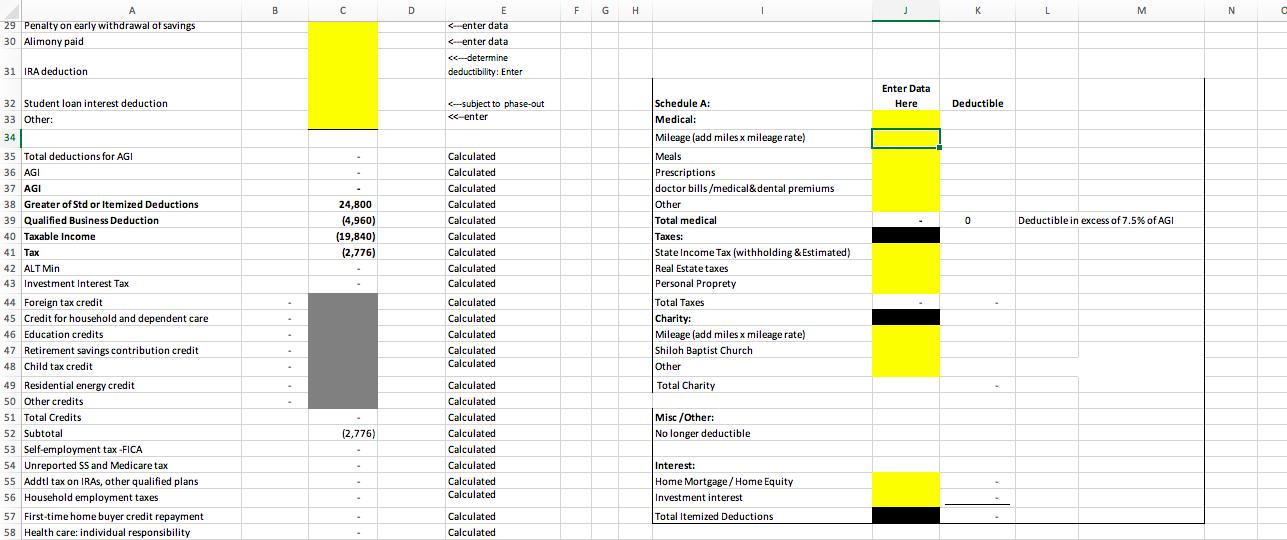

This last research assignment requires you to analyze a couple's tax scenario. They are asking you to forecast their 2020 tax return given the data provided below. It will be your responsibility to determine if the data provided is relevant to the tax return. See the items listed below: Blake and Miranda Shelton (both age 37) are married with one daughter, Sissy (age 7). They do not incur any child care expenses because she is picked up by her aunt after school. Blake's gross salary from his job working as an executive in the music industry was $70,000. Blake $7,000 contributed to his 401(k) plan via payroll deduction for the year. His W-2 reflected these deferrals. Miranda's salary from Plan Ahead Events, an S corporation, was $29,400. Miranda owns 20 percent of Plan Ahead Events outstanding stock. o Her prorated share of the company's ordinary business income was $14,000. Her share of the company's net loss from rental real estate was $8,000. She received a $6,000 cash distribution. o The ordinary income from Plan Ahead Events is considered qualified business income. Blake received a $10,000 cash gift from his wealthy uncle. Black won $5,000 from a winning lottery ticket in the Kentucky state lottery. The couple received a distribution from their investment in the Janus Fund that consisted of $700 of qualified dividends and $4,000 in long-term capital gain. Blake paid $12,000 alimony to a former spouse under a divorce decree entered into in 2015. The couple paid $15,000 of home mortgage interest expense and $3,000 property taxes on their personal residence. The couple paid $7,500 in state income tax and $4,000 in sales (state and local) taxes. Miranda contributed $2,400 ($200 per month) to the Shiloh Baptist Church. Blake had $5,000 of federal income tax withholdings and the couple paid $1,000 of quarterly estimated taxes of $250 each quarter. Required: You will be required to upload an Excel spreadsheet template (provided) and write a memo to your clients. You will submit both files (Word and Excel) as part of your assignment. Your data should be based on 2020 information. See the provided handout, 2020 Important Tax Document. Be concise and technically correct in your explanations. Also, do not overwhelm your client with too much detail but provide enough information to let me and your client understand that you are competent in preparing and explaining the tax return. You will be graded on the following ten items. For each of the line items below I have indicated the chapter(s) that you should be able to find the designated topics. 1. Your memo should outline and communicate the following information (Chapter 14): a. Determine the taxpayers' filing status and describe the importance of the filing status. 2. Compute and explain the importance of, total (gross) income, adjusted gross income (AGI), taxable income, tax liability, credits, and tax/(refund) due. (Chapter 14): a. Place this information in a table format for graphical presentation purposes. These subtotal will be found on the spreadsheet after entering all of the data above. b. Provide the table for an overview and the following paragraphs to explain to your client. c. Be sure to determine and communicate any sources of income that are excluded, deferred and any deductions that are disallowed or carry forward to a subsequent year. Discuss in general terms and indicate specifically, if they have any of these exclusion, deferrals or non-deductible items (Chapters 10, 14, 15, 16, 17). 3. S-Corporation K(1) line items (Chapter 10): a. Explain if Miranda's S corporation's distributive share of the business income is subject to self-employment tax and if so, calculate the amount. b. Determine if the couple has a limitation on deducting the real estate loss based on the passive loss rules and RE exception based on AGI. c. Determine if S-Corp distribution is considered taxable and discuss. 4. Explain the relationship between the standard deduction and itemized deductions and which amount should your client deduct on their tax return, and why. The total itemized deductions will be computed by the spreadsheet (Chapter 14). 5. The spreadsheet will compute the amount of the couple's deduction for qualified business income (QBI). Explain the deduction to your client with a general explanation of its computation based on their given data (Chapters 10 and 14). 6. Compute the regular tax on ordinary income (the spreadsheet will calculate). Discuss the progressive brackets and inform the couple of their marginal tax rate (Chapter 14). 7. Calculate the amount of tax, if any, on the qualifying dividends and LTCG. Discuss the tax treatment of these preferentially taxed items (Chapter 16). 8. Compute (spreadsheet) alternate minimum tax (AMT), if any. Explain the AMT to your client (Chapter 14). 9. Compute the Child Tax Credit (assume they qualify - spreadsheet). Explain the amount and credit to the couple (Chapter 14). 10. Individuals are required pay their income tax and SE tax to the government over the course of the year under the "pay as you go" concept. Otherwise, taxpayers are subject to an underpayment penalty. Discuss the individual tax payment system and how individuals can avoid an underpayment penalty (Chapter 14). a. Include in your discussion federal withholding from earnings, estimated payments, and safe-harbor estimate. b. Determine (compute) if the couple have avoid the underpayment penalty, and explain. A 1 Tax Form 1040: 2 3 Wages/Compensation 4 Interest Income 5 Tax-exempt 6 Oridnary Dividends 7 Qualified dividends 8 Taxable refund of state taxes 9 Alimony received 10 Schedule Cincome or (loss) 11 Capital gain or (loss) 12 Other gains or (losses) Lottery 13 IRA distributions 14 Pension and annuities 15 Rental real estate (k-1) 16 S-Corporation prorata income -(k-1) 17 Unemployment compensation 18 Social Security 19 Other income 20 Gross Income 21 Deductions for AGI: 22 Educator Expenses 23 Reservist, performing artist, et al. 24 Health savings deduction 25 Moving Expenses 26 Deductible portion of SE tax 27 Self-employed SEP, Simple, and qualified plans 28 Self-employed health insurance 29 Penalty on early withdrawal of savings 30 Alimony paid 31 IRA deduction B Miranda and Blake Shelton 2020 Line Amount D E A 29 Penalty on early withdrawal of savings 30 Alimony paid 31 IRA deduction 32 Student loan interest deduction 33 Other: 34 35 Total deductions for AGI 36 AGI 37 AGI 38 Greater of Std or Itemized Deductions 39 Qualified Business Deduction 40 Taxable Income P 41 Tax 42 ALT Min 42 leve 43 Investment Interest Tax + 44 Foreign tax credit 45 Credit for household and dependent care 46 Education credits 47 Retirement savings contribution credit 48 Child tax credit 49 Residential energy credit 50 Other credits 51 Total Credits 52 Subtotal 53 Self-employment tax-FICA 54 Unreported SS and Medicare tax 55 Addtl tax on IRAS, other qualified plans 56 Household employment taxes 57 First-time home buyer credit repayment 58 Health care: individual responsibility. B C 24,800 (4,960) (19,840) (2,776) (2,776) D E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

WagesCompensation Interest Income 5 Taxexempt 6 Ordinary Dividends 7 Qualified Dividends Taxab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started