Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Heidi bought a mountain chalet in 2012 for $150,000 and sold it in 2017 for $180,000. She bought a lakeside cabin in 2013 for

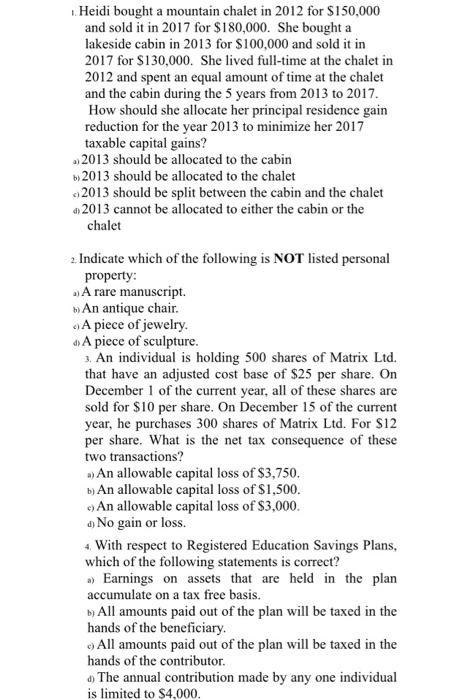

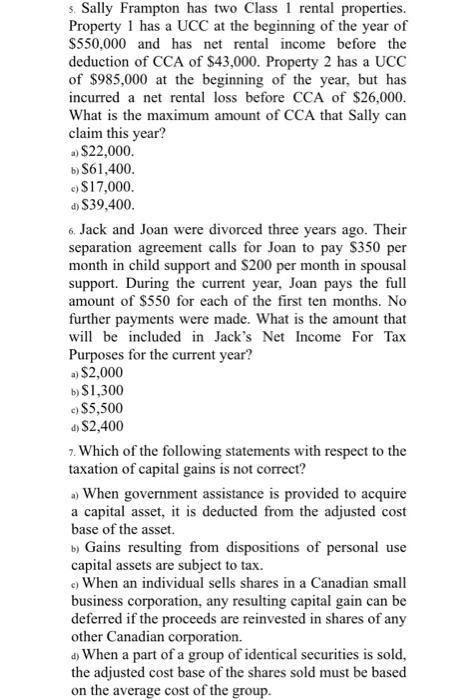

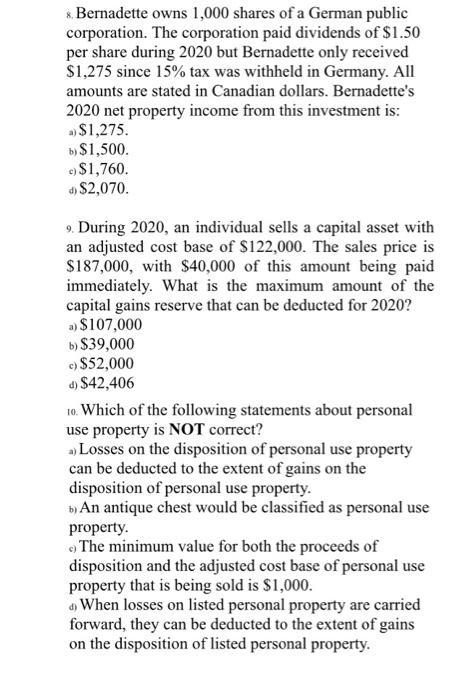

Heidi bought a mountain chalet in 2012 for $150,000 and sold it in 2017 for $180,000. She bought a lakeside cabin in 2013 for $100,000 and sold it in 2017 for $130,000. She lived full-time at the chalet in 2012 and spent an equal amount of time at the chalet and the cabin during the 5 years from 2013 to 2017. How should she allocate her principal residence gain reduction for the year 2013 to minimize her 2017 taxable capital gains? 2013 should be allocated to the cabin b) 2013 should be allocated to the chalet 2013 should be split between the cabin and the chalet 2013 cannot be allocated to either the cabin or the chalet 2 Indicate which of the following is NOT listed personal property: a) A rare manuscript. b)An antique chair. A piece of jewelry. >A piece of sculpture. 3. An individual is holding 500 shares of Matrix Ltd. that have an adjusted cost base of $25 per share. On December 1 of the current year, all of these shares are sold for $10 per share. On December 15 of the current year, he purchases 300 shares of Matrix Ltd. For $12 per share. What is the net tax consequence of these two transactions? a) An allowable capital loss of $3,750. b) An allowable capital loss of $1,500. An allowable capital loss of $3,000. d) No gain or loss. 4. With respect to Registered Education Savings Plans, which of the following statements is correct? a) Earnings on assets that are held in the plan accumulate on a tax free basis. b) All amounts paid out of the plan will be taxed in the hands of the beneficiary. All amounts paid out of the plan will be taxed in the hands of the contributor. d) 4) The annual contribution made by any one individual is limited to $4,000. 5. Sally Frampton has two Class 1 rental properties. Property 1 has a UCC at the beginning of the year of $550,000 and has net rental income before the deduction of CCA of $43,000. Property 2 has a UCC of $985,000 at the beginning of the year, but has incurred a net rental loss before CCA of $26,000. What is the maximum amount of CCA that Sally can claim this year? a) $22,000. b) $61,400. c) $17,000. d) $39,400. 6. Jack and Joan were divorced three years ago. Their separation agreement calls for Joan to pay $350 per month in child support and $200 per month in spousal support. During the current year, Joan pays the full amount of $550 for each of the first ten months. No further payments were made. What is the amount that will be included in Jack's Net Income For Tax Purposes for the current year? a) $2,000 b) $1,300 c) $5,500 d) $2,400 7. Which of the following statements with respect to the taxation of capital gains is not correct? a) When government assistance is provided to acquire a capital asset, it is deducted from the adjusted cost base of the asset. b) Gains resulting from dispositions of personal use capital assets are subject to tax. c) When an individual sells shares in a Canadian small business corporation, any resulting capital gain can be deferred if the proceeds are reinvested in shares of any other Canadian corporation. d) When a part of a group of identical securities is sold, the adjusted cost base of the shares sold must be based on the average cost of the group. 8. Bernadette owns 1,000 shares of a German public corporation. The corporation paid dividends of $1.50 per share during 2020 but Bernadette only received $1,275 since 15% tax was withheld in Germany. All amounts are stated in Canadian dollars. Bernadette's 2020 net property income from this investment is: a) $1,275. b) $1,500. $1,760. d) $2,070. 9. During 2020, an individual sells a capital asset with an adjusted cost base of $122,000. The sales price is $187,000, with $40,000 of this amount being paid immediately. What is the maximum amount of the capital gains reserve that can be deducted for 2020? a) $107,000 b) $39,000 c) $52,000 d) $42,406 10. Which of the following statements about personal use property is NOT correct? a) Losses on the disposition of personal use property can be deducted to the extent of gains on the disposition of personal use property. b) An antique chest would be classified as personal use property. The minimum value for both the proceeds of disposition and the adjusted cost base of personal use property that is being sold is $1,000. 4) When losses on listed personal property are carried forward, they can be deducted to the extent of gains on the disposition of listed personal property.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 99polk d 2013 cannot be allocated to either the cabin or the chalet becau...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started