Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today, you are 20 years old with $2,000 of savings. You want to retire at the age of 55 with a monthly income of

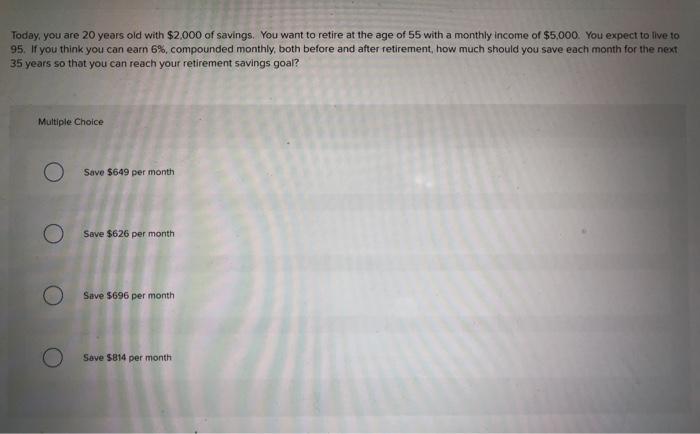

Today, you are 20 years old with $2,000 of savings. You want to retire at the age of 55 with a monthly income of $5,000. You expect to live to 95. If you think you can earn 6%, compounded monthly, both before and after retirement, how much should you save each month for the next 35 years so that you can reach your retirement savings goal? Multiple Choice Save $649 per month Save $626 per month O Save $696 per month Save $814 per month

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 2 Interest rate per month 612 05 3 Number ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started