Answered step by step

Verified Expert Solution

Question

1 Approved Answer

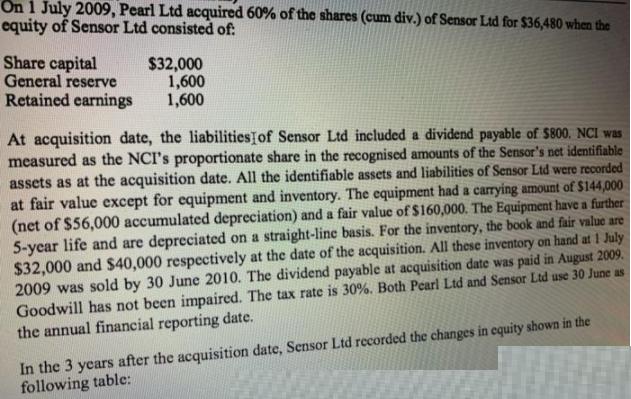

On 1 July 2009, Pearl Ltd acquired 60% of the shares (cum div.) of Sensor Ltd for $36,480 when the equity of Sensor Ltd

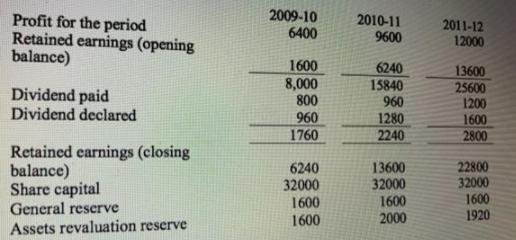

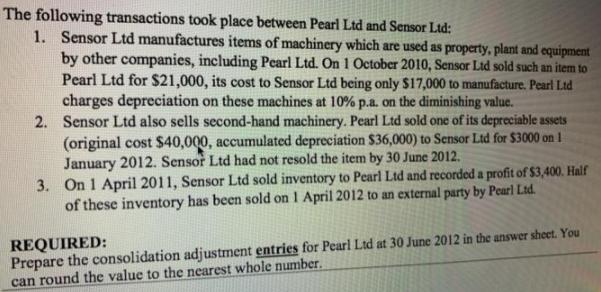

On 1 July 2009, Pearl Ltd acquired 60% of the shares (cum div.) of Sensor Ltd for $36,480 when the equity of Sensor Ltd consisted of: Share capital General reserve Retained earnings $32,000 1,600 1,600 At acquisition date, the liabilitiesIof Sensor Ltd included a dividend payable of $800, NCI was measured as the NCI's proportionate share in the recognised amounts of the Sensor's net identifiable assets as at the acquisition date. All the identifiable assets and liabilities of Sensor Ltd were recorded at fair value except for equipment and inventory. The equipment had a carrying amount of $144,000 (net of $56,000 accumulated depreciation) and a fair value of $160,000. The Equipment have a further 5-ycar life and are depreciated on a straight-line basis. For the inventory, the book and fair value are $32,000 and $40,000 respectively at the date of the acquisition. All these inventory on hand at 1 July 2009 was sold by 30 June 2010. The dividend payable at acquisition date was paid in August 2009. Goodwill has not been impaired. The tax rate is 30%. Both Pearl Ltd and Sensor Ltd use 30 June as the annual financial reporting date. In the 3 years after the acquisition date, Sensor Ltd recorded the changes in equity shown in the following table: 2009-10 6400 Profit for the period Retained earnings (opening balance) 2010-11 9600 2011-12 12000 1600 8,000 800 6240 13600 25600 1200 1600 2800 Dividend paid Dividend declared 15840 960 960 1280 1760 2240 Retained earnings (closing balance) Share capital 6240 32000 1600 1600 13600 32000 1600 2000 22800 32000 1600 1920 General reserve Assets revaluation reserve The following transactions took place between Pearl Ltd and Sensor Ltd: 1. Sensor Ltd manufactures items of machinery which are used as property, plant and equipment by other companies, including Pearl Ltd. On 1 October 2010, Sensor Ltd sold such an item to Pearl Ltd for $21,000, its cost to Sensor Ltd being only $17,000 to manufacture. Pearl Ltd charges depreciation on these machines at 10% p.a. on the diminishing value. 2. Sensor Ltd also sells second-hand machinery. Pearl Ltd sold one of its depreciable assets (original cost $40,000, accumulated depreciation $36,000) to Sensor Ltd for $3000 on 1 January 2012. Sensor Ltd had not resold the item by 30 June 2012. 3. On 1 April 2011, Sensor Ltd sold inventory to Pearl Ltd and recorded a profit of $3,400. Half of these inventory has been sold on 1 April 2012 to an external party by Pearl Ltd. REQUIRED: Prepare the consolidation adjustment entries for Pearl Ltd at 30 June 2012 in the answer sheet. You can round the value to the nearest whole number.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

th As at 30 June 2012 Concolidation Actuctment Enkies for Pearlid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started