Answered step by step

Verified Expert Solution

Question

1 Approved Answer

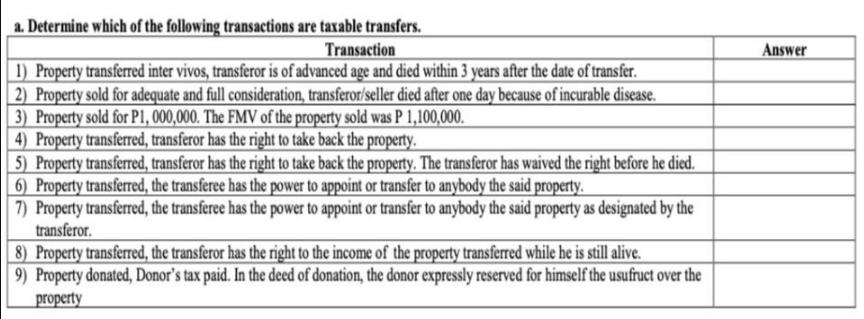

a. Determine which of the following transactions are taxable transfers. Transaction Answer 1) Property transferred inter vivos, transferor is of advanced age and died

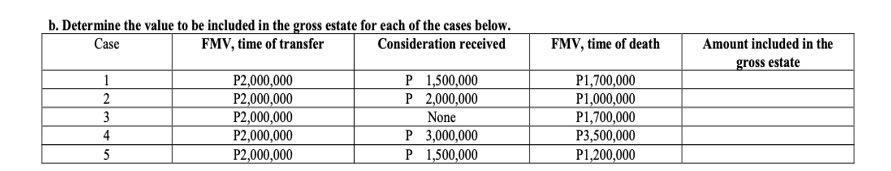

a. Determine which of the following transactions are taxable transfers. Transaction Answer 1) Property transferred inter vivos, transferor is of advanced age and died within 3 years after the date of transfer. 2) Property sold for adequate and full consideration, transferor/seller died after one day because of incurable disease. 3) Property sold for PI, 000,000. The FMV of the property sold was P 1,100,000. 4) Property transferred, transferor has the right to take back the property. 5) Property transferred, transferor has the right to take back the property. The transferor has waived the right before he died. 6) Property transferred, the transferee has the power to appoint or transfer to anybody the said property. 7) Property transferred, the transferee has the power to appoint or transfer to anybody the said property as designated by the transferor. 8) Property transferred, the transferor has the right to the income of the property transferred while he is still alive. 9) Property donated, Donor's tax paid. In the deed of donation, the donor expressly reserved for himself the usufruct over the property b. Determine the value to be included in the gross estate for each of the cases below. FMV, time of transfer Case Consideration received FMV, time of death Amount included in the gross estate P2,000,000 P2,000,000 P2,000,000 P 1,500,000 P 2,000,000 1 P1,700,000 P1,000,000 P1,700,000 P3,500,000 2 3 None P 3,000,000 P 1,500,000 4 P2,000,000 P2,000,000 5 P1,200,000

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Taxable 2Taxable 3Taxable 4not deemed as transfer becuase ownership is not ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started