Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 QUESTION 1 (15 marks) (18 minutes) KayFC Ltd acquired 70 000 of the 100 000 ordinary shares in Nandas Ltd on 1 May

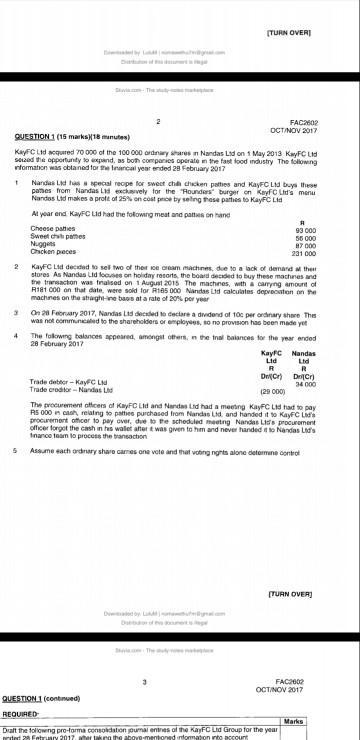

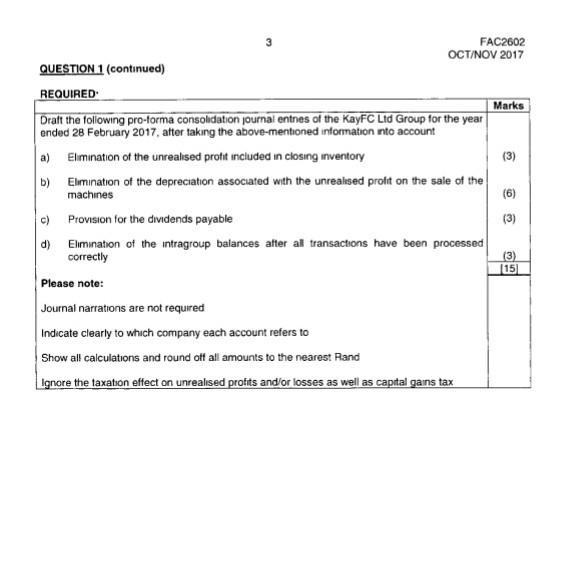

1 QUESTION 1 (15 marks) (18 minutes) KayFC Ltd acquired 70 000 of the 100 000 ordinary shares in Nandas Ltd on 1 May 2013 KayFC Lid seized the opportunity to expand, as both companies operate in the fast food industry The following information was obtained for the financial year ended 28 February 2017 2 4 5 Cheese patties Sweet chipames Nandas Ltd has a special recipe for sweet che chicken pathes and KayFC Ltd buys these pates from Nandas Ld exclusively for the "Rounders burger on KayfCL's menu Nandos Ltd makes a profe of 25% on cost price by seling those parties to KayFC Lid At year end KayFC Lid had the following meat and patties on hand Nuggets Chicken pieces [TURN OVER] FAC2602 OCT/NOV 2017 3 On 28 February 2017, Nandas Ltd decided to declare a dividend of 100 per ordinary share The was not communicated to the shareholders or employees, so no provision has been made yet The following balances appeared, amongst others, in the Inal balances for the year ended 28 February 2017 KayFC Ltd decided to sell two of their ice cream machines, due to a lack of demand at the stores As Nandas Lid focuses on holiday resorts, the board decided to buy these machines and the transaction was finalised on 1 August 2015 The machines, with a carrying amount of R181 000 on that date, were sold for R185 000 Nandas Ltd calculates deprecation on the machines on the straight-ine bass at a rate of 20% per year Trade debtor-KayFC Li Trade creditor-Nandas d QUESTION 1 (continued) REQUIRED D 93 000 55 000 87 000 231 000 R Dr(Cr) (29 000) The procurement officers of KayFC Ltd and Nandas Ltd had a meeting KayFC Ltd had to pay R5 000 cash relating to paties purchased from Nandas Ltd. and handed it to KayFC Lid procurement officer to pay over, due to the scheduled meeting Nandas Ltd's procurement officer forgot the cash in his wallet after t was given to him and never handed it to Nandas Ltd's Inance team to process the transaction Assume each ordinary share cames one vote and that voting nights alone determine control KayFC Nandas Lid Ltd R DriCr) 34 000 [TURN OVER] Draft the following pro-forma consolidation journal entries of the KayFC Ltd Group for the year sted 28 February 2017, ater taking the above-mentioned information into account FAC2002 OCT/NOV 2017 Marks FAC2602 OCT/NOV 2017 QUESTION 1 (continued) REQUIRED Draft the following pro-forma consolidation journal entnes of the KayFC Ltd Group for the year ended 28 February 2017, after taking the above-mentioned information into account a) Elimination of the unrealised profit included in closing inventory b) Elimination of the depreciation associated with the unrealised profit on the sale of the machines c) Provision for the dividends payable d) Elimination of the intragroup balances after all transactions have been processed correctly Please note: Journal narrations are not required Indicate clearly to which company each account refers to Show all calculations and round off all amounts to the nearest Rand Ignore the taxation effect on unrealised profits and/or losses as well as capital gains tax Marks (3) (6) (3) (3) [15]

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SHEET 1 KayFC Lid Group Consolidated Investment in Subsidiary Dr Investment in Nandas Lag 70 090 Cr ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started