Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tutorial 4 question In this question, ignore GST. Eric operates his own computer repair and network support business, Tech-Wizard. Tech Wizard has branches across

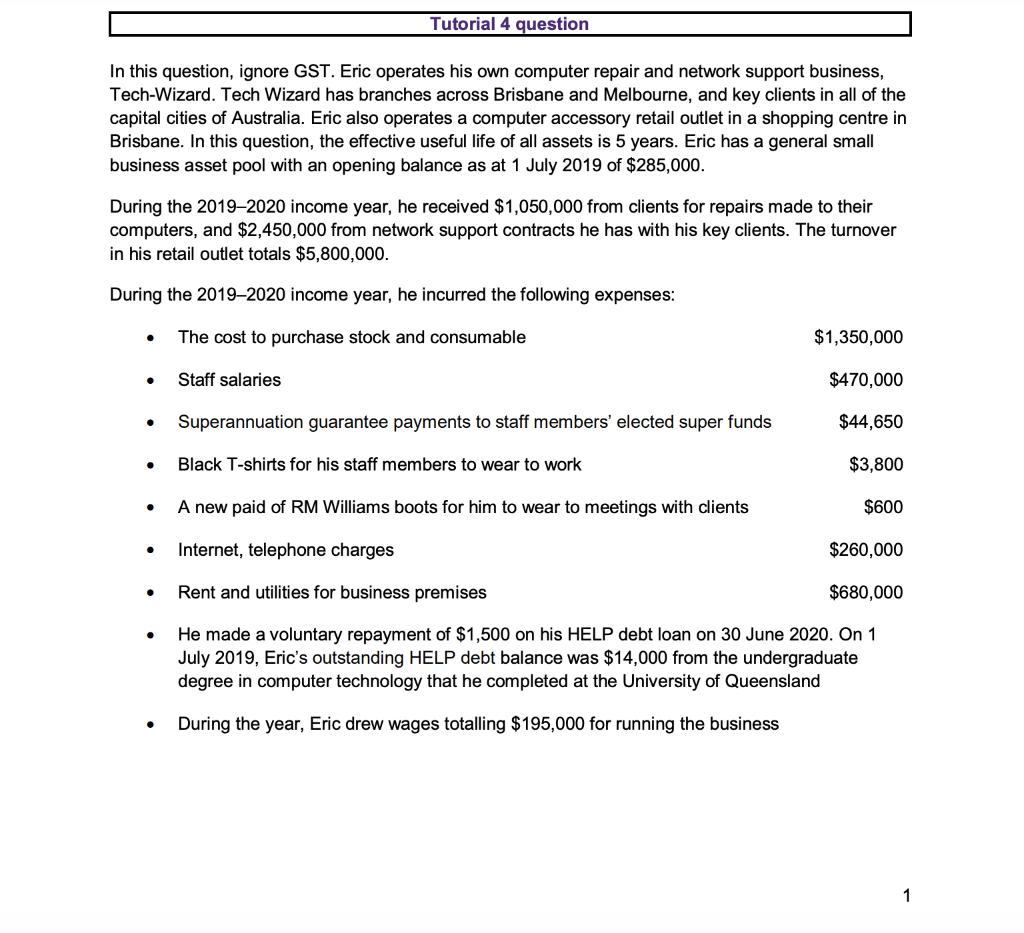

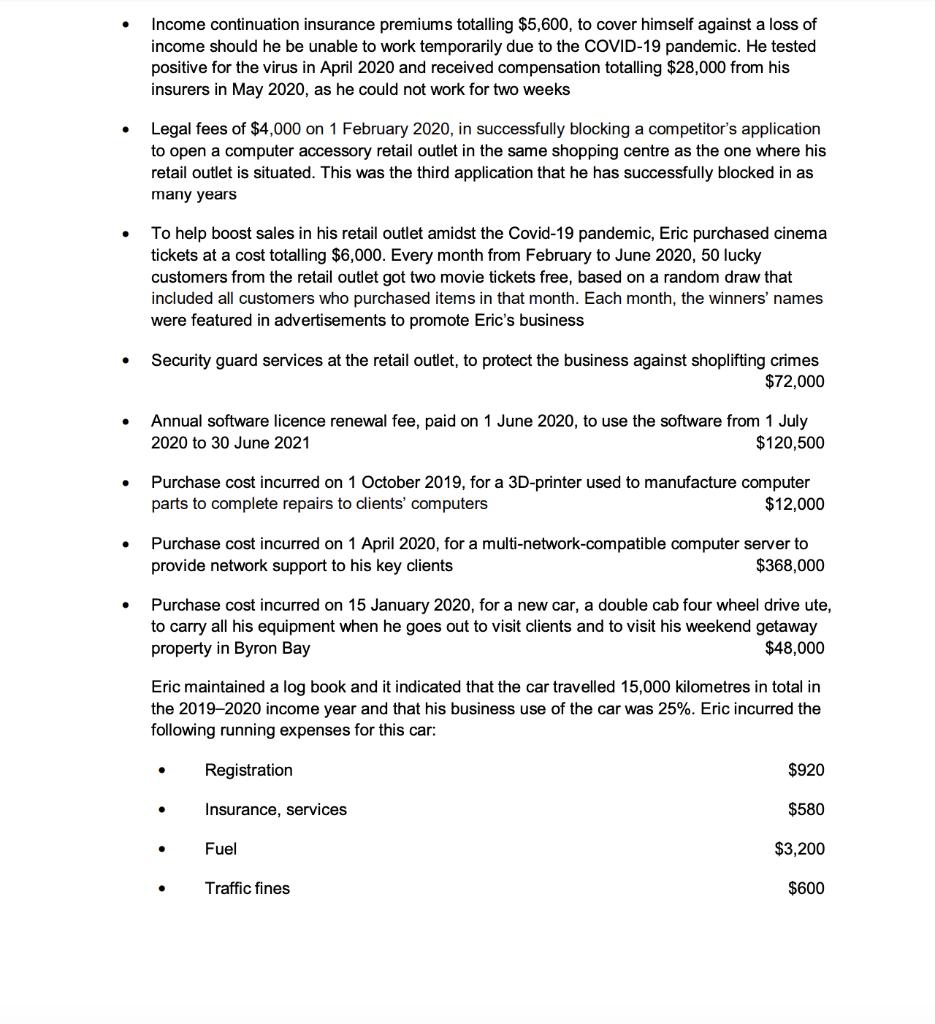

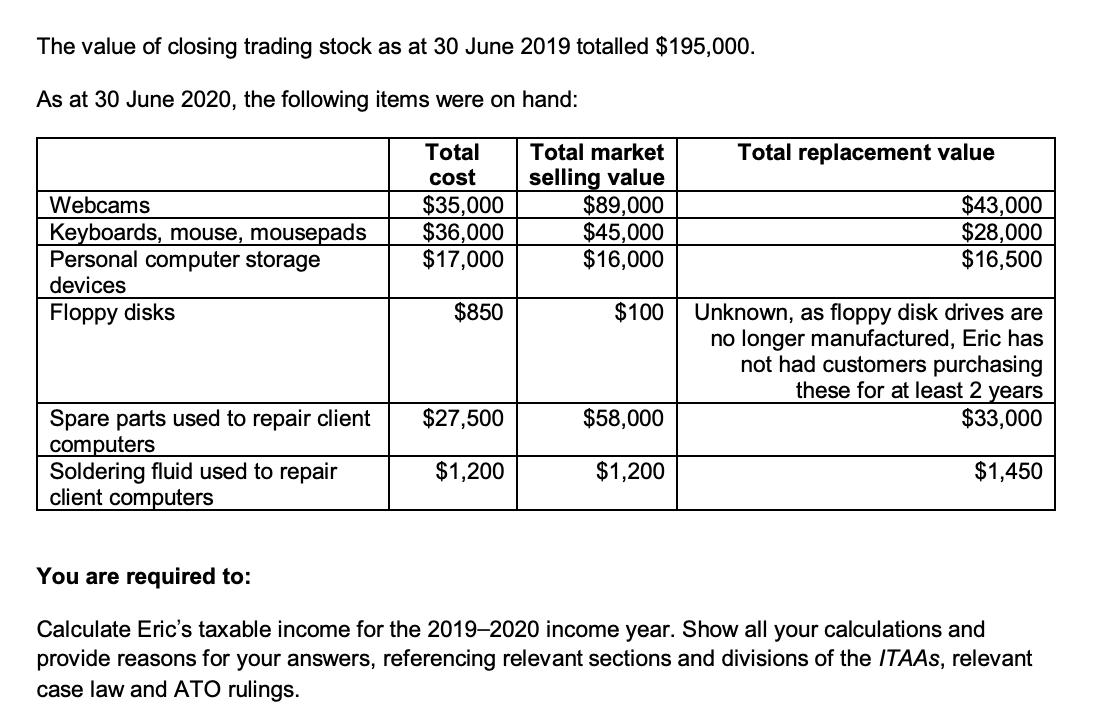

Tutorial 4 question In this question, ignore GST. Eric operates his own computer repair and network support business, Tech-Wizard. Tech Wizard has branches across Brisbane and Melbourne, and key clients in all of the capital cities of Australia. Eric also operates a computer accessory retail outlet in a shopping centre in Brisbane. In this question, the effective useful life of all assets is 5 years. Eric has a general small business asset pool with an opening balance as at 1 July 2019 of $285,000. During the 2019-2020 income year, he received $1,050,000 from clients for repairs made to their computers, and $2,450,000 from network support contracts he has with his key clients. The turnover in his retail outlet totals $5,800,000. During the 2019-2020 income year, he incurred the following expenses: The cost to purchase stock and consumable Staff salaries Superannuation guarantee payments to staff members' elected super funds Black T-shirts for his staff members to wear to work $1,350,000 $470,000 $44,650 $3,800 $600 A new paid of RM Williams boots for him to wear to meetings with clients Internet, telephone charges $260,000 Rent and utilities for business premises $680,000 He made a voluntary repayment of $1,500 on his HELP debt loan on 30 June 2020. On 1 July 2019, Eric's outstanding HELP debt balance was $14,000 from the undergraduate degree in computer technology that he completed at the University of Queensland During the year, Eric drew wages totalling $195,000 for running the business 1 . Income continuation insurance premiums totalling $5,600, to cover himself against a loss of income should he be unable to work temporarily due to the COVID-19 pandemic. He tested positive for the virus in April 2020 and received compensation totalling $28,000 from his insurers in May 2020, as he could not work for two weeks Legal fees of $4,000 on 1 February 2020, in successfully blocking a competitor's application to open a computer accessory retail outlet in the same shopping centre as the one where his retail outlet is situated. This was the third application that he has successfully blocked in as many years To help boost sales in his retail outlet amidst the Covid-19 pandemic, Eric purchased cinema tickets at a cost totalling $6,000. Every month from February to June 2020, 50 lucky customers from the retail outlet got two movie tickets free, based on a random draw that included all customers who purchased items in that month. Each month, the winners' names were featured in advertisements to promote Eric's business Security guard services at the retail outlet, to protect the business against shoplifting crimes $72,000 Annual software licence renewal fee, paid on 1 June 2020, to use the software from 1 July 2020 to 30 June 2021 $120,500 Purchase cost incurred on 1 October 2019, for a 3D-printer used to manufacture computer parts to complete repairs to clients' computers $12,000 Purchase cost incurred on 1 April 2020, for a multi-network-compatible computer server to provide network support to his key clients $368,000 Purchase cost incurred on 15 January 2020, for a new car, a double cab four wheel drive ute, to carry all his equipment when he goes out to visit clients and to visit his weekend getaway property in Byron Bay $48,000 Eric maintained a log book and it indicated that the car travelled 15,000 kilometres in total in the 2019-2020 income year and that his business use of the car was 25%. Eric incurred the following running expenses for this car: Registration Insurance, services . Fuel Traffic fines $920 $580 $3,200 $600 The value of closing trading stock as at 30 June 2019 totalled $195,000. As at 30 June 2020, the following items were on hand: Total cost Webcams Keyboards, mouse, mousepads Personal computer storage devices Floppy disks Spare parts used to repair client computers Soldering fluid used to repair client computers $35,000 $36,000 $17,000 $850 $27,500 $1,200 Total market selling value $89,000 $45,000 $16,000 Total replacement value $58,000 $1,200 $43,000 $28,000 $16,500 $100 Unknown, as floppy disk drives are no longer manufactured, Eric has not had customers purchasing these for at least 2 years $33,000 $1,450 You are required to: Calculate Eric's taxable income for the 2019-2020 income year. Show all your calculations and provide reasons for your answers, referencing relevant sections and divisions of the ITAAS, relevant case law and ATO rulings.

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started