Question

Assume that a company is a wholesaler of goods that are purchased from manufacturers or other suppliers. It segregates its inventory purchasing activities from all

Assume that a company is a wholesaler of goods that are purchased from manufacturers or other suppliers. It segregates its inventory purchasing activities from all other purchasing and payables [such as plant, equipment, utilities or services]. In the normal course of events, inventories are replenished by purchasing from vendors, which deliver goods that are entered into inventory. The company then sells the goods. The values of some items in inventory become impaired [that is, they can only be sold at prices below cost] and are written down. The company estimates the aggregate impairment as an allowance for obsolescence, which is a contra asset account.

Here are the relationships involved:

Ie = Ib + P- COS -WD

VPe =VPb + P – R&A

AOBSe = AOBSb + XOBS - WD

Ie and Ib are ending and beginning of period inventory amounts, at original or written down costs

P is purchases during the period.

COS is cost of inventory sold

WD is the amount of individual inventory items that have been written down during the period.

VPe and VPb are the end and beginning of period amount of vouchers payable for purchased inventory.

R&A and returns and allowances during the period

AOBSe and AOBSb are end and beginning of period allowance for obsolescent inventory.

XOBS is an estimate of the amount of loss in inventory value due to unsalability.

The company charges the estimated loss to selling, general and administrative costs [SGA], and income statement account.

| A | Think of a misstatement condition and describe how it could occur. [text will wrap] | |||||||||||

| B | Identify the affected assertion[s] | |||||||||||

| DO NOT ASSUME THAT YOU NEED TO IDENTIFY | ||||||||||||

| MORE THAN ONE | ||||||||||||

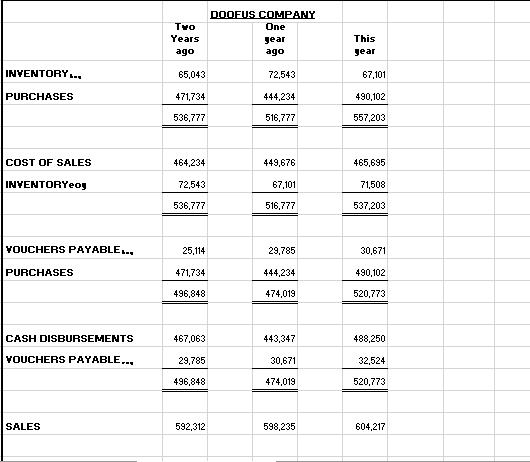

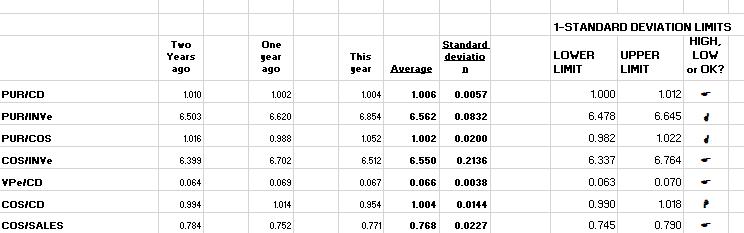

INVENTORY... PURCHASES COST OF SALES INVENTORYeog YOUCHERS PAYABLE... PURCHASES CASH DISBURSEMENTS YOUCHERS PAYABLE... SALES Two Years ago 65,043 471,734 536,777 464,234 72,543 536,777 25,114 471,734 496,848 467,063 29,785 496,848 592,312 DOOFUS COMPANY One gear ago 72,543 444,234 516,777 449,676 67,101 516,777 29,785 444,234 474,019 443,347 30,671 474,019 598,235 This gear 67,101 490,102 557,203 465,695 71,508 537,203 30,671 490,102 520,773 488,250 32,524 520,773 604,217

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A misstatement could occur in inventory accounts such that the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started