Answered step by step

Verified Expert Solution

Question

1 Approved Answer

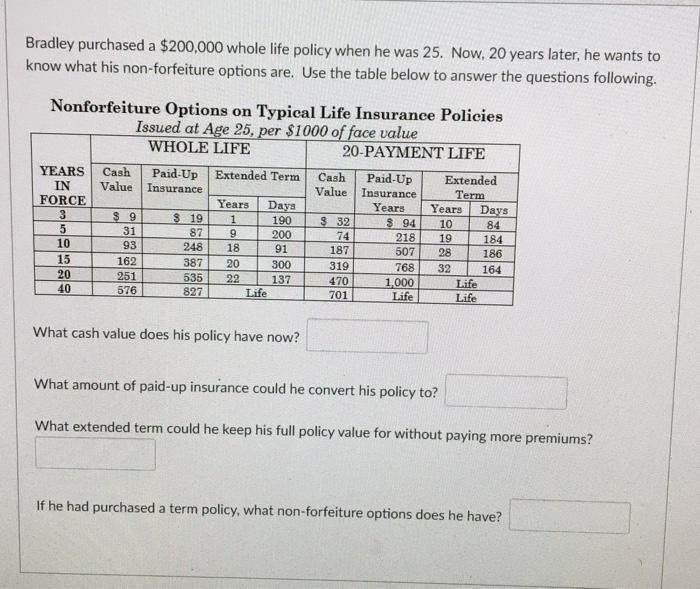

Bradley purchased a $200,000 whole life policy when he was 25. Now, 20 years later, he wants to know what his non-forfeiture options are.

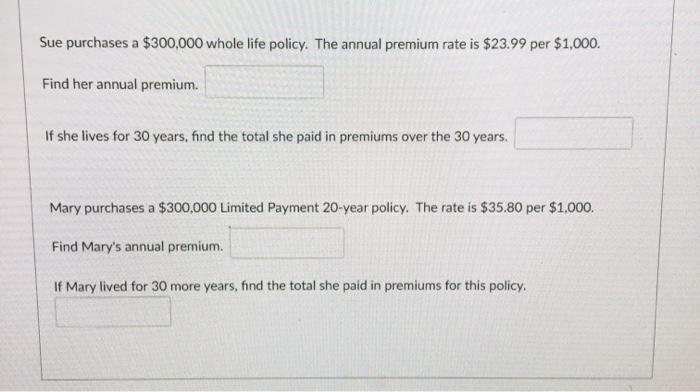

Bradley purchased a $200,000 whole life policy when he was 25. Now, 20 years later, he wants to know what his non-forfeiture options are. Use the table below to answer the questions following. Nonforfeiture Options on Typical Life Insurance Policies Issued at Age 25, per $1000 of face value WHOLE LIFE 20-PAYMENT LIFE YEARS Cash Paid-Up Extended Term Cash Paid-Up Extended IN Value Insurance. Value Insurance. Term FORCE Years Days Years 3 $9 8 19 190 $ 32 $94 5 31 87 200 74 218 10 93 248 91 187 507 15 162 387 300 319 768 32 20 251 535 137 470 1,000 Life 40 576 827 Life 701 Life Life What cash value does his policy have now? What amount of paid-up insurance could he convert his policy to? What extended term could he keep his full policy value for without paying more premiums? If he had purchased a term policy, what non-forfeiture options does he have? 10882 22 Years 10 3855 19 28 Days 84 184 186 164 Sue purchases a $300,000 whole life policy. The annual premium rate is $23.99 per $1,000. Find her annual premium. If she lives for 30 years, find the total she paid in premiums over the 30 years. Mary purchases a $300,000 Limited Payment 20-year policy. The rate is $35.80 per $1,000. Find Mary's annual premium. If Mary lived for 30 more years, find the total she paid in premiums for this policy.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

What cash value does his policy value have For 1000 value for 20 years of Whole Life Policy Cash v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started