Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VI. Your company sells a 30-year bond with a face value of $2,750,500 and a coupon rate of 3.875% in a market where the interest

VI. Your company sells a 30-year bond with a face value of $2,750,500 and a coupon rate of 3.875% in a market where the interest rate for bonds of similar credit quality and maturity is 4.125%. The bond pays interest semiannually.

a. Draw a timeline and label the cash flows identified above.

b. Using NPV analysis should Julie buy the machine? Why or why not?

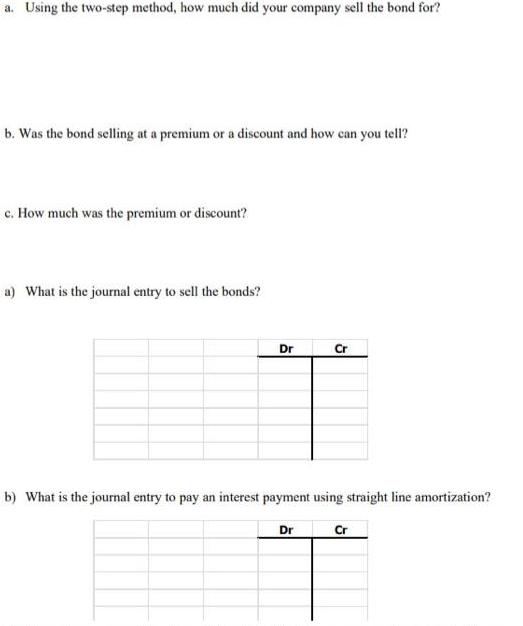

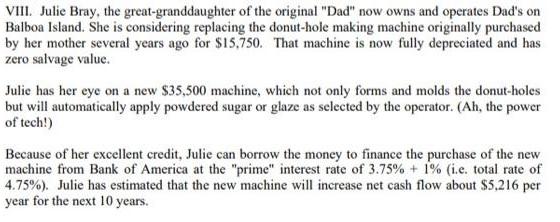

a. Using the two-step method, how much did your company sell the bond for? b. Was the bond selling at a premium or a discount and how can you tell? c. How much was the premium or discount? a) What is the journal entry to sell the bonds? Dr Cr T b) What is the journal entry to pay an interest payment using straight line amortization? Dr Cr VIII. Julie Bray, the great-granddaughter of the original Dad now owns and operates Dad s on Balboa Island. She is considering replacing the donut-hole making machine originally purchased by her mother several years ago for $15.750. That machine is now fully depreciated and has zero salvage value. Julie has her eye on a new $35,500 machine, which not only forms and molds the donut-holes but will automatically apply powdered sugar or glaze as selected by the operator. (Ah, the power of tech!) Because of her excellent credit, Julie can borrow the money to finance the purchase of the new machine from Bank of America at the prime interest rate of 3.75% + 1% (i.e. total rate of 4.75%). Julie has estimated that the new machine will increase net cash flow about $5,216 per year for the next 10 years.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started