Question

The value of a European call option with a strike price $90 and 6 months to expiry, using a one-step binomial model, with the

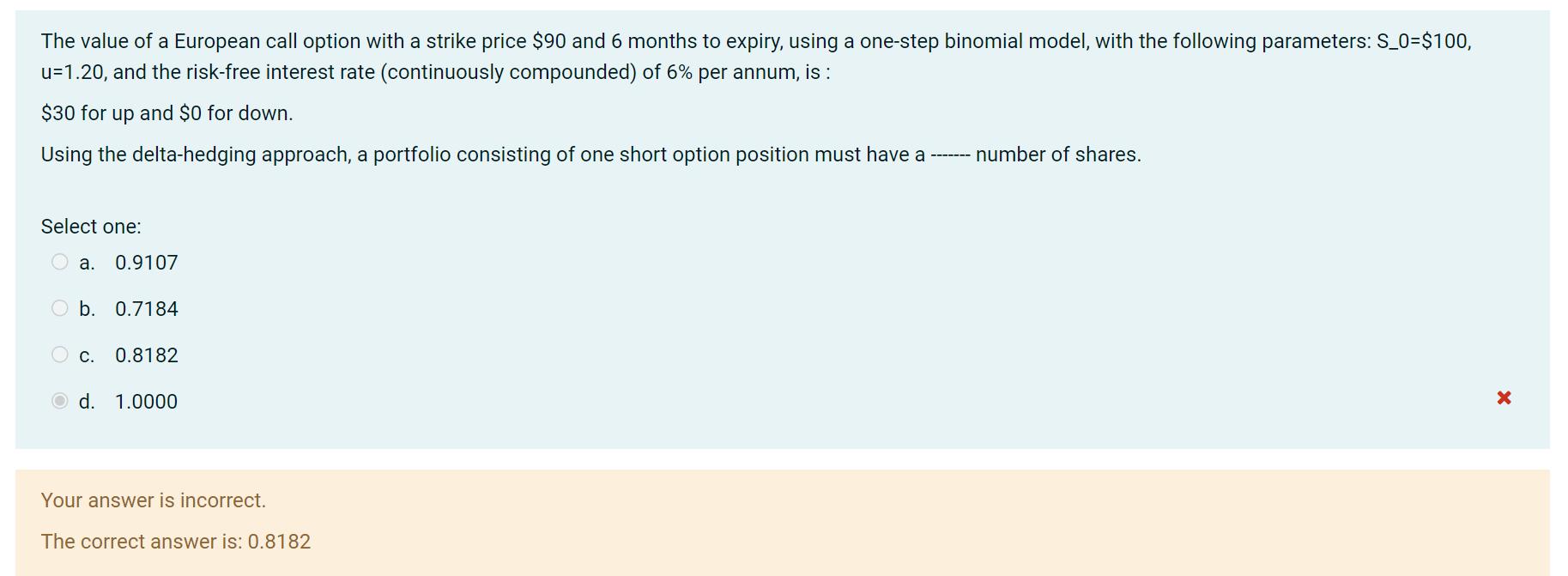

The value of a European call option with a strike price $90 and 6 months to expiry, using a one-step binomial model, with the following parameters: S_0=$100, u=1.20, and the risk-free interest rate (continuously compounded) of 6% per annum, is : $30 for up and $0 for down. Using the delta-hedging approach, a portfolio consisting of one short option position must have a ------- number of shares. Select one: a. 0.9107 b. 0.7184 C. 0.8182 Od. 1.0000 Your answer is incorrect. The correct answer is: 0.8182 X

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is 08182 The value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

13th edition

978-1-119-4110, 1119411483, 9781119411017, 978-1119411482

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App