Wedemeyer, Inc. is a seasonal company that began October 1, 2019. By the end of 2019 there were 3 employees. Carol Wolfe and Mary

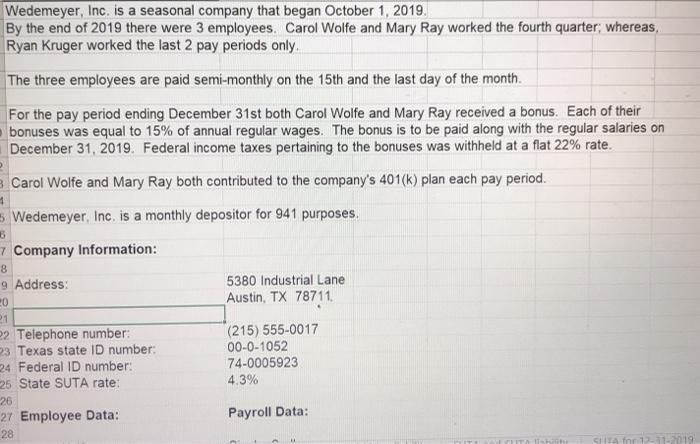

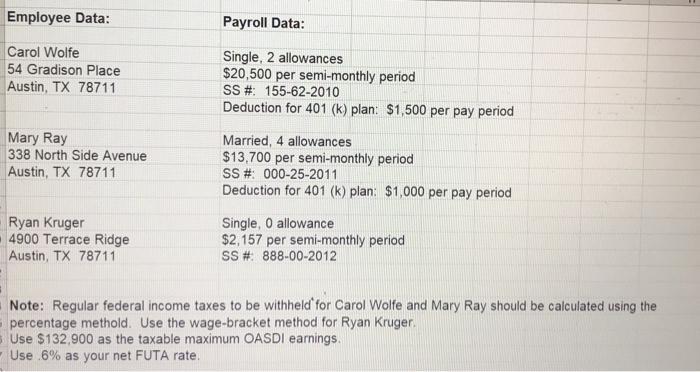

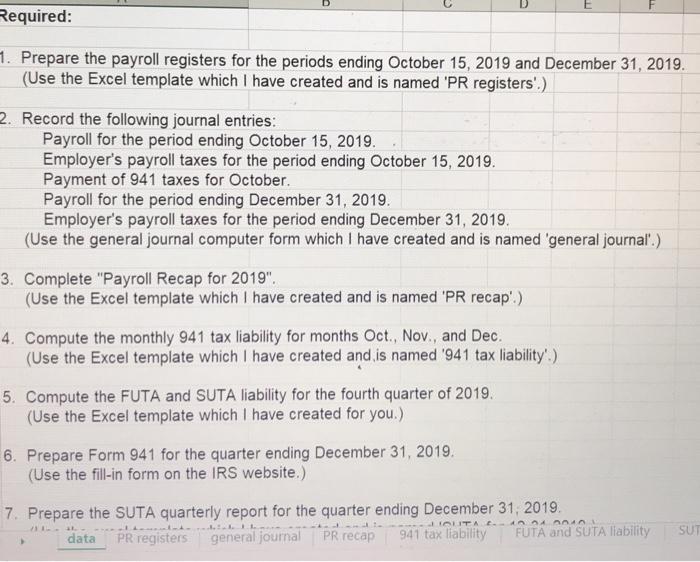

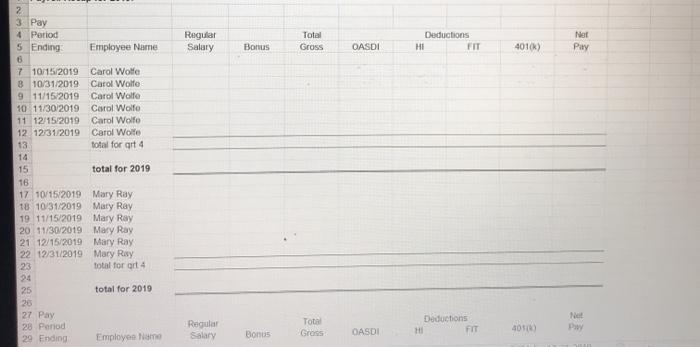

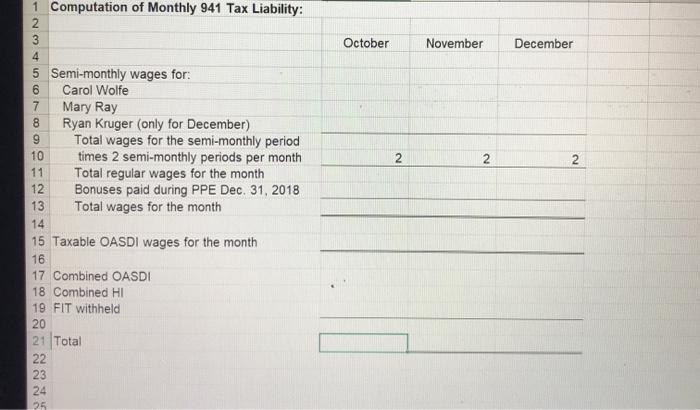

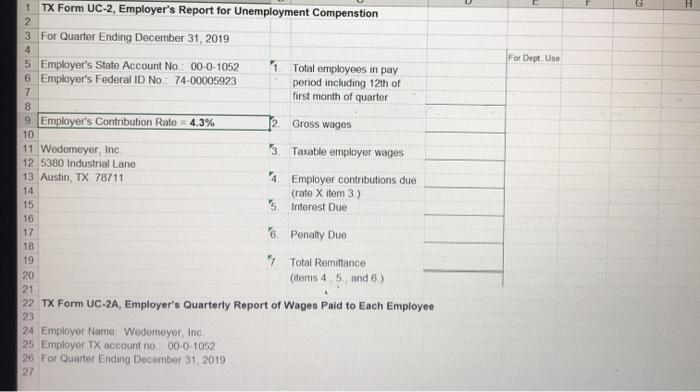

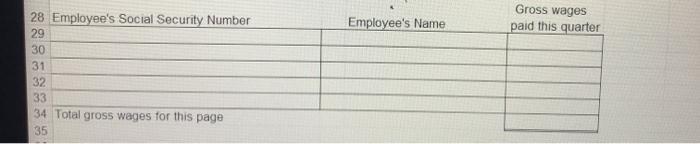

Wedemeyer, Inc. is a seasonal company that began October 1, 2019. By the end of 2019 there were 3 employees. Carol Wolfe and Mary Ray worked the fourth quarter; whereas, Ryan Kruger worked the last 2 pay periods only. The three employees are paid semi-monthly on the 15th and the last day of the month. For the pay period ending December 31st both Carol Wolfe and Mary Ray received a bonus. Each of their bonuses was equal to 15% of annual regular wages. The bonus is to be paid along with the regular salaries on December 31, 2019. Federal income taxes pertaining to the bonuses was withheld at a flat 22% rate. 3 Carol Wolfe and Mary Ray both contributed to the company's 401(k) plan each pay period. 1 Wedemeyer, Inc. is a monthly depositor for 941 purposes. 6 7 Company Information: 8 9 Address: 20 21 22 Telephone number: 23 Texas state ID number: 24 Federal ID number: 25 State SUTA rate: 26 27 Employee Data: 28 5380 Industrial Lane Austin, TX 78711. (215) 555-0017 00-0-1052 74-0005923 4.3% Payroll Data: SHTA for 12-31-2019) Employee Data: Carol Wolfe 54 Gradison Place Austin, TX 78711 Mary Ray 338 North Side Avenue Austin, TX 78711 Ryan Kruger 4900 Terrace Ridge Austin, TX 78711 Payroll Data: Single, 2 allowances $20,500 per semi-monthly period SS #: 155-62-2010 Deduction for 401 (k) plan: $1,500 per pay period Married, 4 allowances $13,700 per semi-monthly period SS#: 000-25-2011 Deduction for 401 (k) plan: $1,000 per pay period Single, 0 allowance $2,157 per semi-monthly period SS # 888-00-2012 Note: Regular federal income taxes to be withheld for Carol Wolfe and Mary Ray should be calculated using the 6 percentage methold. Use the wage-bracket method for Ryan Kruger. Use $132,900 as the taxable maximum OASDI earnings. Use .6% as your net FUTA rate. Required: 1. Prepare the payroll registers for the periods ending October 15, 2019 and December 31, 2019. (Use the Excel template which I have created and is named 'PR registers'.) 2. Record the following journal entries: Payroll for the period ending October 15, 2019. Employer's payroll taxes for the period ending October 15, 2019. Payment of 941 taxes for October. Payroll for the period ending December 31, 2019. Employer's payroll taxes for the period ending December 31, 2019. (Use the general journal computer form which I have created and is named 'general journal'.) 3. Complete "Payroll Recap for 2019". (Use the Excel template which I have created and is named 'PR recap'.) 4. Compute the monthly 941 tax liability for months Oct., Nov., and Dec. (Use the Excel template which I have created and is named '941 tax liability'.) 5. Compute the FUTA and SUTA liability for the fourth quarter of 2019. (Use the Excel template which I have created for you.) 6. Prepare Form 941 for the quarter ending December 31, 2019. (Use the fill-in form on the IRS website.) 7. Prepare the SUTA quarterly report for the quarter ending December 31, 2019. 21.144. HOUTAC 100100101 data aldatak PR registers 4414 general journal Landi PR recap 941 tax liability FUTA and SUTA liability SUT 7. Prepare the SUTA quarterly report for the quarter ending December 31, 2019. (Use the excel template which I have created and is named 'SUTA for 12-31-2019.) 8. Prepare the annual Form 940 for 2019. (Use the fill-in form on the IRS website.) 9. Prepare the W-2s for the three employees for 2019. (Use the word document which I have placed on Brightspace.) 10. Prepare W-3 for 2019. (Use the word document which I have placed on Brightspace.) 12. Upon completion put your project in a 3-ring binder. If you need one of these come and see me and I will give you one. Your project should be in the following order: Payroll Registers General Journal Payroll Recap for 2019 Computation of Monthly 941 Tax Liability Computation of FUTA and Computation of SUTA Form 941 for Quarter Ending December 31, 2019 SUTA Report (TX Form UC-2) for Quarter Ending Decemberh 31, 2019 Form 940, Annual FUTA Report W-3 for 2019 W-2s for 2019 for each of the three employees Date General Journal Account Titles and Explanation PR Debit Credit 2 3 Pay 4 Period 5 Ending 6 7 10/15/2019 Carol Wolfe 8 10/31/2019 Carol Wolfe 9 11/15/2019 Carol Wolfe 10 11/30/2019 Carol Wolfe 11 12/15/2019 Carol Wolfo 12 12/31/2019 Carol Wolfe 13 total for grt 4 14 15 Employee Name 20 11/30/2019 21 12/15/2019 22 12/31/2019 23 24 25 16 17 10/15/2019 Mary Ray 18 10/31/2019 Mary Ray 19 11/15/2019 Mary Ray Mary Ray. Mary Ray Mary Ray total for grt 4 26 27 Pay 28 Period 29 Ending total for 2019 total for 2019 Employee Name Regular Salary Regular Salary Bonus Bonus Total Gross Total Gross OASDI OASDI Deductions HI FIT Deductions HI FIT 401(k) 401(k) Net Pay Net Pay 27 Pay 28 Period 29 Ending 30 31 12/15/2019 32 12/31/2019 33 34 35 40 41 42 43 44 45 Employee Name Ryan Kruger Ryan Kruger total for grt 4 total for 2019 36 37 Recap for the quarter ending December 31, 2019 and for the year: 38 39 46 47 40 Employee Name Carol Wolfe Mary Ray Ryan Kruger Total Regular Salary total for 2019 Bonus Regular Salary Total Gross Total Bonus . Gross OASDI OASDI HI HI Deductions Deductions FIT FIT 401(k) 401(k) Not Pay Net Pay 1 Computation of Monthly 941 Tax Liability: 1234567 5 Semi-monthly wages for: Carol Wolfe Mary Ray Ryan Kruger (only for December) Total wages for the semi-monthly period times 2 semi-monthly periods per month Total regular wages for the month Bonuses paid during PPE Dec. 31, 2018 Total wages for the month 7 8 9 10 11 12 13 14 15 Taxable OASDI wages for the month 16 17 Combined OASDI 18 Combined HI 19 FIT withheld 20 21 Total 22 23 24 25 October 2 November 2 December 2 1 Name: 2 Computation of FUTA: 3 4 5 Name 6 Carol Wolfe 7 Mary Ray 8 Ryan Kruger 9 Total 10 FUTA rate 11 FUTA taxes 12 13 Computation of SUTA: 14 15 16 Name: 17 Carol Wolfe 18 Mary Ray 19 Ryan Kruger 20 Total 21 SUTA rate 22 SUTA taxes B current gross current gross C 4th quarter ytd gross 4th quarter ytd gross O taxable wages 0.6% taxable wages 4.3% E LL G 1 TX Form UC-2, Employer's Report for Unemployment Compenstion 2 3 For Quarter Ending December 31, 2019 4 5 Employer's State Account No.: 00-0-1052 6 Employer's Federal ID No.: 74-00005923 7 8 9 Employer's Contribution Rate = 4.3% 10 11 Wedemeyer, Inc. 12 5380 Industrial Lane 13 Austin, TX 78711 14 15 16 17 18 19 24 Employer Name: Wedemeyer, Inc. 25 Employer TX account no 00-0-1052 26 For Quarter Ending December 31, 2019 27 Total employees in pay period including 12th of first month of quarter Gross wages Taxable employer wages 12. 3. 4. Employer contributions due (rate X item 3.) 5. Interest Due 6. 7 Penalty Duel Total Remittance (items 4, 5, and 6) 20 21 22 TX Form UC-2A, Employer's Quarterly Report of Wages Paid to Each Employee 23 For Dept. Use G H 28 Employee's Social Security Number 29 30 31 32 33 34 Total gross wages for this page 35 Employee's Name Gross wages paid this quarter

Step by Step Solution

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Prepare the payroll registers for the periods ending October 15 2019 and December 31 2019 The payroll register is a table that records employee inform...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started