Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the following documents please answer the following: a) What calculations or ratios would be useful to help estimate future returns? Please calculate the dividend

Using the following documents please answer the following:

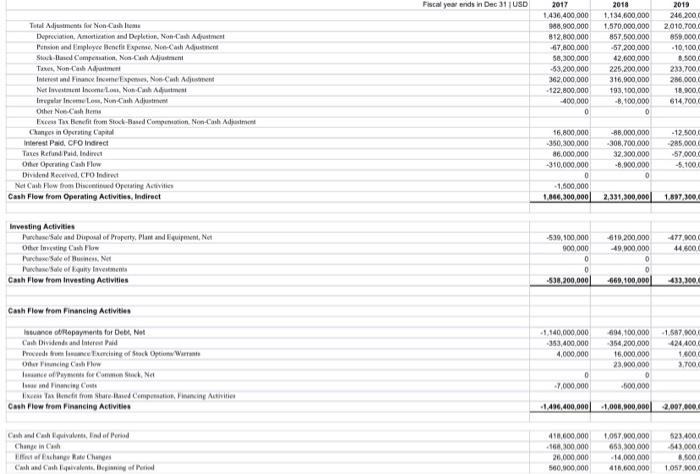

a) What calculations or ratios would be useful to help estimate future returns? Please calculate the dividend yield for the most recent year (assume price is $50, use dividends declared)

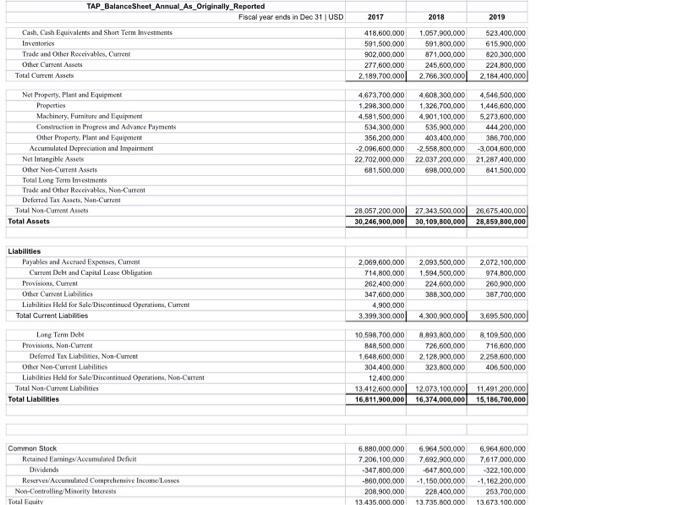

b) Suggest the best ratio that could calculate how quickly the company could liquidate its current assest's and calculate it for the most recent year

c) Explain why you chose this ratio

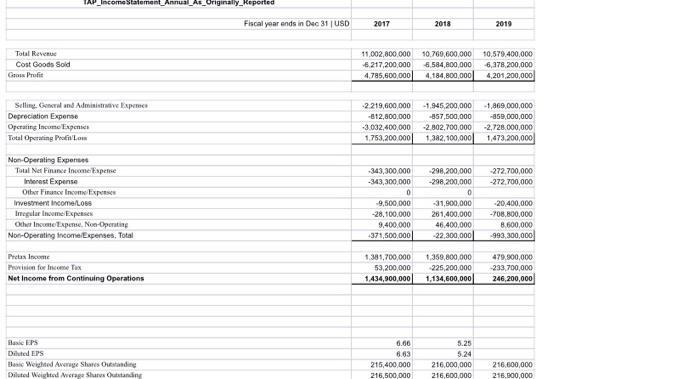

Total Revenue Cost Goods Sold nus Profit TAP_Income Statement Annual As Originally Reported Selling General and Administrative Expenses Depreciation Expense Operating Income Expenses Total Operating Profit/Lom Non-Operating Expenses Total Net Finance Income Expense Interest Expense Other Finance Income Expenses Investment Income/Loss Irregular Income Expenses Other Income Expense. Non-Operating Non-Operating Income/Expenses, Total Pretas Income Provision for Income Tax Net Income from Continuing Operations Basic EPS Dited EPS Basic Weighted Average Shares Outstanding Diluted Weighted Average Shares Outstanding Fiscal year ends in Dec 31 USD 2017 11,002,800,000 10,769,600,000 10,579,400,000 -6,217,200,000 6,584,800,000 6,378,200,000 4,785,600,000 4,184,800,000 4,201,200,000 2018 -2.219,600,000 -1.945,200,000 -1,869,000,000 -812,800,000 -857,500,000 -859,000,000 -3.032,400,000 -2,802,700,000 -2,728.000,000 1,753,200.000 1,382,100,000 1,473,200,000 0 -343,300,000 -298,200,000 -272,700,000 -343,300,000 -298,200,000 -272,700,000 -9,500,000 -31,900,000 -28,100,000 261,400.000 9,400,000 46,400,000 +371,500,000 -22,300,000 6.66 6.63 0 1.381,700,000 1,359,800,000 53,200,000 1,434,900,000 215,400,000 216,500,000 2019 5.25 5.24 216,000,000 216,600,000 -20,400,000 -708,800,000 479,900,000 -225,200,000 -233,700,000 1,134,600,000 246,200,000 8,600,000 993,300,000 216,600,000 216,900,000

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a The dividend yield for the most recent year can be calculated by dividing the div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started