Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the overall formula for computing taxes? Remember to start with gross income, subtract any for AGI deductions to get to AGI, subtract

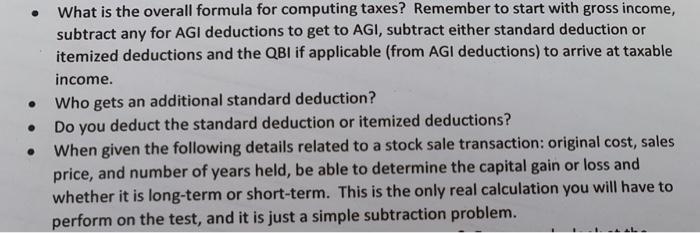

What is the overall formula for computing taxes? Remember to start with gross income, subtract any for AGI deductions to get to AGI, subtract either standard deduction or itemized deductions and the QBI if applicable (from AGI deductions) to arrive at taxable income. Who gets an additional standard deduction? Do you deduct the standard deduction or itemized deductions? When given the following details related to a stock sale transaction: original cost, sales price, and number of years held, be able to determine the capital gain or loss and whether it is long-term or short-term. This is the only real calculation you will have to perform on the test, and it is just a simple subtraction problem.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The overall formula for computing taxes is Gross Income AGI deductions Stand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started