the next two years. Currently, WSDC has $2,000,000 on hand and available for investment. In 6 months, 12 months, and 18 months, WSDC expects

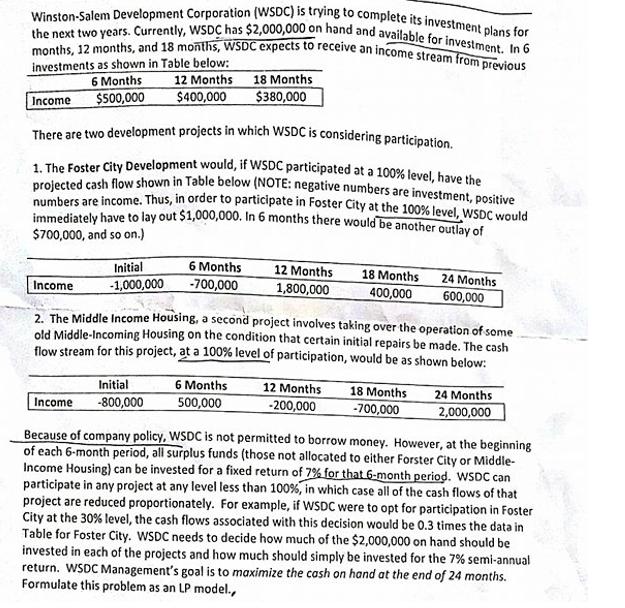

the next two years. Currently, WSDC has $2,000,000 on hand and available for investment. In 6 months, 12 months, and 18 months, WSDC expects to receive an income stream from previous Winston-Salem Development Corporation (WSDC) is trying to complete its investment plans for investments as shown in Table below: 6 Months $500,000 18 Months $380,000 12 Months Income $400,000 There are two development projects in which WSDC is considering participation. 1 The Foster City Development would, if WSDC participated at a 100% level, have the projected cash flow shown in Table below (NOTE: negative numbers are investment, positive numbers are income. Thus, in order to participate in Foster City at the 100% level, WSDC would immediately have to lay out $1,000,000. In 6 months there would be another outlay of $700,000, and so on.) Initial -1,000,000 6 Months -700,000 12 Months 1,800,000 18 Months 400,000 24 Months 600,000 Income 2. The Middle Income Housing, a second project involves taking over the operation of some old Middle-Incoming Housing on the condition that certain initial repairs be made. The cash flow stream for this project, at a 100% level of participation, would be as shown below: Initial -800,000 6 Months 500,000 12 Months 24 Months 2,000,000 18 Months Income -200,000 -700,000 Because of company policy, WSDC is not permitted to borrow money. However, at the beginning of each 6-month period, all surplus funds (those not allocated to either Forster City or Middle- Income Housing) can be invested for a fixed return of 7% for that 6-month period. WSDC can participate in any project at any level less than 100%, in which case all of the cash flows of that project are reduced proportionately. For example, if WSDC were to opt for participation in Foster City at the 30% level, the cash flows associated with this decision would be 0.3 times the data in Table for Foster City. WSDC needs to decide how much of the $2,000,000 on hand should be invested in each of the projects and how much should simply be invested for the 7% semi-annual return. WSDC Management's goal is to maximize the cash on hand at the end of 24 months. Formulate this problem as an LP model.,

Step by Step Solution

3.24 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Initial cash in hand Co 2000000 Let the income from previous investments be a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started