Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are required to construct a statement of earnings, a statement of retained earnings, and a balanced sheet for the year-end, or as at, April

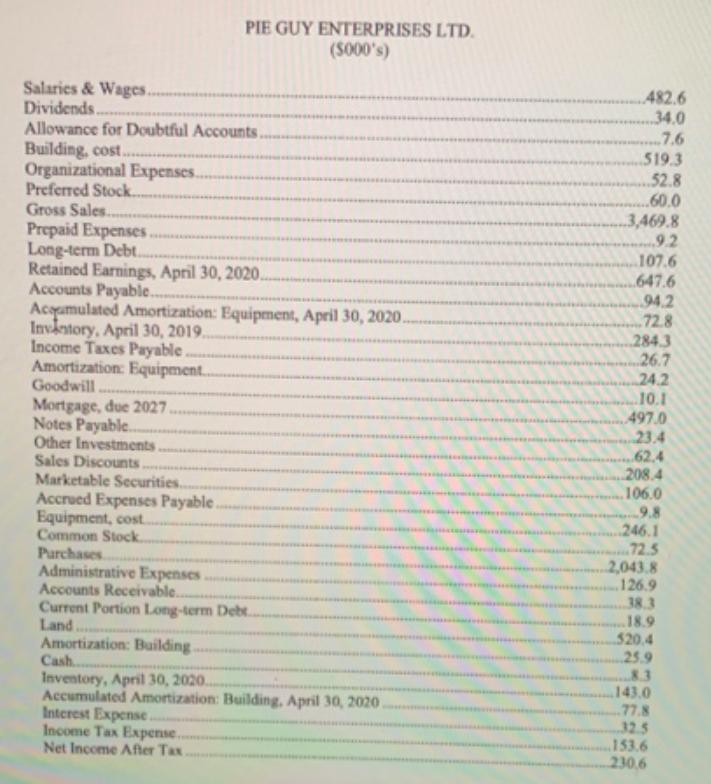

You are required to construct a statement of earnings, a statement of retained earnings, and a balanced sheet for the year-end, or as at, April 30, 2020, whichever is appropriate. Not all the account titles needed are given. You must provide the missing titles as well as use those listed below and, in certain cases, determine the missing amounts. This quiz has been designed so that if you cannot complete one section you can still proceed to the next section and not be at a disadvantage.

PIE GUY ENTERPRISES LTD. (S000's) Salaries & Wages. Dividends. Allowance for Doubtful Accounts. Building, cost. Organizational Expenses. Preferred Stock. Gross Sales.. Prepaid Expenses. Long-term Debt. Retained Earnings, April 30, 2020.. Accounts Payable. Acagumulated Amortization: Equipment, April 30, 2020. Invintory, April 30, 2019. Income Taxes Payable. Amortization: Equipment.. Goodwill 482.6 34.0 7.6 519.3 52.8 .60.0 3,469.8 9.2 107.6 647.6 94.2 .72.8 284.3 26.7 24.2 10.1 Mortgage, due 2027. Notes Payable. Other Investments Sales Discounts. Marketable Securities. Accrued Expenses Payable. Equipment, cost. Common Stock. Purchases Administrative Expenses. Accounts Receivable.. Current Portion Long-term Debe. Land. Amortization: Building Cash. Inventory, April 30, 2020. Accumulated Amortization: Building, April 30, 2020 Interest Expense. Income Tax Expense. Net Income After Tax 497.0 23.4 62.4 208.4 106.0 9.8 246.1 72.5 2,043.8 126.9 38.3 .18.9 520.4 25.9 8.3 143.0 77.8 32.5 153.6 230.6

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started