Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been hired by Hill and Associates, CPAs, as a first year accountant. The firm has a client who is in need of

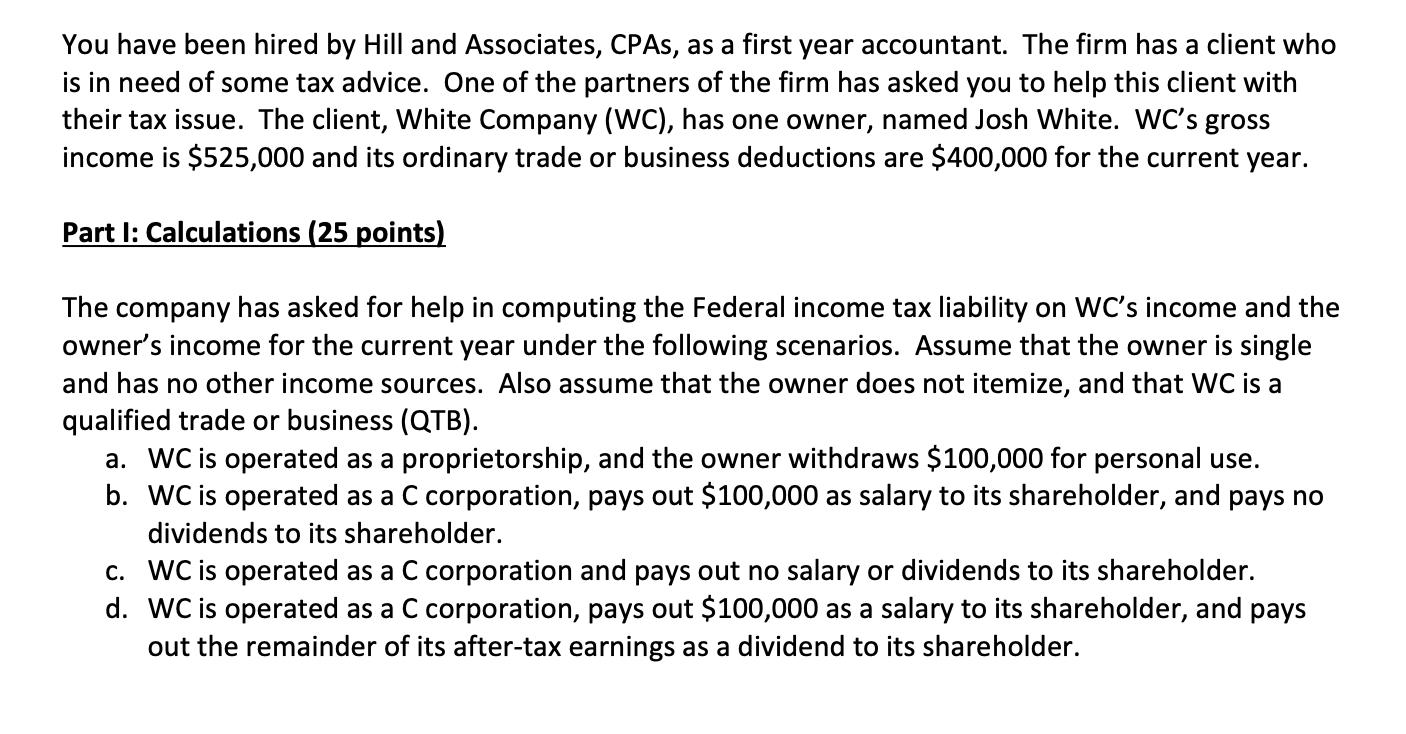

You have been hired by Hill and Associates, CPAs, as a first year accountant. The firm has a client who is in need of some tax advice. One of the partners of the firm has asked you to help this client with their tax issue. The client, White Company (WC), has one owner, named Josh White. WC's gross income is $525,000 and its ordinary trade or business deductions are $400,000 for the current year. Part I: Calculations (25 points) The company has asked for help in computing the Federal income tax liability on WC's income and the owner's income for the current year under the following scenarios. Assume that the owner is single and has no other income sources. Also assume that the owner does not itemize, and that WC is a qualified trade or business (QTB). a. WC is operated as a proprietorship, and the owner withdraws $100,000 for personal use. b. WC is operated as a C corporation, pays out $100,000 as salary to its shareholder, and pays no dividends to its shareholder. c. WC is operated as a C corporation and pays out no salary or dividends to its shareholder. d. WC is operated as a C corporation, pays out $100,000 as a salary to its shareholder, and pays out the remainder of its after-tax earnings as a dividend to its shareholder.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A WC OPERATED AS PROPRIETORSHIP As a sole proprietor you must report all business income or losses o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started