Question

Open T account and close all the accounts. EXERCISE 3 The opening balance of 20X1: ASSETS Fixed assets Current assets Deferred costs (RMC) Deferred income

Open T account and close all the accounts.

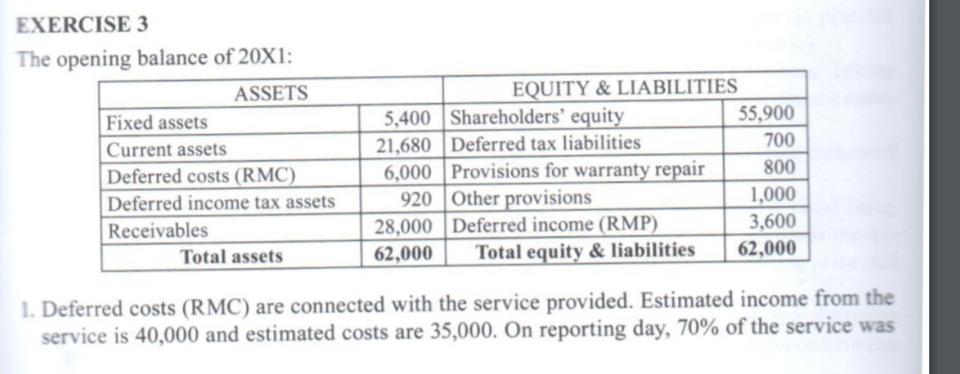

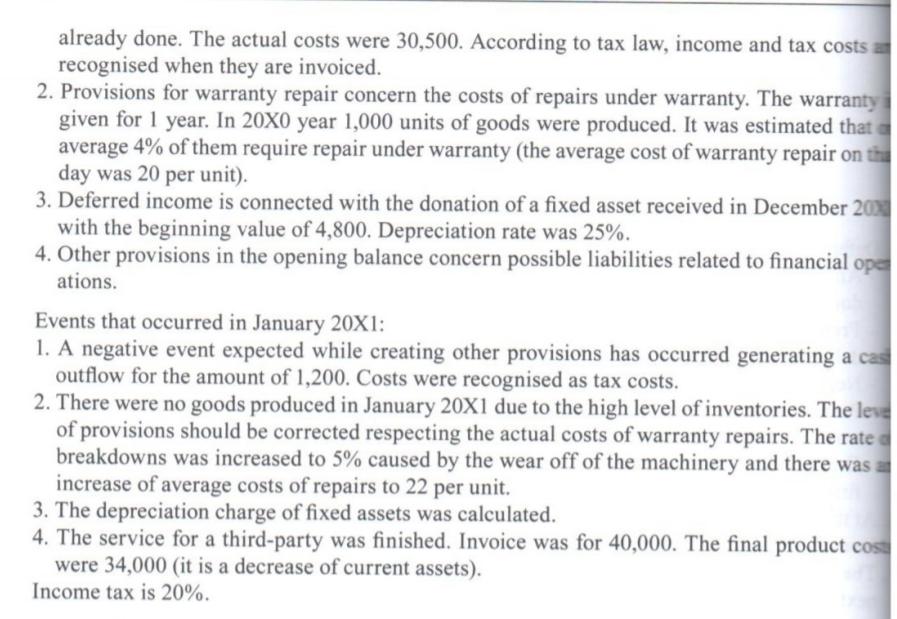

EXERCISE 3 The opening balance of 20X1: ASSETS Fixed assets Current assets Deferred costs (RMC) Deferred income tax assets Receivables Total assets EQUITY & LIABILITIES 5,400 Shareholders' equity 21,680 Deferred tax liabilities 6,000 920 28,000 62,000 Provisions for warranty repair Other provisions Deferred income (RMP) Total equity & liabilities 55,900 700 800 1,000 3,600 62,000 1. Deferred costs (RMC) are connected with the service provided. Estimated income from the service is 40,000 and estimated costs are 35,000. On reporting day, 70% of the service was

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here is a summary of the events that occurred in January 20X1 and their impact on the financial statements The negative event that occurred generated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Cost Accounting

Authors: William Lanen, Shannon Anderson, Michael Maher

3rd Edition

9780078025525, 9780077517359, 77517350, 978-0077398194

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App