Answered step by step

Verified Expert Solution

Question

1 Approved Answer

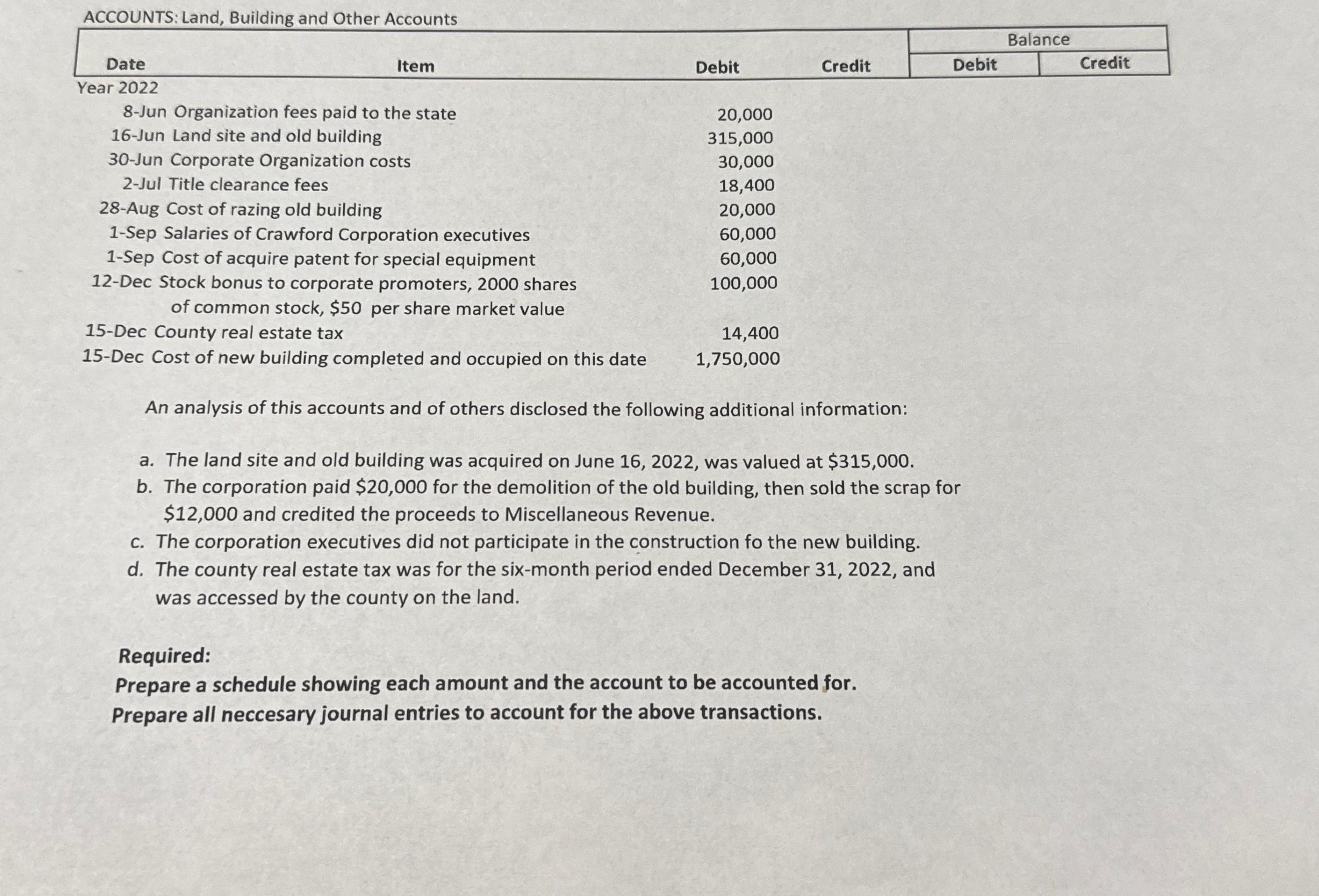

ACCOUNTS: Land, Building and Other Accounts Date Year 2022 Item 8-Jun Organization fees paid to the state 16-Jun Land site and old building 30-Jun

ACCOUNTS: Land, Building and Other Accounts Date Year 2022 Item 8-Jun Organization fees paid to the state 16-Jun Land site and old building 30-Jun Corporate Organization costs 2-Jul Title clearance fees 28-Aug Cost of razing old building 1-Sep Salaries of Crawford Corporation executives 1-Sep Cost of acquire patent for special equipment 12-Dec Stock bonus to corporate promoters, 2000 shares of common stock, $50 per share market value 15-Dec County real estate tax 15-Dec Cost of new building completed and occupied on this date Debit 20,000 315,000 30,000 18,400 20,000 60,000 60,000 100,000 14,400 1,750,000 Balance Credit Debit Credit An analysis of this accounts and of others disclosed the following additional information: a. The land site and old building was acquired on June 16, 2022, was valued at $315,000. b. The corporation paid $20,000 for the demolition of the old building, then sold the scrap for $12,000 and credited the proceeds to Miscellaneous Revenue. c. The corporation executives did not participate in the construction fo the new building. d. The county real estate tax was for the six-month period ended December 31, 2022, and was accessed by the county on the land. Required: Prepare a schedule showing each amount and the account to be accounted for. Prepare all neccesary journal entries to account for the above transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started