Question

Accounts payable Accounts receivable Accumulated Amortization-Right-of-Use Asset Accumulated depreciationBuilding Accumulated depreciationEquipment Amortization expense Bond interest expense Bond interest payable Bond interest revenue Bonds payable Building

Accounts payable

Accounts receivable

Accumulated Amortization-Right-of-Use Asset

Accumulated depreciationBuilding

Accumulated depreciationEquipment

Amortization expense

Bond interest expense

Bond interest payable

Bond interest revenue

Bonds payable

Building

Cash

Common dividend payable

Common stock dividend distributable

Common stock, $10 par value

Common stock, no-par value

Cost of goods sold

Depreciation expense - Building

Depreciation expense - Equipment

Discount on bonds payable

Equipment

Gain on retirement of bonds payable

Income summary

Inventory

Land

Lease liability

Loss on retirement of bonds payable

Notes payable

Organization expenses

Paid-in capital in excess of par value, common stock

Paid-in capital in excess of par value, preferred stock

Paid-in capital, treasury stock

Preferred stock, $100 par value

Premium on bonds payable

Rental expense

Rental revenue

Retained earnings

Right-of-Use Asset

Salaries expense

Sales

Sales discounts

Sales returns and allowances

Supplies

Supplies expense

Treasury stock

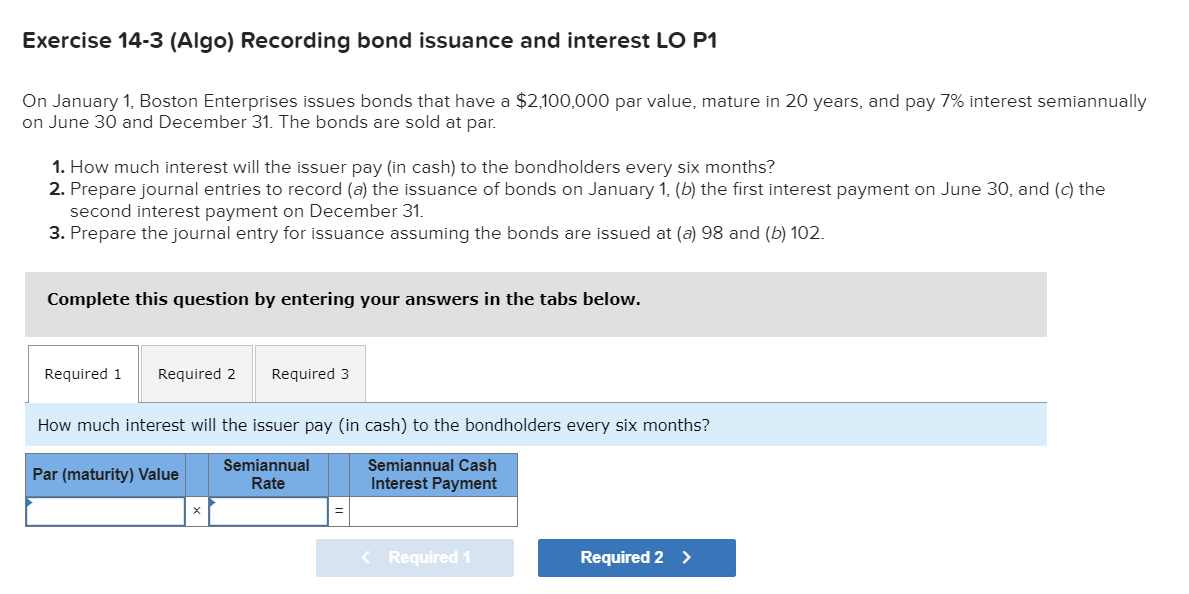

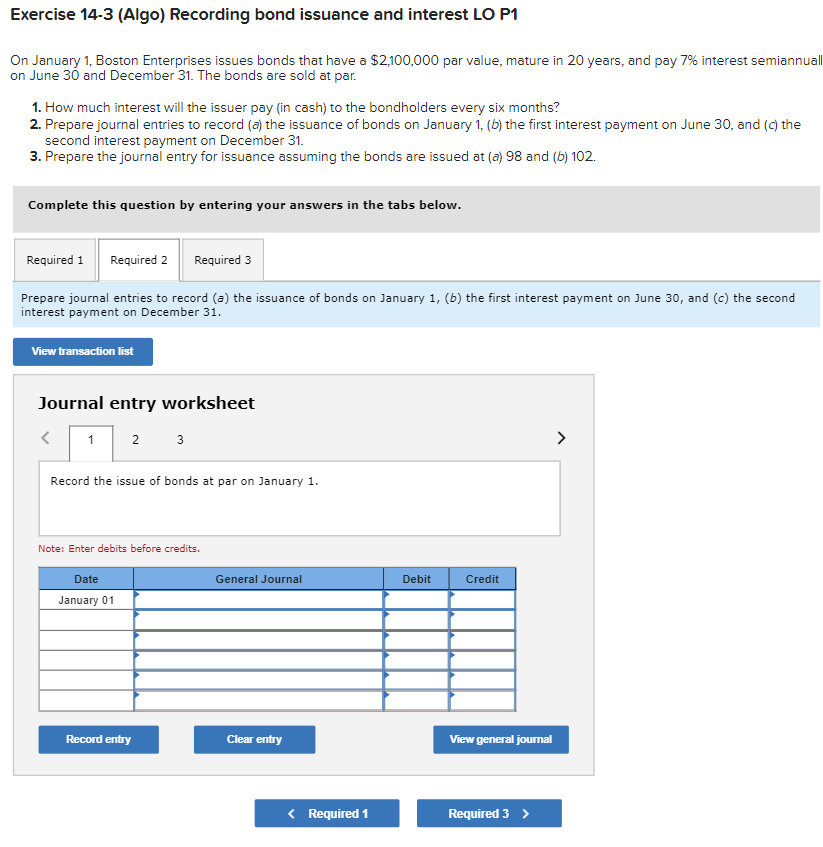

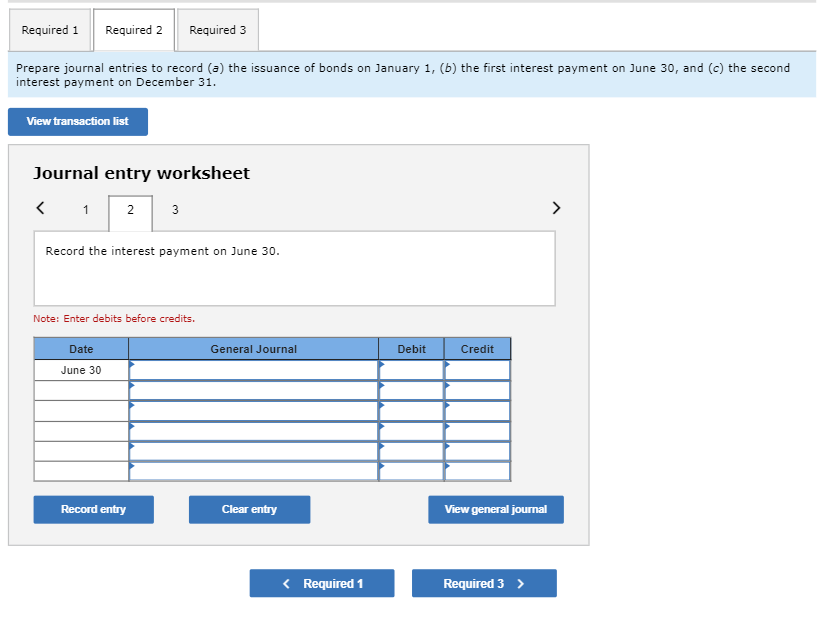

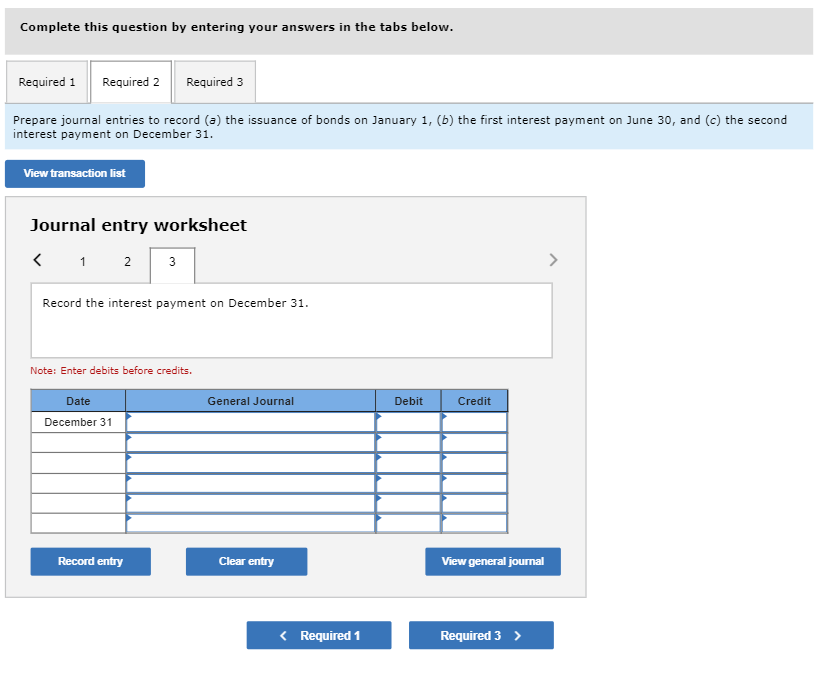

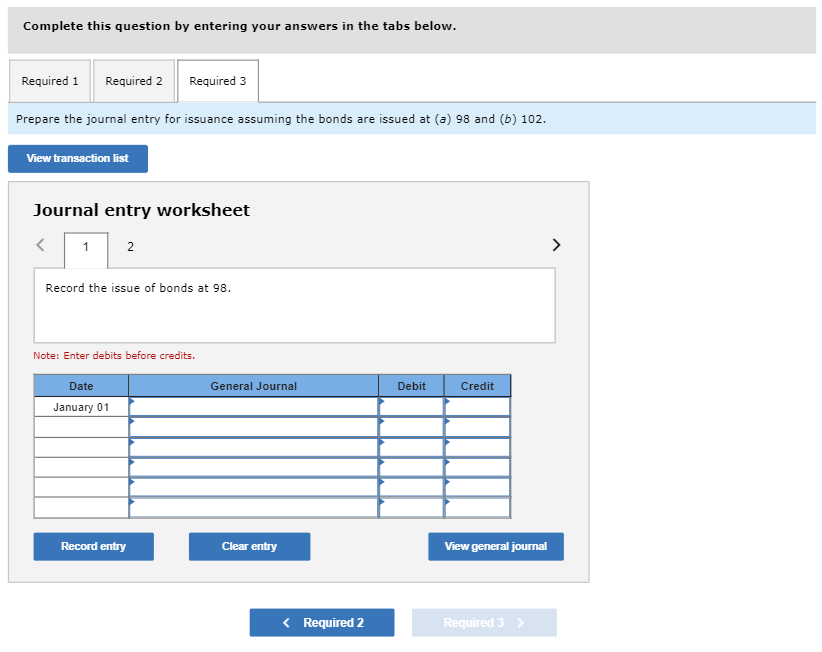

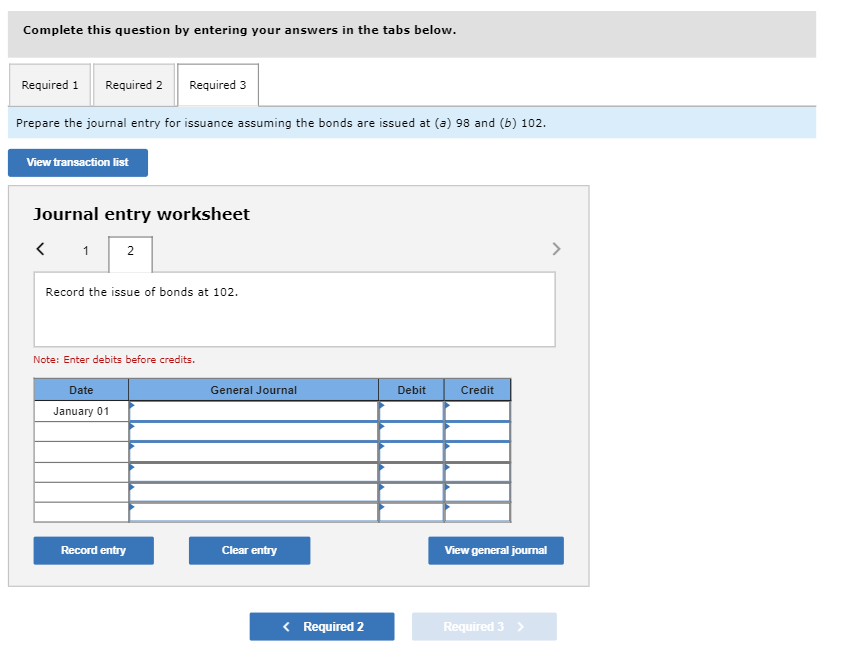

Exercise 14-3 (Algo) Recording bond issuance and interest LO P1 On January 1, Boston Enterprises issues bonds that have a $2,100,000 par value, mature in 20 years, and pay 7% interest semiannually on June 30 and December 31 . The bonds are sold at par. 1. How much interest will the issuer pay (in cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the issuance of bonds on January 1 , (b) the first interest payment on June 30, and (c) the second interest payment on December 31. 3. Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. Complete this question by entering your answers in the tabs below. How much interest will the issuer pay (in cash) to the bondholders every six months? On January 1, Boston Enterprises issues bonds that have a $2,100,000 par value, mature in 20 years, and pay 7% interest semiannua on June 30 and December 31 . The bonds are sold at par. 1. How much interest will the issuer pay (in cash) to the bondholders every six months? 2. Prepare journal entries to record (a) the issuance of bonds on January 1, (b) the first interest payment on June 30 , and (c) the second interest payment on December 31 . 3. Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. Complete this question by entering your answers in the tabs below. Prepare journal entries to record (a) the issuance of bonds on January 1,(b) the first interest payment on June 30 , and (c) the second interest payment on December 31. Journal entry worksheet Record the issue of bonds at par on January 1. Note: Enter debits before credits. Prepare journal entries to record (a) the issuance of bonds on January 1,(b) the first interest payment on June 30 , and (c) the second interest payment on December 31 . Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare journal entries to record ( a ) the issuance of bonds on January 1,(b) the first interest payment on June 30, and (c) the second interest payment on December 31 . Journal entry worksheet Record the interest payment on December 31. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entry for issuance assuming the bonds are issued at (a) 98 and (b) 102. Journal entry worksheet Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started