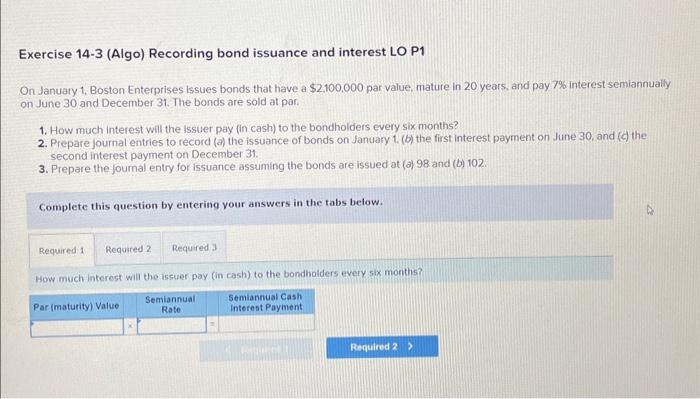

Question

Accounts payable Accounts receivable Accumulated Amortization-Right-of-Use Asset Accumulated depreciationBuilding Accumulated depreciationEquipment Amortization expense Bond interest expense Bond interest payable Bond interest revenue Bonds payable Building

Accounts payable

Accounts receivable

Accumulated Amortization-Right-of-Use Asset

Accumulated depreciationBuilding

Accumulated depreciationEquipment

Amortization expense

Bond interest expense

Bond interest payable

Bond interest revenue

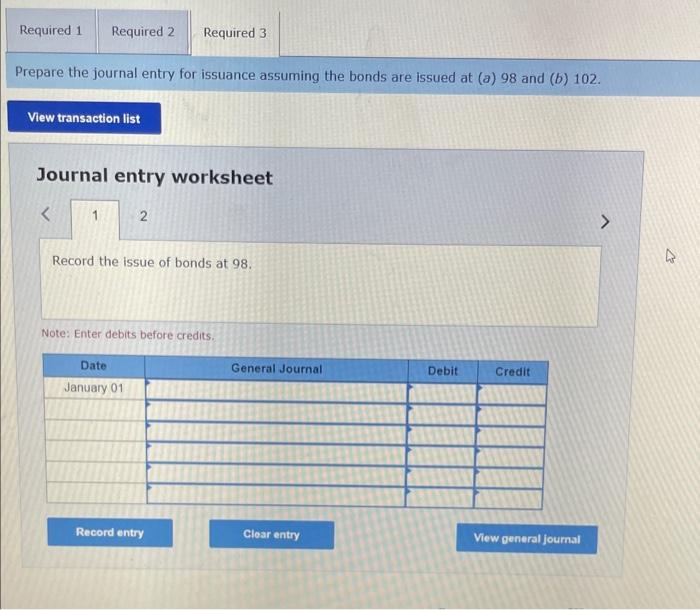

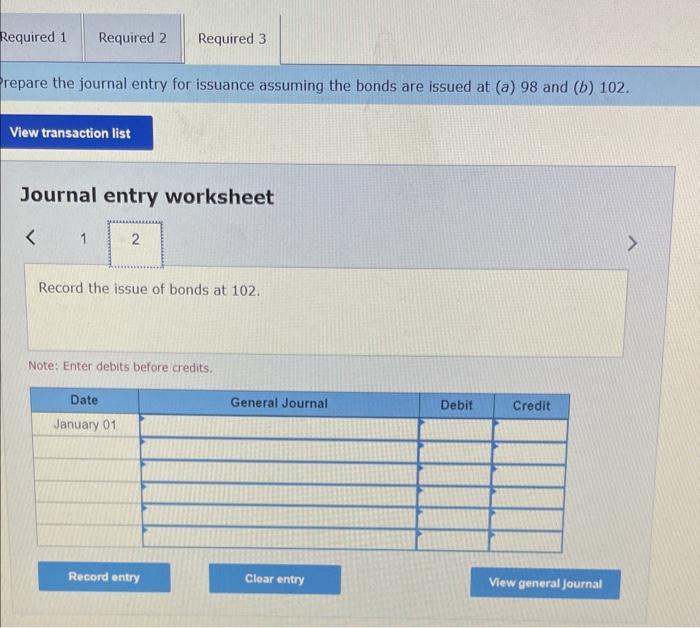

Bonds payable

Building

Cash

Common dividend payable

Common stock dividend distributable

Common stock, $10 par value

Common stock, no-par value

Cost of goods sold

Depreciation expense - Building

Depreciation expense - Equipment

Discount on bonds payable

Equipment

Gain on retirement of bonds payable

Income summary

Inventory

Land

Lease liability

Loss on retirement of bonds payable

Notes payable

Organization expenses

Paid-in capital in excess of par value, common stock

Paid-in capital in excess of par value, preferred stock

Paid-in capital, treasury stock

Preferred stock, $100 par value

Premium on bonds payable

Rental expense

Rental revenue

Retained earnings

Right-of-Use Asset

Salaries expense

Sales

Sales discounts

Sales returns and allowances

Supplies

Supplies expense

Treasury stock

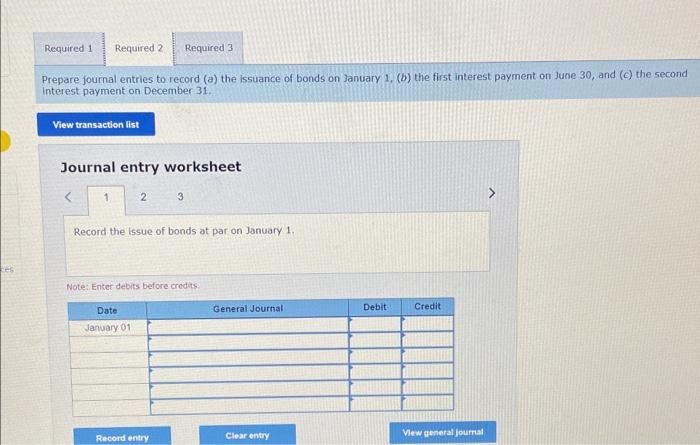

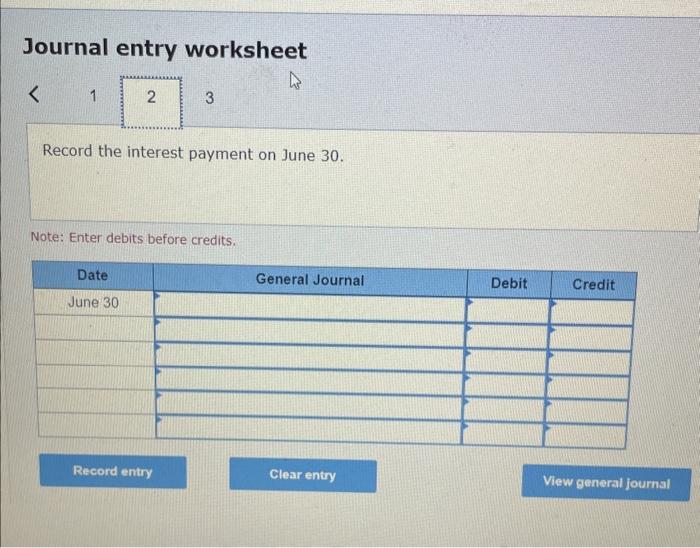

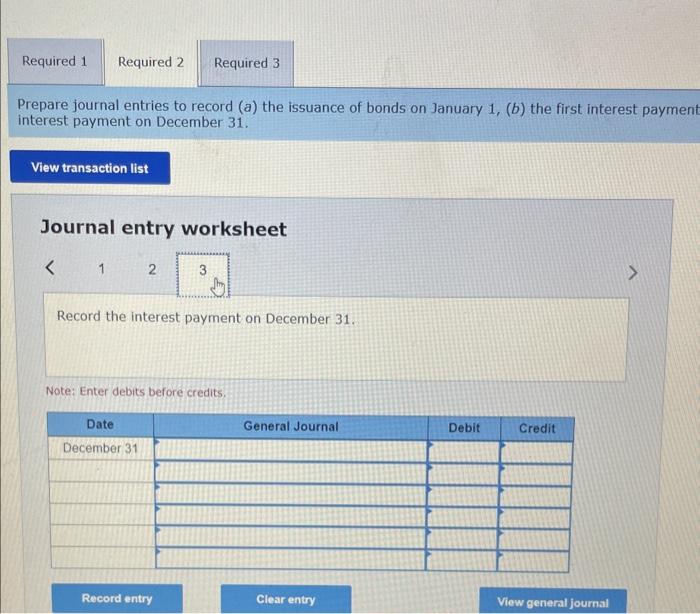

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started